Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

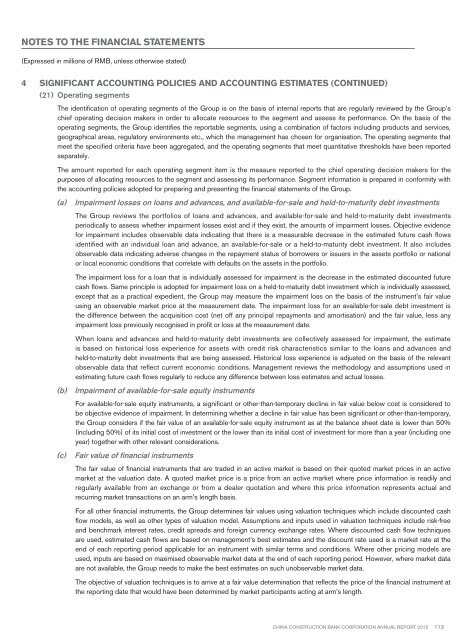

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)4 Significant accounting policies and accounting estimates (continued)(21) Operating segmentsThe identification of operating segments of the Group is on the basis of internal reports that are regularly reviewed by the Group’schief operating decision makers in order to allocate resources to the segment and assess its performance. On the basis of theoperating segments, the Group identifies the reportable segments, using a combination of factors including products and services,geographical areas, regulatory environments etc., which the management has chosen for organisation. The operating segments thatmeet the specified criteria have been aggregated, and the operating segments that meet quantitative thresholds have been reportedseparately.The amount reported for each operating segment item is the measure reported to the chief operating decision makers for thepurposes of allocating resources to the segment and assessing its performance. Segment information is prepared in conformity withthe accounting policies adopted for preparing and presenting the financial statements of the Group.(a)Impairment losses on loans and advances, and available-for-sale and held-to-maturity debt investmentsThe Group reviews the portfolios of loans and advances, and available-for-sale and held-to-maturity debt investmentsperiodically to assess whether impairment losses exist and if they exist, the amounts of impairment losses. Objective evidencefor impairment includes observable data indicating that there is a measurable decrease in the estimated future cash flowsidentified with an individual loan and advance, an available-for-sale or a held-to-maturity debt investment. It also includesobservable data indicating adverse changes in the repayment status of borrowers or issuers in the assets portfolio or nationalor local economic conditions that correlate with defaults on the assets in the portfolio.The impairment loss for a loan that is individually assessed for impairment is the decrease in the estimated discounted futurecash flows. Same principle is adopted for impairment loss on a held-to-maturity debt investment which is individually assessed,except that as a practical expedient, the Group may measure the impairment loss on the basis of the instrument’s fair valueusing an observable market price at the measurement date. The impairment loss for an available-for-sale debt investment isthe difference between the acquisition cost (net off any principal repayments and amortisation) and the fair value, less anyimpairment loss previously recognised in profit or loss at the measurement date.When loans and advances and held-to-maturity debt investments are collectively assessed for impairment, the estimateis based on historical loss experience for assets with credit risk characteristics similar to the loans and advances andheld-to-maturity debt investments that are being assessed. Historical loss experience is adjusted on the basis of the relevantobservable data that reflect current economic conditions. Management reviews the methodology and assumptions used inestimating future cash flows regularly to reduce any difference between loss estimates and actual losses.(b) Impairment of available-for-sale equity instrumentsFor available-for-sale equity instruments, a significant or other-than-temporary decline in fair value below cost is considered tobe objective evidence of impairment. In determining whether a decline in fair value has been significant or other-than-temporary,the Group considers if the fair value of an available-for-sale equity instrument as at the balance sheet date is lower than 50%(including 50%) of its initial cost of investment or the lower than its initial cost of investment for more than a year (including oneyear) together with other relevant considerations.(c)Fair value of financial instrumentsThe fair value of financial instruments that are traded in an active market is based on their quoted market prices in an activemarket at the valuation date. A quoted market price is a price from an active market where price information is readily andregularly available from an exchange or from a dealer quotation and where this price information represents actual andrecurring market transactions on an arm’s length basis.For all other financial instruments, the Group determines fair values using valuation techniques which include discounted cashflow models, as well as other types of valuation model. Assumptions and inputs used in valuation techniques include risk-freeand benchmark interest rates, credit spreads and foreign currency exchange rates. Where discounted cash flow techniquesare used, estimated cash flows are based on management’s best estimates and the discount rate used is a market rate at theend of each reporting period applicable for an instrument with similar terms and conditions. Where other pricing models areused, inputs are based on maximised observable market data at the end of each reporting period. However, where market dataare not available, the Group needs to make the best estimates on such unobservable market data.The objective of valuation techniques is to arrive at a fair value determination that reflects the price of the financial instrument atthe reporting date that would have been determined by market participants acting at arm’s length.China Construction Bank Corporation annual report <strong>2012</strong>113