Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

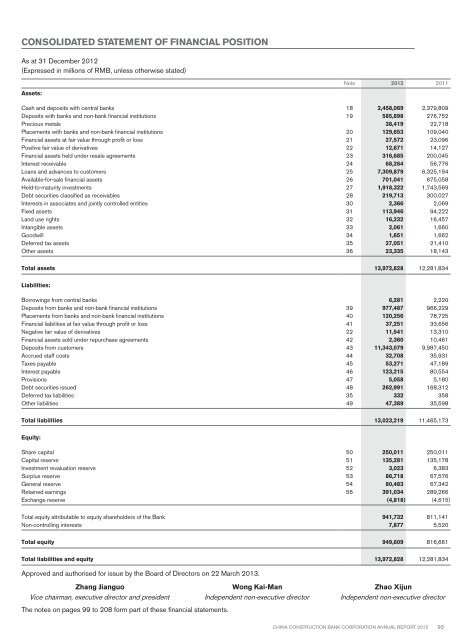

Consolidated statement of financial positionAs at 31 December <strong>2012</strong>(Expressed in millions of RMB, unless otherwise stated)Assets:Note <strong>2012</strong> 2011Cash and deposits with central banks 18 2,458,069 2,379,809Deposits with banks and non-bank financial institutions 19 585,898 276,752Precious metals 38,419 22,718Placements with banks and non-bank financial institutions 20 129,653 109,040Financial assets at fair value through profit or loss 21 27,572 23,096Positive fair value of derivatives 22 12,671 14,127Financial assets held under resale agreements 23 316,685 200,045Interest receivable 24 68,264 56,776Loans and advances to customers 25 7,309,879 6,325,194Available-for-sale financial assets 26 701,041 675,058Held-to-maturity investments 27 1,918,322 1,743,569Debt securities classified as receivables 28 219,713 300,027Interests in associates and jointly controlled entities 30 2,366 2,069Fixed assets 31 113,946 94,222Land use rights 32 16,232 16,457Intangible assets 33 2,061 1,660Goodwill 34 1,651 1,662Deferred tax assets 35 27,051 21,410Other assets 36 23,335 18,143Total assets 13,972,828 12,281,834Liabilities:Borrowings from central banks 6,281 2,220Deposits from banks and non-bank financial institutions 39 977,487 966,229Placements from banks and non-bank financial institutions 40 120,256 78,725Financial liabilities at fair value through profit or loss 41 37,251 33,656Negative fair value of derivatives 22 11,541 13,310Financial assets sold under repurchase agreements 42 2,360 10,461Deposits from customers 43 11,343,079 9,987,450Accrued staff costs 44 32,708 35,931Taxes payable 45 53,271 47,189Interest payable 46 123,215 80,554Provisions 47 5,058 5,180Debt securities issued 48 262,991 168,312Deferred tax liabilities 35 332 358Other liabilities 49 47,389 35,598Total liabilities 13,023,219 11,465,173Equity:Share capital 50 250,011 250,011Capital reserve 51 135,281 135,178Investment revaluation reserve 52 3,023 6,383Surplus reserve 53 86,718 67,576General reserve 54 80,483 67,342Retained earnings 55 391,034 289,266Exchange reserve (4,818) (4,615)Total equity attributable to equity shareholders of the Bank 941,732 811,141Non-controlling interests 7,877 5,520Total equity 949,609 816,661Total liabilities and equity 13,972,828 12,281,834Approved and authorised for issue by the Board of Directors on 22 March 2013.Zhang Jianguo Wong Kai-Man Zhao XijunVice chairman, executive director and president Independent non-executive director Independent non-executive directorThe notes on pages 99 to 208 form part of these financial statements.China Construction Bank Corporation annual report <strong>2012</strong>93