Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

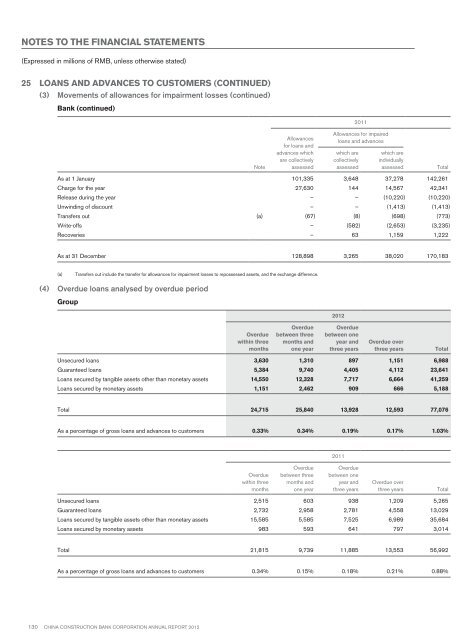

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)25 Loans and advances to customers (continued)(3) Movements of allowances for impairment losses (continued)Bank (continued)2011NoteAllowancesfor loans andadvances whichare collectivelyassessedAllowances for impairedloans and advanceswhich arecollectivelyassessedwhich areindividuallyassessedTotalAs at 1 January 101,335 3,648 37,278 142,261Charge for the year 27,630 144 14,567 42,341Release during the year – – (10,220) (10,220)Unwinding of discount – – (1,413) (1,413)Transfers out (a) (67) (8) (698) (773)Write-offs – (582) (2,653) (3,235)Recoveries – 63 1,159 1,222As at 31 December 128,898 3,265 38,020 170,183(a)Transfers out include the transfer for allowances for impairment losses to repossessed assets, and the exchange difference.(4) Overdue loans analysed by overdue periodGroup<strong>2012</strong>Overduewithin threemonthsOverduebetween threemonths andone yearOverduebetween oneyear andthree yearsOverdue overthree yearsTotalUnsecured loans 3,630 1,310 897 1,151 6,988Guaranteed loans 5,384 9,740 4,405 4,112 23,641Loans secured by tangible assets other than monetary assets 14,550 12,328 7,717 6,664 41,259Loans secured by monetary assets 1,151 2,462 909 666 5,188Total 24,715 25,840 13,928 12,593 77,076As a percentage of gross loans and advances to customers 0.33% 0.34% 0.19% 0.17% 1.03%2011Overduewithin threemonthsOverduebetween threemonths andone yearOverduebetween oneyear andthree yearsOverdue overthree yearsTotalUnsecured loans 2,515 603 938 1,209 5,265Guaranteed loans 2,732 2,958 2,781 4,558 13,029Loans secured by tangible assets other than monetary assets 15,585 5,585 7,525 6,989 35,684Loans secured by monetary assets 983 593 641 797 3,014Total 21,815 9,739 11,885 13,553 56,992As a percentage of gross loans and advances to customers 0.34% 0.15% 0.18% 0.21% 0.88%130 China Construction Bank Corporation annual report <strong>2012</strong>