Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

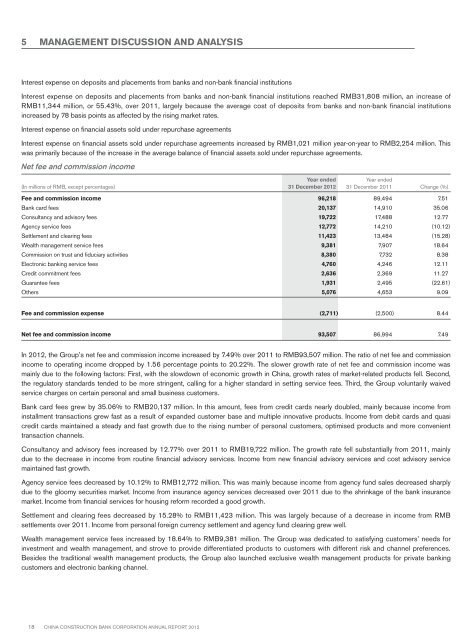

5 MANAGEMENT DISCUSSION AND ANALYSISInterest expense on deposits and placements from banks and non-bank financial institutionsInterest expense on deposits and placements from banks and non-bank financial institutions reached RMB31,808 million, an increase ofRMB11,344 million, or 55.43%, over 2011, largely because the average cost of deposits from banks and non-bank financial institutionsincreased by 78 basis points as affected by the rising market rates.Interest expense on financial assets sold under repurchase agreementsInterest expense on financial assets sold under repurchase agreements increased by RMB1,021 million year-on-year to RMB2,254 million. Thiswas primarily because of the increase in the average balance of financial assets sold under repurchase agreements.Net fee and commission income(In millions of RMB, except percentages)Year ended31 December <strong>2012</strong>Year ended31 December 2011 Change (%)Fee and commission income 96,218 89,494 7.51Bank card fees 20,137 14,910 35.06Consultancy and advisory fees 19,722 17,488 12.77Agency service fees 12,772 14,210 (10.12)Settlement and clearing fees 11,423 13,484 (15.28)Wealth management service fees 9,381 7,907 18.64Commission on trust and fiduciary activities 8,380 7,732 8.38Electronic banking service fees 4,760 4,246 12.11Credit commitment fees 2,636 2,369 11.27Guarantee fees 1,931 2,495 (22.61)Others 5,076 4,653 9.09Fee and commission expense (2,711) (2,500) 8.44Net fee and commission income 93,507 86,994 7.49In <strong>2012</strong>, the Group’s net fee and commission income increased by 7.49% over 2011 to RMB93,507 million. The ratio of net fee and commissionincome to operating income dropped by 1.56 percentage points to 20.22%. The slower growth rate of net fee and commission income wasmainly due to the following factors: First, with the slowdown of economic growth in China, growth rates of market-related products fell. Second,the regulatory standards tended to be more stringent, calling for a higher standard in setting service fees. Third, the Group voluntarily waivedservice charges on certain personal and small business customers.Bank card fees grew by 35.06% to RMB20,137 million. In this amount, fees from credit cards nearly doubled, mainly because income frominstallment transactions grew fast as a result of expanded customer base and multiple innovative products. Income from debit cards and quasicredit cards maintained a steady and fast growth due to the rising number of personal customers, optimised products and more convenienttransaction channels.Consultancy and advisory fees increased by 12.77% over 2011 to RMB19,722 million. The growth rate fell substantially from 2011, mainlydue to the decrease in income from routine financial advisory services. Income from new financial advisory services and cost advisory servicemaintained fast growth.Agency service fees decreased by 10.12% to RMB12,772 million. This was mainly because income from agency fund sales decreased sharplydue to the gloomy securities market. Income from insurance agency services decreased over 2011 due to the shrinkage of the bank insurancemarket. Income from financial services for housing reform recorded a good growth.Settlement and clearing fees decreased by 15.28% to RMB11,423 million. This was largely because of a decrease in income from RMBsettlements over 2011. Income from personal foreign currency settlement and agency fund clearing grew well.Wealth management service fees increased by 18.64% to RMB9,381 million. The Group was dedicated to satisfying customers’ needs forinvestment and wealth management, and strove to provide differentiated products to customers with different risk and channel preferences.Besides the traditional wealth management products, the Group also launched exclusive wealth management products for private bankingcustomers and electronic banking channel.18 China Construction Bank Corporation annual report <strong>2012</strong>