Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

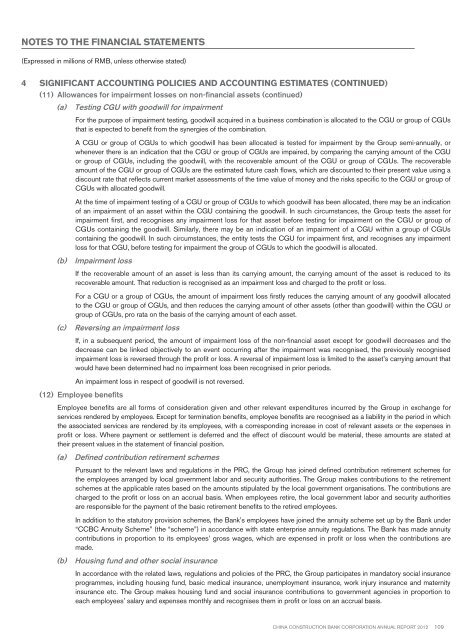

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)4 Significant accounting policies and accounting estimates (continued)(11) Allowances for impairment losses on non-financial assets (continued)(a)Testing CGU with goodwill for impairmentFor the purpose of impairment testing, goodwill acquired in a business combination is allocated to the CGU or group of CGUsthat is expected to benefit from the synergies of the combination.A CGU or group of CGUs to which goodwill has been allocated is tested for impairment by the Group semi-annually, orwhenever there is an indication that the CGU or group of CGUs are impaired, by comparing the carrying amount of the CGUor group of CGUs, including the goodwill, with the recoverable amount of the CGU or group of CGUs. The recoverableamount of the CGU or group of CGUs are the estimated future cash flows, which are discounted to their present value using adiscount rate that reflects current market assessments of the time value of money and the risks specific to the CGU or group ofCGUs with allocated goodwill.At the time of impairment testing of a CGU or group of CGUs to which goodwill has been allocated, there may be an indicationof an impairment of an asset within the CGU containing the goodwill. In such circumstances, the Group tests the asset forimpairment first, and recognises any impairment loss for that asset before testing for impairment on the CGU or group ofCGUs containing the goodwill. Similarly, there may be an indication of an impairment of a CGU within a group of CGUscontaining the goodwill. In such circumstances, the entity tests the CGU for impairment first, and recognises any impairmentloss for that CGU, before testing for impairment the group of CGUs to which the goodwill is allocated.(b) Impairment lossIf the recoverable amount of an asset is less than its carrying amount, the carrying amount of the asset is reduced to itsrecoverable amount. That reduction is recognised as an impairment loss and charged to the profit or loss.(c)For a CGU or a group of CGUs, the amount of impairment loss firstly reduces the carrying amount of any goodwill allocatedto the CGU or group of CGUs, and then reduces the carrying amount of other assets (other than goodwill) within the CGU orgroup of CGUs, pro rata on the basis of the carrying amount of each asset.Reversing an impairment lossIf, in a subsequent period, the amount of impairment loss of the non-financial asset except for goodwill decreases and thedecrease can be linked objectively to an event occurring after the impairment was recognised, the previously recognisedimpairment loss is reversed through the profit or loss. A reversal of impairment loss is limited to the asset’s carrying amount thatwould have been determined had no impairment loss been recognised in prior periods.An impairment loss in respect of goodwill is not reversed.(12) Employee benefitsEmployee benefits are all forms of consideration given and other relevant expenditures incurred by the Group in exchange forservices rendered by employees. Except for termination benefits, employee benefits are recognised as a liability in the period in whichthe associated services are rendered by its employees, with a corresponding increase in cost of relevant assets or the expenses inprofit or loss. Where payment or settlement is deferred and the effect of discount would be material, these amounts are stated attheir present values in the statement of financial position.(a)Defined contribution retirement schemesPursuant to the relevant laws and regulations in the PRC, the Group has joined defined contribution retirement schemes forthe employees arranged by local government labor and security authorities. The Group makes contributions to the retirementschemes at the applicable rates based on the amounts stipulated by the local government organisations. The contributions arecharged to the profit or loss on an accrual basis. When employees retire, the local government labor and security authoritiesare responsible for the payment of the basic retirement benefits to the retired employees.In addition to the statutory provision schemes, the Bank’s employees have joined the annuity scheme set up by the Bank under“CCBC Annuity Scheme” (the “scheme”) in accordance with state enterprise annuity regulations. The Bank has made annuitycontributions in proportion to its employees’ gross wages, which are expensed in profit or loss when the contributions aremade.(b) Housing fund and other social insuranceIn accordance with the related laws, regulations and policies of the PRC, the Group participates in mandatory social insuranceprogrammes, including housing fund, basic medical insurance, unemployment insurance, work injury insurance and maternityinsurance etc. The Group makes housing fund and social insurance contributions to government agencies in proportion toeach employees’ salary and expenses monthly and recognises them in profit or loss on an accrual basis.China Construction Bank Corporation annual report <strong>2012</strong>109