Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

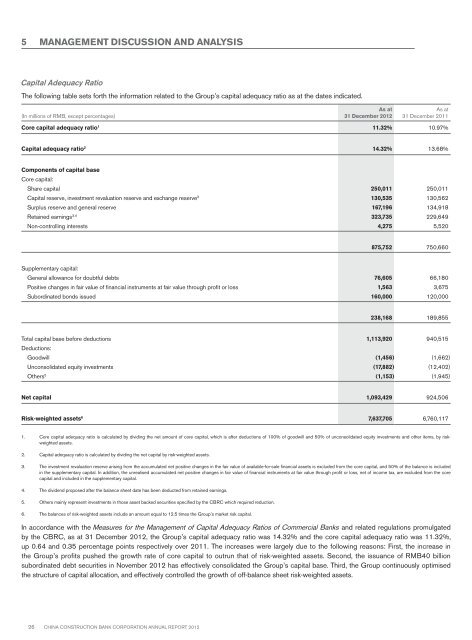

5 MANAGEMENT DISCUSSION AND ANALYSISCapital Adequacy RatioThe following table sets forth the information related to the Group’s capital adequacy ratio as at the dates indicated.(In millions of RMB, except percentages)As at31 December <strong>2012</strong>As at31 December 2011Core capital adequacy ratio 1 11.32% 10.97%Capital adequacy ratio 2 14.32% 13.68%Components of capital baseCore capital:Share capital 250,011 250,011Capital reserve, investment revaluation reserve and exchange reserve 3 130,535 130,562Surplus reserve and general reserve 167,196 134,918Retained earnings 3,4 323,735 229,649Non-controlling interests 4,275 5,520875,752 750,660Supplementary capital:General allowance for doubtful debts 76,605 66,180Positive changes in fair value of financial instruments at fair value through profit or loss 1,563 3,675Subordinated bonds issued 160,000 120,000238,168 189,855Total capital base before deductions 1,113,920 940,515Deductions:Goodwill (1,456) (1,662)Unconsolidated equity investments (17,882) (12,402)Others 5 (1,153) (1,945)Net capital 1,093,429 924,506Risk-weighted assets 6 7,637,705 6,760,1171. Core capital adequacy ratio is calculated by dividing the net amount of core capital, which is after deductions of 100% of goodwill and 50% of unconsolidated equity investments and other items, by riskweightedassets.2. Capital adequacy ratio is calculated by dividing the net capital by risk-weighted assets.3. The investment revaluation reserve arising from the accumulated net positive changes in the fair value of available-for-sale financial assets is excluded from the core capital, and 50% of the balance is includedin the supplementary capital. In addition, the unrealised accumulated net positive changes in fair value of financial instruments at fair value through profit or loss, net of income tax, are excluded from the corecapital and included in the supplementary capital.4. The dividend proposed after the balance sheet date has been deducted from retained earnings.5. Others mainly represent investments in those asset backed securities specified by the CBRC which required reduction.6. The balances of risk-weighted assets include an amount equal to 12.5 times the Group’s market risk capital.In accordance with the Measures for the Management of Capital Adequacy Ratios of Commercial Banks and related regulations promulgatedby the CBRC, as at 31 December <strong>2012</strong>, the Group’s capital adequacy ratio was 14.32% and the core capital adequacy ratio was 11.32%,up 0.64 and 0.35 percentage points respectively over 2011. The increases were largely due to the following reasons: First, the increase inthe Group’s profits pushed the growth rate of core capital to outrun that of risk-weighted assets. Second, the issuance of RMB40 billionsubordinated debt securities in November <strong>2012</strong> has effectively consolidated the Group’s capital base. Third, the Group continuously optimisedthe structure of capital allocation, and effectively controlled the growth of off-balance sheet risk-weighted assets.26 China Construction Bank Corporation annual report <strong>2012</strong>