Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

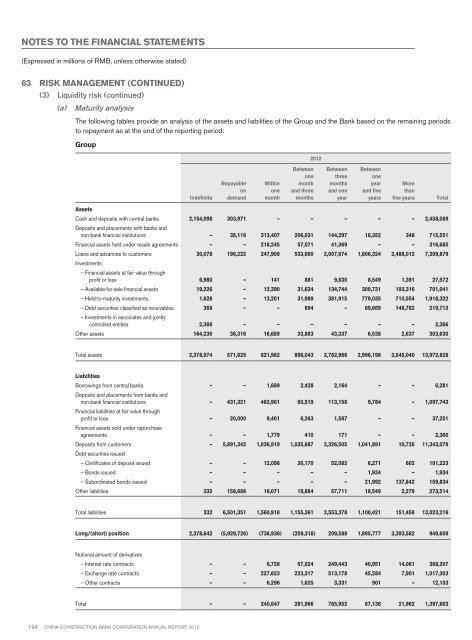

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)63 Risk Management (continued)(3) Liquidity risk (continued)(a)Maturity analysisThe following tables provide an analysis of the assets and liabilities of the Group and the Bank based on the remaining periodsto repayment as at the end of the reporting period:Group<strong>2012</strong>IndefiniteRepayableondemandWithinonemonthBetweenonemonthand threemonthsBetweenthreemonthsand oneyearBetweenoneyearand fiveyearsMorethanfive yearsTotalAssetsCash and deposits with central banks 2,154,098 303,971 – – – – – 2,458,069Deposits and placements with banks andnon-bank financial institutions – 35,116 313,407 206,031 144,297 16,352 348 715,551Financial assets held under resale agreements – – 218,245 57,071 41,369 – – 316,685Loans and advances to customers 30,078 196,222 247,909 533,660 2,007,674 1,806,324 2,488,012 7,309,879Investments– Financial assets at fair value throughprofit or loss 6,980 – 141 881 9,630 8,549 1,391 27,572– Available-for-sale financial assets 19,226 – 12,390 31,634 134,744 309,731 193,316 701,041– Held-to-maturity investments 1,628 – 13,201 31,989 381,915 779,035 710,554 1,918,322– Debt securities classified as receivables 368 – – 894 – 69,669 148,782 219,713– Investments in associates and jointlycontrolled entities 2,366 – – – – – – 2,366Other assets 164,230 36,316 16,689 33,883 43,337 6,538 2,637 303,630Total assets 2,378,974 571,625 821,982 896,043 2,762,966 2,996,198 3,545,040 13,972,828LiabilitiesBorrowings from central banks – – 1,689 2,428 2,164 – – 6,281Deposits and placements from banks andnon-bank financial institutions – 431,321 482,961 60,519 113,158 9,784 – 1,097,743Financial liabilities at fair value throughprofit or loss – 20,000 9,401 6,263 1,587 – – 37,251Financial assets sold under repurchaseagreements – – 1,779 410 171 – – 2,360Deposits from customers – 5,891,342 1,036,919 1,035,687 2,326,505 1,041,891 10,735 11,343,079Debt securities issued– Certificates of deposit issued – – 12,098 30,170 52,082 6,271 602 101,223– Bonds issued – – – – – 1,934 – 1,934– Subordinated bonds issued – – – – – 21,992 137,842 159,834Other liabilities 332 158,688 16,071 19,884 57,711 18,549 2,279 273,514Total liabilities 332 6,501,351 1,560,918 1,155,361 2,553,378 1,100,421 151,458 13,023,219Long/(short) position 2,378,642 (5,929,726) (738,936) (259,318) 209,588 1,895,777 3,393,582 949,609Notional amount of derivatives– Interest rate contracts – – 6,728 57,024 249,443 40,951 14,061 368,207– Exchange rate contracts – – 227,623 223,317 513,178 45,284 7,901 1,017,303– Other contracts – – 6,296 1,625 3,331 901 – 12,153Total – – 240,647 281,966 765,952 87,136 21,962 1,397,663194 China Construction Bank Corporation annual report <strong>2012</strong>