Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

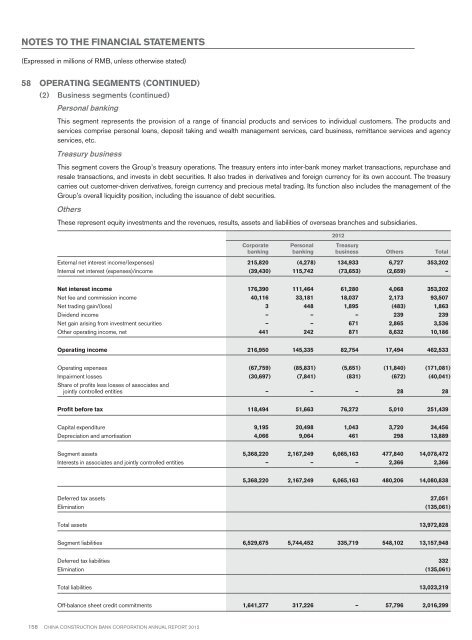

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)58 Operating segments (continued)(2) Business segments (continued)Personal bankingThis segment represents the provision of a range of financial products and services to individual customers. The products andservices comprise personal loans, deposit taking and wealth management services, card business, remittance services and agencyservices, etc.Treasury businessThis segment covers the Group’s treasury operations. The treasury enters into inter-bank money market transactions, repurchase andresale transactions, and invests in debt securities. It also trades in derivatives and foreign currency for its own account. The treasurycarries out customer-driven derivatives, foreign currency and precious metal trading. Its function also includes the management of theGroup’s overall liquidity position, including the issuance of debt securities.OthersThese represent equity investments and the revenues, results, assets and liabilities of overseas branches and subsidiaries.<strong>2012</strong>CorporatebankingPersonalbankingTreasurybusiness Others TotalExternal net interest income/(expenses) 215,820 (4,278) 134,933 6,727 353,202Internal net interest (expenses)/income (39,430) 115,742 (73,653) (2,659) –Net interest income 176,390 111,464 61,280 4,068 353,202Net fee and commission income 40,116 33,181 18,037 2,173 93,507Net trading gain/(loss) 3 448 1,895 (483) 1,863Dividend income – – – 239 239Net gain arising from investment securities – – 671 2,865 3,536Other operating income, net 441 242 871 8,632 10,186Operating income 216,950 145,335 82,754 17,494 462,533Operating expenses (67,759) (85,831) (5,651) (11,840) (171,081)Impairment losses (30,697) (7,841) (831) (672) (40,041)Share of profits less losses of associates andjointly controlled entities – – – 28 28Profit before tax 118,494 51,663 76,272 5,010 251,439Capital expenditure 9,195 20,498 1,043 3,720 34,456Depreciation and amortisation 4,066 9,064 461 298 13,889Segment assets 5,368,220 2,167,249 6,065,163 477,840 14,078,472Interests in associates and jointly controlled entities – – – 2,366 2,3665,368,220 2,167,249 6,065,163 480,206 14,080,838Deferred tax assets 27,051Elimination (135,061)Total assets 13,972,828Segment liabilities 6,529,675 5,744,452 335,719 548,102 13,157,948Deferred tax liabilities 332Elimination (135,061)Total liabilities 13,023,219Off-balance sheet credit commitments 1,641,277 317,226 – 57,796 2,016,299158 China Construction Bank Corporation annual report <strong>2012</strong>