Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

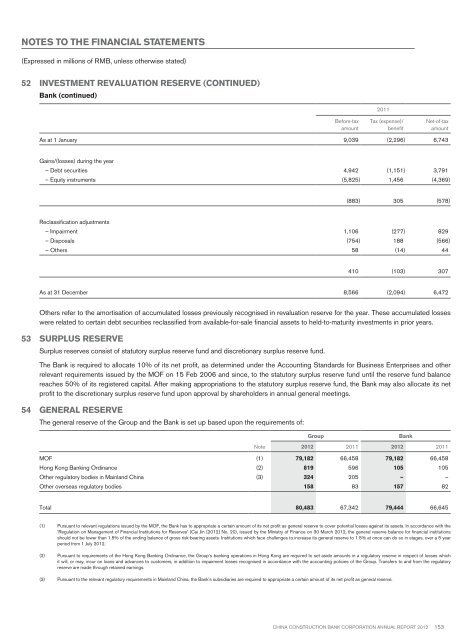

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)52 Investment revaluation reserve (continued)Bank (continued)Before-taxamount2011Tax (expense)/benefitNet-of-taxamountAs at 1 January 9,039 (2,296) 6,743Gains/(losses) during the year– Debt securities 4,942 (1,151) 3,791– Equity instruments (5,825) 1,456 (4,369)(883) 305 (578)Reclassification adjustments– Impairment 1,106 (277) 829– Disposals (754) 188 (566)– Others 58 (14) 44410 (103) 307As at 31 December 8,566 (2,094) 6,472Others refer to the amortisation of accumulated losses previously recognised in revaluation reserve for the year. These accumulated losseswere related to certain debt securities reclassified from available-for-sale financial assets to held-to-maturity investments in prior years.53 Surplus reserveSurplus reserves consist of statutory surplus reserve fund and discretionary surplus reserve fund.The Bank is required to allocate 10% of its net profit, as determined under the Accounting Standards for Business Enterprises and otherrelevant requirements issued by the MOF on 15 Feb 2006 and since, to the statutory surplus reserve fund until the reserve fund balancereaches 50% of its registered capital. After making appropriations to the statutory surplus reserve fund, the Bank may also allocate its netprofit to the discretionary surplus reserve fund upon approval by shareholders in annual general meetings.54 General reserveThe general reserve of the Group and the Bank is set up based upon the requirements of:GroupBankNote <strong>2012</strong> 2011 <strong>2012</strong> 2011MOF (1) 79,182 66,458 79,182 66,458Hong Kong Banking Ordinance (2) 819 596 105 105Other regulatory bodies in Mainland China (3) 324 205 – –Other overseas regulatory bodies 158 83 157 82Total 80,483 67,342 79,444 66,645(1) Pursuant to relevant regulations issued by the MOF, the Bank has to appropriate a certain amount of its net profit as general reserve to cover potential losses against its assets. In accordance with the‘Regulation on Management of Financial Institutions for Reserves’ (Cai Jin [<strong>2012</strong>] No. 20), issued by the Ministry of Finance on 30 March <strong>2012</strong>, the general reserve balance for financial institutionsshould not be lower than 1.5% of the ending balance of gross risk-bearing assets. Institutions which face challenges to increase its general reserve to 1.5% at once can do so in stages, over a 5 yearperiod from 1 July <strong>2012</strong>.(2) Pursuant to requirements of the Hong Kong Banking Ordinance, the Group’s banking operations in Hong Kong are required to set aside amounts in a regulatory reserve in respect of losses whichit will, or may, incur on loans and advances to customers, in addition to impairment losses recognised in accordance with the accounting policies of the Group. Transfers to and from the regulatoryreserve are made through retained earnings.(3) Pursuant to the relevant regulatory requirements in Mainland China, the Bank’s subsidiaries are required to appropriate a certain amount of its net profit as general reserve.China Construction Bank Corporation annual report <strong>2012</strong>153