Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

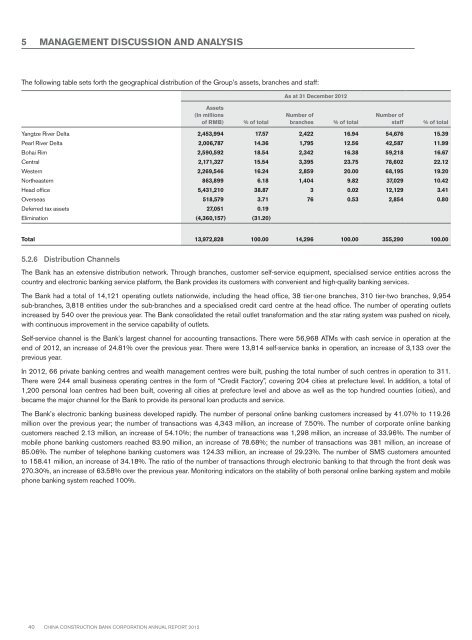

5 MANAGEMENT DISCUSSION AND ANALYSISThe following table sets forth the geographical distribution of the Group’s assets, branches and staff:Assets(In millionsof RMB)% of totalAs at 31 December <strong>2012</strong>Number ofbranches% of totalNumber ofstaff% of totalYangtze River Delta 2,453,994 17.57 2,422 16.94 54,676 15.39Pearl River Delta 2,006,787 14.36 1,795 12.56 42,587 11.99Bohai Rim 2,590,592 18.54 2,342 16.38 59,218 16.67Central 2,171,327 15.54 3,395 23.75 78,602 22.12Western 2,269,546 16.24 2,859 20.00 68,195 19.20Northeastern 863,899 6.18 1,404 9.82 37,029 10.42Head office 5,431,210 38.87 3 0.02 12,129 3.41Overseas 518,579 3.71 76 0.53 2,854 0.80Deferred tax assets 27,051 0.19Elimination (4,360,157) (31.20)Total 13,972,828 100.00 14,296 100.00 355,290 100.005.2.6 Distribution ChannelsThe Bank has an extensive distribution network. Through branches, customer self-service equipment, specialised service entities across thecountry and electronic banking service platform, the Bank provides its customers with convenient and high-quality banking services.The Bank had a total of 14,121 operating outlets nationwide, including the head office, 38 tier-one branches, 310 tier-two branches, 9,954sub-branches, 3,818 entities under the sub-branches and a specialised credit card centre at the head office. The number of operating outletsincreased by 540 over the previous year. The Bank consolidated the retail outlet transformation and the star rating system was pushed on nicely,with continuous improvement in the service capability of outlets.Self-service channel is the Bank’s largest channel for accounting transactions. There were 56,968 ATMs with cash service in operation at theend of <strong>2012</strong>, an increase of 24.81% over the previous year. There were 13,814 self-service banks in operation, an increase of 3,133 over theprevious year.In <strong>2012</strong>, 66 private banking centres and wealth management centres were built, pushing the total number of such centres in operation to 311.There were 244 small business operating centres in the form of “Credit Factory”, covering 204 cities at prefecture level. In addition, a total of1,200 personal loan centres had been built, covering all cities at prefecture level and above as well as the top hundred counties (cities), andbecame the major channel for the Bank to provide its personal loan products and service.The Bank’s electronic banking business developed rapidly. The number of personal online banking customers increased by 41.07% to 119.26million over the previous year; the number of transactions was 4,343 million, an increase of 7.50%. The number of corporate online bankingcustomers reached 2.13 million, an increase of 54.10%; the number of transactions was 1,298 million, an increase of 33.96%. The number ofmobile phone banking customers reached 83.90 million, an increase of 78.68%; the number of transactions was 381 million, an increase of85.06%. The number of telephone banking customers was 124.33 million, an increase of 29.23%. The number of SMS customers amountedto 158.41 million, an increase of 34.18%. The ratio of the number of transactions through electronic banking to that through the front desk was270.30%, an increase of 63.58% over the previous year. Monitoring indicators on the stability of both personal online banking system and mobilephone banking system reached 100%.40 China Construction Bank Corporation annual report <strong>2012</strong>