Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

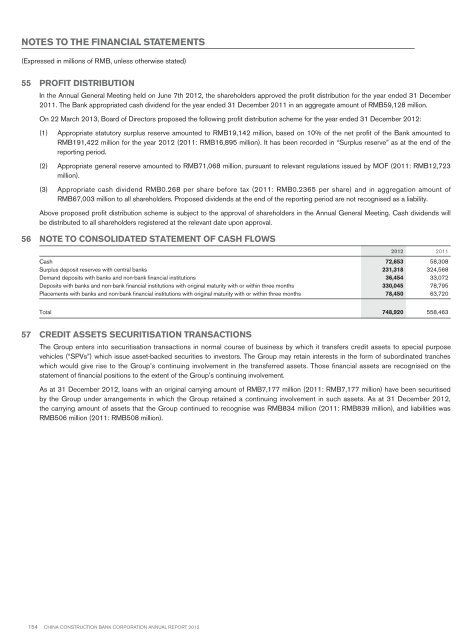

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)55 Profit distributionIn the <strong>Annual</strong> General Meeting held on June 7th <strong>2012</strong>, the shareholders approved the profit distribution for the year ended 31 December2011. The Bank appropriated cash dividend for the year ended 31 December 2011 in an aggregate amount of RMB59,128 million.On 22 March 2013, Board of Directors proposed the following profit distribution scheme for the year ended 31 December <strong>2012</strong>:(1) Appropriate statutory surplus reserve amounted to RMB19,142 million, based on 10% of the net profit of the Bank amounted toRMB191,422 million for the year <strong>2012</strong> (2011: RMB16,895 million). It has been recorded in “Surplus reserve” as at the end of thereporting period.(2) Appropriate general reserve amounted to RMB71,068 million, pursuant to relevant regulations issued by MOF (2011: RMB12,723million).(3) Appropriate cash dividend RMB0.268 per share before tax (2011: RMB0.2365 per share) and in aggregation amount ofRMB67,003 million to all shareholders. Proposed dividends at the end of the reporting period are not recognised as a liability.Above proposed profit distribution scheme is subject to the approval of shareholders in the <strong>Annual</strong> General Meeting. Cash dividends willbe distributed to all shareholders registered at the relevant date upon approval.56 Note to consolidated statement of cash flows<strong>2012</strong> 2011Cash 72,653 58,308Surplus deposit reserves with central banks 231,318 324,568Demand deposits with banks and non-bank financial institutions 36,454 33,072Deposits with banks and non-bank financial institutions with original maturity with or within three months 330,045 78,795Placements with banks and non-bank financial institutions with original maturity with or within three months 78,450 63,720Total 748,920 558,46357 Credit Assets Securitisation TransactionsThe Group enters into securitisation transactions in normal course of business by which it transfers credit assets to special purposevehicles (“SPVs”) which issue asset-backed securities to investors. The Group may retain interests in the form of subordinated trancheswhich would give rise to the Group’s continuing involvement in the transferred assets. Those financial assets are recognised on thestatement of financial positions to the extent of the Group’s continuing involvement.As at 31 December <strong>2012</strong>, loans with an original carrying amount of RMB7,177 million (2011: RMB7,177 million) have been securitisedby the Group under arrangements in which the Group retained a continuing involvement in such assets. As at 31 December <strong>2012</strong>,the carrying amount of assets that the Group continued to recognise was RMB834 million (2011: RMB839 million), and liabilities wasRMB506 million (2011: RMB508 million).154 China Construction Bank Corporation annual report <strong>2012</strong>