Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

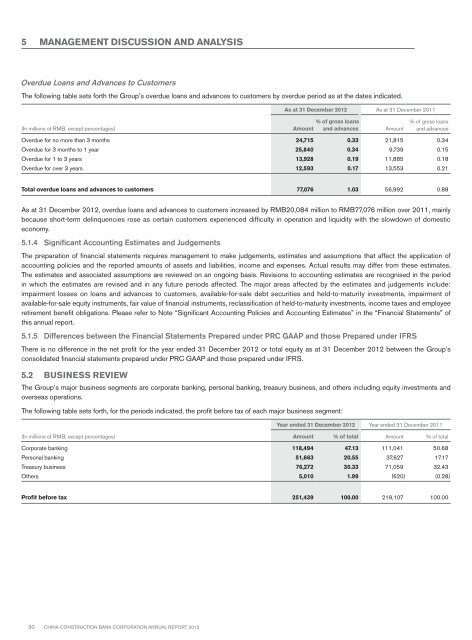

5 MANAGEMENT DISCUSSION AND ANALYSISOverdue Loans and Advances to CustomersThe following table sets forth the Group’s overdue loans and advances to customers by overdue period as at the dates indicated.(In millions of RMB, except percentages)As at 31 December <strong>2012</strong> As at 31 December 2011Amount% of gross loansand advancesAmount% of gross loansand advancesOverdue for no more than 3 months 24,715 0.33 21,815 0.34Overdue for 3 months to 1 year 25,840 0.34 9,739 0.15Overdue for 1 to 3 years 13,928 0.19 11,885 0.18Overdue for over 3 years 12,593 0.17 13,553 0.21Total overdue loans and advances to customers 77,076 1.03 56,992 0.88As at 31 December <strong>2012</strong>, overdue loans and advances to customers increased by RMB20,084 million to RMB77,076 million over 2011, mainlybecause short-term delinquencies rose as certain customers experienced difficulty in operation and liquidity with the slowdown of domesticeconomy.5.1.4 Significant Accounting Estimates and JudgementsThe preparation of financial statements requires management to make judgements, estimates and assumptions that affect the application ofaccounting policies and the reported amounts of assets and liabilities, income and expenses. Actual results may differ from these estimates.The estimates and associated assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the periodin which the estimates are revised and in any future periods affected. The major areas affected by the estimates and judgements include:impairment losses on loans and advances to customers, available-for-sale debt securities and held-to-maturity investments, impairment ofavailable-for-sale equity instruments, fair value of financial instruments, reclassification of held-to-maturity investments, income taxes and employeeretirement benefit obligations. Please refer to Note “Significant Accounting Policies and Accounting Estimates” in the “Financial Statements” ofthis annual report.5.1.5 Differences between the Financial Statements Prepared under PRC GAAP and those Prepared under IFRSThere is no difference in the net profit for the year ended 31 December <strong>2012</strong> or total equity as at 31 December <strong>2012</strong> between the Group’sconsolidated financial statements prepared under PRC GAAP and those prepared under IFRS.5.2 BUSINESS REVIEWThe Group’s major business segments are corporate banking, personal banking, treasury business, and others including equity investments andoverseas operations.The following table sets forth, for the periods indicated, the profit before tax of each major business segment:Year ended 31 December <strong>2012</strong> Year ended 31 December 2011(In millions of RMB, except percentages) Amount % of total Amount % of totalCorporate banking 118,494 47.13 111,041 50.68Personal banking 51,663 20.55 37,627 17.17Treasury business 76,272 30.33 71,059 32.43Others 5,010 1.99 (620) (0.28)Profit before tax 251,439 100.00 219,107 100.0030 China Construction Bank Corporation annual report <strong>2012</strong>