Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

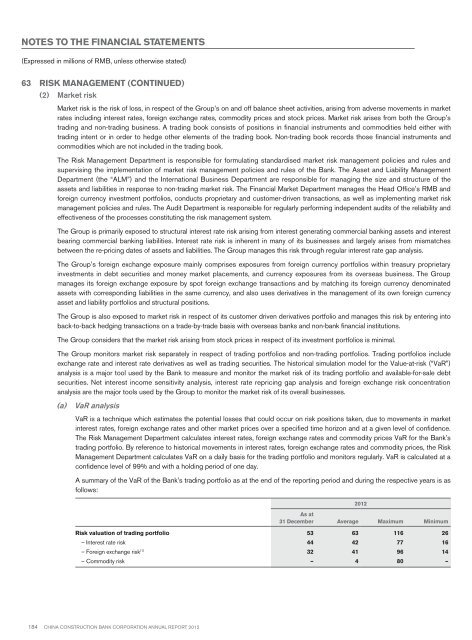

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)63 Risk Management (continued)(2) Market riskMarket risk is the risk of loss, in respect of the Group’s on and off balance sheet activities, arising from adverse movements in marketrates including interest rates, foreign exchange rates, commodity prices and stock prices. Market risk arises from both the Group’strading and non-trading business. A trading book consists of positions in financial instruments and commodities held either withtrading intent or in order to hedge other elements of the trading book. Non-trading book records those financial instruments andcommodities which are not included in the trading book.The Risk Management Department is responsible for formulating standardised market risk management policies and rules andsupervising the implementation of market risk management policies and rules of the Bank. The Asset and Liability ManagementDepartment (the “ALM”) and the International Business Department are responsible for managing the size and structure of theassets and liabilities in response to non-trading market risk. The Financial Market Department manages the Head Office’s RMB andforeign currency investment portfolios, conducts proprietary and customer-driven transactions, as well as implementing market riskmanagement policies and rules. The Audit Department is responsible for regularly performing independent audits of the reliability andeffectiveness of the processes constituting the risk management system.The Group is primarily exposed to structural interest rate risk arising from interest generating commercial banking assets and interestbearing commercial banking liabilities. Interest rate risk is inherent in many of its businesses and largely arises from mismatchesbetween the re-pricing dates of assets and liabilities. The Group manages this risk through regular interest rate gap analysis.The Group’s foreign exchange exposure mainly comprises exposures from foreign currency portfolios within treasury proprietaryinvestments in debt securities and money market placements, and currency exposures from its overseas business. The Groupmanages its foreign exchange exposure by spot foreign exchange transactions and by matching its foreign currency denominatedassets with corresponding liabilities in the same currency, and also uses derivatives in the management of its own foreign currencyasset and liability portfolios and structural positions.The Group is also exposed to market risk in respect of its customer driven derivatives portfolio and manages this risk by entering intoback-to-back hedging transactions on a trade-by-trade basis with overseas banks and non-bank financial institutions.The Group considers that the market risk arising from stock prices in respect of its investment portfolios is minimal.The Group monitors market risk separately in respect of trading portfolios and non-trading portfolios. Trading portfolios includeexchange rate and interest rate derivatives as well as trading securities. The historical simulation model for the Value-at-risk (“VaR”)analysis is a major tool used by the Bank to measure and monitor the market risk of its trading portfolio and available-for-sale debtsecurities. Net interest income sensitivity analysis, interest rate repricing gap analysis and foreign exchange risk concentrationanalysis are the major tools used by the Group to monitor the market risk of its overall businesses.(a)VaR analysisVaR is a technique which estimates the potential losses that could occur on risk positions taken, due to movements in marketinterest rates, foreign exchange rates and other market prices over a specified time horizon and at a given level of confidence.The Risk Management Department calculates interest rates, foreign exchange rates and commodity prices VaR for the Bank’strading portfolio. By reference to historical movements in interest rates, foreign exchange rates and commodity prices, the RiskManagement Department calculates VaR on a daily basis for the trading portfolio and monitors regularly. VaR is calculated at aconfidence level of 99% and with a holding period of one day.A summary of the VaR of the Bank’s trading portfolio as at the end of the reporting period and during the respective years is asfollows:<strong>2012</strong>As at31 December Average Maximum MinimumRisk valuation of trading portfolio 53 63 116 26– Interest rate risk 44 42 77 16– Foreign exchange risk (1) 32 41 96 14– Commodity risk – 4 80 –184 China Construction Bank Corporation annual report <strong>2012</strong>