Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

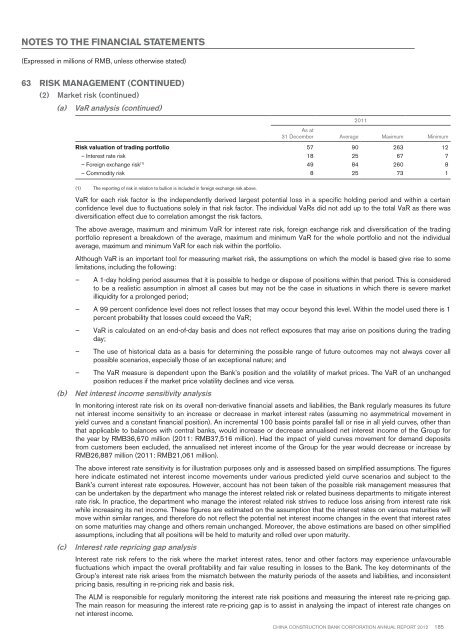

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)63 Risk Management (continued)(2) Market risk (continued)(a) VaR analysis (continued)2011As at31 December Average Maximum MinimumRisk valuation of trading portfolio 57 90 263 12– Interest rate risk 18 25 67 7– Foreign exchange risk (1) 49 84 260 8– Commodity risk 8 25 73 1(1) The reporting of risk in relation to bullion is included in foreign exchange risk above.VaR for each risk factor is the independently derived largest potential loss in a specific holding period and within a certainconfidence level due to fluctuations solely in that risk factor. The individual VaRs did not add up to the total VaR as there wasdiversification effect due to correlation amongst the risk factors.The above average, maximum and minimum VaR for interest rate risk, foreign exchange risk and diversification of the tradingportfolio represent a breakdown of the average, maximum and minimum VaR for the whole portfolio and not the individualaverage, maximum and minimum VaR for each risk within the portfolio.Although VaR is an important tool for measuring market risk, the assumptions on which the model is based give rise to somelimitations, including the following:– A 1-day holding period assumes that it is possible to hedge or dispose of positions within that period. This is consideredto be a realistic assumption in almost all cases but may not be the case in situations in which there is severe marketilliquidity for a prolonged period;– A 99 percent confidence level does not reflect losses that may occur beyond this level. Within the model used there is 1percent probability that losses could exceed the VaR;– VaR is calculated on an end-of-day basis and does not reflect exposures that may arise on positions during the tradingday;– The use of historical data as a basis for determining the possible range of future outcomes may not always cover allpossible scenarios, especially those of an exceptional nature; and– The VaR measure is dependent upon the Bank’s position and the volatility of market prices. The VaR of an unchangedposition reduces if the market price volatility declines and vice versa.(b) Net interest income sensitivity analysisIn monitoring interest rate risk on its overall non-derivative financial assets and liabilities, the Bank regularly measures its futurenet interest income sensitivity to an increase or decrease in market interest rates (assuming no asymmetrical movement inyield curves and a constant financial position). An incremental 100 basis points parallel fall or rise in all yield curves, other thanthat applicable to balances with central banks, would increase or decrease annualised net interest income of the Group forthe year by RMB36,670 million (2011: RMB37,516 million). Had the impact of yield curves movement for demand depositsfrom customers been excluded, the annualised net interest income of the Group for the year would decrease or increase byRMB26,887 million (2011: RMB21,061 million).The above interest rate sensitivity is for illustration purposes only and is assessed based on simplified assumptions. The figureshere indicate estimated net interest income movements under various predicted yield curve scenarios and subject to theBank’s current interest rate exposures. However, account has not been taken of the possible risk management measures thatcan be undertaken by the department who manage the interest related risk or related business departments to mitigate interestrate risk. In practice, the department who manage the interest related risk strives to reduce loss arising from interest rate riskwhile increasing its net income. These figures are estimated on the assumption that the interest rates on various maturities willmove within similar ranges, and therefore do not reflect the potential net interest income changes in the event that interest rateson some maturities may change and others remain unchanged. Moreover, the above estimations are based on other simplifiedassumptions, including that all positions will be held to maturity and rolled over upon maturity.(c)Interest rate repricing gap analysisInterest rate risk refers to the risk where the market interest rates, tenor and other factors may experience unfavourablefluctuations which impact the overall profitability and fair value resulting in losses to the Bank. The key determinants of theGroup’s interest rate risk arises from the mismatch between the maturity periods of the assets and liabilities, and inconsistentpricing basis, resulting in re-pricing risk and basis risk.The ALM is responsible for regularly monitoring the interest rate risk positions and measuring the interest rate re-pricing gap.The main reason for measuring the interest rate re-pricing gap is to assist in analysing the impact of interest rate changes onnet interest income.China Construction Bank Corporation annual report <strong>2012</strong>185