5 MANAGEMENT DISCUSSION AND ANALYSIS5.3.4 Market Risk ManagementMarket risk is the risk of loss in respect of the Bank’s on and off-balance sheet activities, arising from adverse movements in market rates,including interest rates, foreign exchange rates, commodity prices and stock prices.In <strong>2012</strong>, the Bank watched closely on the market development trend, refined its market risk management policy system, innovated risk monitoringmanner, and promoted the development of risk management system and tools, further enhancing its market risk management capability.Improvement of the market risk management policy system. The Bank made policies for financial market business and market risk limit schemefor trading, clarified the orientation of market risk policies and the risk tolerance limits, created indicators, such as VaR limit of market risk capital,established an emergency mechanism of significant market risk, and enhanced the investment approval and post-investment managementmechanism of credit-related debt securities investments, further optimising the counterparty credit risk management.With a close watch on the market and business practices, innovating the monitoring model. The Bank continuously traced and monitored theperformance of credit approval, authorisation and risk limits of the financial market business, timely published risk warning and reminders, andmade specific improvements. Timely reporting and responses were made over the material market changes concerning the policy adjustments ofinterest rates and exchange rates, as well as the progress of European debt crisis. The Bank carried out recognition and review for new products,and researched to optimise the risk control process of new products to support business innovation.Promoting the development of market risk measurement system and tools. The Bank conducted verification of measurement models, positionsand market parameters and inspection of data quality, continuously enhanced the capabilities of valuation, verification and risk measurement, andcompleted the launch of treasury operation risk management system in overseas branches.Value at Risk analysisThe Bank has separated on and off-balance sheet activities into two major categories, trading book and banking book. The Bank performs VaRanalysis on its trading portfolio to measure and monitor the potential losses that could occur on risk positions taken, due to movements in marketinterest rates, foreign exchange rates and other market prices. The Bank calculates the VaR of RMB and foreign currency trading portfolio on adaily basis (at a confidence level of 99% and with a holding period of one-day).The VaR analysis on the Bank’s trading portfolio as at the balance sheet date and during the respective years is as follows:(In millions of RMB)<strong>2012</strong> 2011As at31 December Average Maximum MinimumAs at31 December Average Maximum MinimumRisk valuation oftrading portfolio 53 63 116 26 57 90 263 12– Interest rate risk 44 42 77 16 18 25 67 7– Foreign exchange risk 32 41 96 14 49 84 260 8– Commodity risk – 4 80 – 8 25 73 1Interest rate risk managementInterest rate risk is the risk of loss in the overall income and economic value of the banking book as a result of adverse movements in interestrates, term structure and other interest-related factors. Repricing risk and basis risk arising from mismatch of term structure and pricing basis ofassets and liabilities are the primary sources of interest rate risk for the Bank. The overall objective of the Bank’s interest rate risk management isto maintain steady growth of net interest income, while keeping interest rate risk within a tolerable range in accordance with the risk appetite andrisk management capability.In <strong>2012</strong>, the Bank further refined its interest rate risk system framework, and formulated emergency response scheme for the interest rate risk ofits banking book. It conducted regular analysis by comprehensively using multiple tools such as interest rate sensitivity gap, net interest incomesensitivity analysis, scenario simulation and stress testing, to enhance regular analysis and prediction of the net interest margin. The overallinterest rate risk in <strong>2012</strong> was kept within the set tolerable level and the net interest margin remained stable. In response to influence of theinterest rate liberalisation, the Bank adopted the pricing strategy, which combined the standardised and differentiated techniques, adjusted theauthorisation in time, and optimised the system, to promptly respond to the demands of customers.China Construction Bank Corporation annual report <strong>2012</strong>47

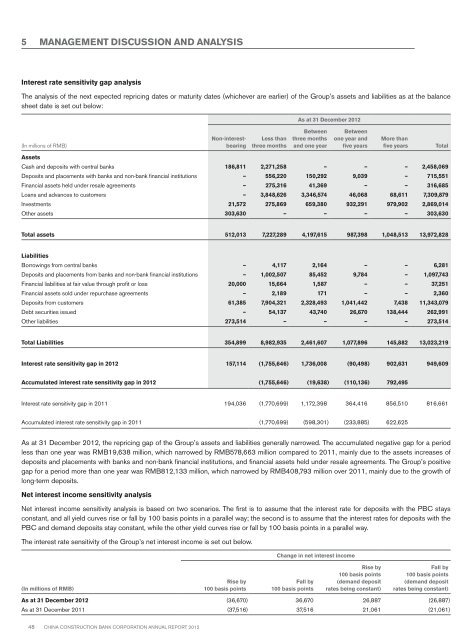

5 MANAGEMENT DISCUSSION AND ANALYSISInterest rate sensitivity gap analysisThe analysis of the next expected repricing dates or maturity dates (whichever are earlier) of the Group’s assets and liabilities as at the balancesheet date is set out below:(In millions of RMB)Non-interestbearingLess thanthree monthsAs at 31 December <strong>2012</strong>Betweenthree monthsand one yearBetweenone year andfive yearsMore thanfive yearsAssetsCash and deposits with central banks 186,811 2,271,258 – – – 2,458,069Deposits and placements with banks and non-bank financial institutions – 556,220 150,292 9,039 – 715,551Financial assets held under resale agreements – 275,316 41,369 – – 316,685Loans and advances to customers – 3,848,626 3,346,574 46,068 68,611 7,309,879Investments 21,572 275,869 659,380 932,291 979,902 2,869,014Other assets 303,630 – – – – 303,630TotalTotal assets 512,013 7,227,289 4,197,615 987,398 1,048,513 13,972,828LiabilitiesBorrowings from central banks – 4,117 2,164 – – 6,281Deposits and placements from banks and non-bank financial institutions – 1,002,507 85,452 9,784 – 1,097,743Financial liabilities at fair value through profit or loss 20,000 15,664 1,587 – – 37,251Financial assets sold under repurchase agreements – 2,189 171 – – 2,360Deposits from customers 61,385 7,904,321 2,328,493 1,041,442 7,438 11,343,079Debt securities issued – 54,137 43,740 26,670 138,444 262,991Other liabilities 273,514 – – – – 273,514Total Liabilities 354,899 8,982,935 2,461,607 1,077,896 145,882 13,023,219Interest rate sensitivity gap in <strong>2012</strong> 157,114 (1,755,646) 1,736,008 (90,498) 902,631 949,609Accumulated interest rate sensitivity gap in <strong>2012</strong> (1,755,646) (19,638) (110,136) 792,495Interest rate sensitivity gap in 2011 194,036 (1,770,699) 1,172,398 364,416 856,510 816,661Accumulated interest rate sensitivity gap in 2011 (1,770,699) (598,301) (233,885) 622,625As at 31 December <strong>2012</strong>, the repricing gap of the Group’s assets and liabilities generally narrowed. The accumulated negative gap for a periodless than one year was RMB19,638 million, which narrowed by RMB578,663 million compared to 2011, mainly due to the assets increases ofdeposits and placements with banks and non-bank financial institutions, and financial assets held under resale agreements. The Group’s positivegap for a period more than one year was RMB812,133 million, which narrowed by RMB408,793 million over 2011, mainly due to the growth oflong-term deposits.Net interest income sensitivity analysisNet interest income sensitivity analysis is based on two scenarios. The first is to assume that the interest rate for deposits with the PBC staysconstant, and all yield curves rise or fall by 100 basis points in a parallel way; the second is to assume that the interest rates for deposits with thePBC and demand deposits stay constant, while the other yield curves rise or fall by 100 basis points in a parallel way.The interest rate sensitivity of the Group’s net interest income is set out below.Change in net interest incomeRise by100 basis points(demand depositrates being constant)Fall by100 basis points(demand depositrates being constant)(In millions of RMB)Rise by100 basis pointsFall by100 basis pointsAs at 31 December <strong>2012</strong> (36,670) 36,670 26,887 (26,887)As at 31 December 2011 (37,516) 37,516 21,061 (21,061)48 China Construction Bank Corporation annual report <strong>2012</strong>