Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

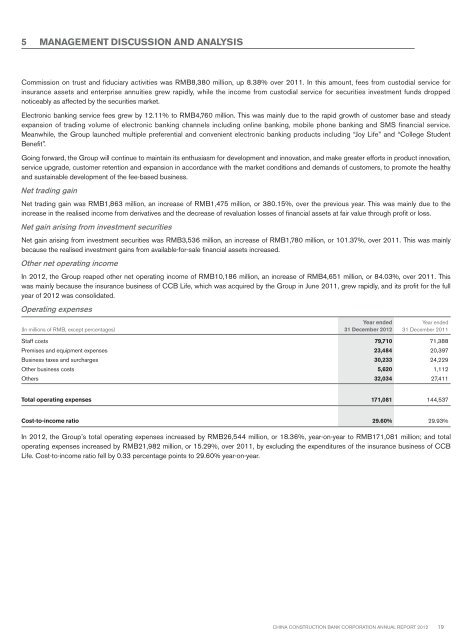

5 MANAGEMENT DISCUSSION AND ANALYSISCommission on trust and fiduciary activities was RMB8,380 million, up 8.38% over 2011. In this amount, fees from custodial service forinsurance assets and enterprise annuities grew rapidly, while the income from custodial service for securities investment funds droppednoticeably as affected by the securities market.Electronic banking service fees grew by 12.11% to RMB4,760 million. This was mainly due to the rapid growth of customer base and steadyexpansion of trading volume of electronic banking channels including online banking, mobile phone banking and SMS financial service.Meanwhile, the Group launched multiple preferential and convenient electronic banking products including “Joy Life” and “College StudentBenefit”.Going forward, the Group will continue to maintain its enthusiasm for development and innovation, and make greater efforts in product innovation,service upgrade, customer retention and expansion in accordance with the market conditions and demands of customers, to promote the healthyand sustainable development of the fee-based business.Net trading gainNet trading gain was RMB1,863 million, an increase of RMB1,475 million, or 380.15%, over the previous year. This was mainly due to theincrease in the realised income from derivatives and the decrease of revaluation losses of financial assets at fair value through profit or loss.Net gain arising from investment securitiesNet gain arising from investment securities was RMB3,536 million, an increase of RMB1,780 million, or 101.37%, over 2011. This was mainlybecause the realised investment gains from available-for-sale financial assets increased.Other net operating incomeIn <strong>2012</strong>, the Group reaped other net operating income of RMB10,186 million, an increase of RMB4,651 million, or 84.03%, over 2011. Thiswas mainly because the insurance business of CCB Life, which was acquired by the Group in June 2011, grew rapidly, and its profit for the fullyear of <strong>2012</strong> was consolidated.Operating expenses(In millions of RMB, except percentages)Year ended31 December <strong>2012</strong>Year ended31 December 2011Staff costs 79,710 71,388Premises and equipment expenses 23,484 20,397Business taxes and surcharges 30,233 24,229Other business costs 5,620 1,112Others 32,034 27,411Total operating expenses 171,081 144,537Cost-to-income ratio 29.60% 29.93%In <strong>2012</strong>, the Group’s total operating expenses increased by RMB26,544 million, or 18.36%, year-on-year to RMB171,081 million; and totaloperating expenses increased by RMB21,982 million, or 15.29%, over 2011, by excluding the expenditures of the insurance business of CCBLife. Cost-to-income ratio fell by 0.33 percentage points to 29.60% year-on-year.China Construction Bank Corporation annual report <strong>2012</strong>19