Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

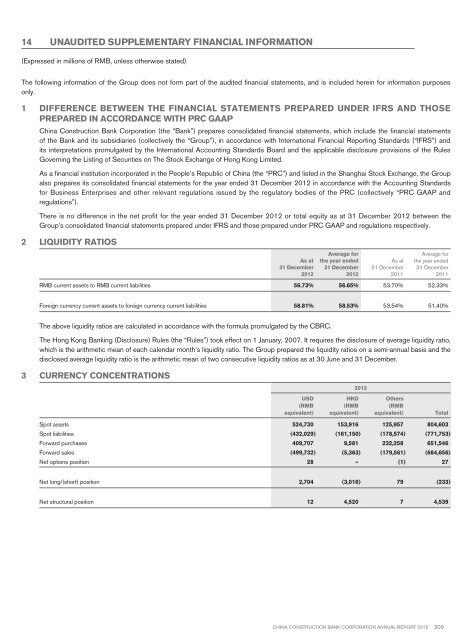

14 UNAUDITED SUPPLEMENTARY FINANCIAL INFORMATION(Expressed in millions of RMB, unless otherwise stated)The following information of the Group does not form part of the audited financial statements, and is included herein for information purposesonly.1 Difference between the financial statements prepared under IFRS and thoseprepared in accordance with PRC GAAPChina Construction Bank Corporation (the “Bank”) prepares consolidated financial statements, which include the financial statementsof the Bank and its subsidiaries (collectively the “Group”), in accordance with International Financial <strong>Report</strong>ing Standards (“IFRS”) andits interpretations promulgated by the International Accounting Standards Board and the applicable disclosure provisions of the RulesGoverning the Listing of Securities on The Stock Exchange of Hong Kong Limited.As a financial institution incorporated in the People’s Republic of China (the “PRC”) and listed in the Shanghai Stock Exchange, the Groupalso prepares its consolidated financial statements for the year ended 31 December <strong>2012</strong> in accordance with the Accounting Standardsfor Business Enterprises and other relevant regulations issued by the regulatory bodies of the PRC (collectively “PRC GAAP andregulations”).There is no difference in the net profit for the year ended 31 December <strong>2012</strong> or total equity as at 31 December <strong>2012</strong> between theGroup’s consolidated financial statements prepared under IFRS and those prepared under PRC GAAP and regulations respectively.2 Liquidity ratiosAs at31 December<strong>2012</strong>Average forthe year ended31 December<strong>2012</strong>As at31 December2011Average forthe year ended31 December2011RMB current assets to RMB current liabilities 56.73% 56.65% 53.70% 52.33%Foreign currency current assets to foreign currency current liabilities 58.81% 58.53% 53.54% 51.40%The above liquidity ratios are calculated in accordance with the formula promulgated by the CBRC.The Hong Kong Banking (Disclosure) Rules (the “Rules”) took effect on 1 January, 2007. It requires the disclosure of average liquidity ratio,which is the arithmetic mean of each calendar month’s liquidity ratio. The Group prepared the liquidity ratios on a semi-annual basis and thedisclosed average liquidity ratio is the arithmetic mean of two consecutive liquidity ratios as at 30 June and 31 December.3 Currency concentrationsUSD(RMBequivalent)HKD(RMBequivalent)<strong>2012</strong>Others(RMBequivalent)Spot assets 524,730 153,916 125,957 804,603Spot liabilities (432,029) (161,150) (178,574) (771,753)Forward purchases 409,707 9,581 232,258 651,546Forward sales (499,732) (5,363) (179,561) (684,656)Net options position 28 – (1) 27TotalNet long/(short) position 2,704 (3,016) 79 (233)Net structural position 12 4,520 7 4,539China Construction Bank Corporation annual report <strong>2012</strong>209