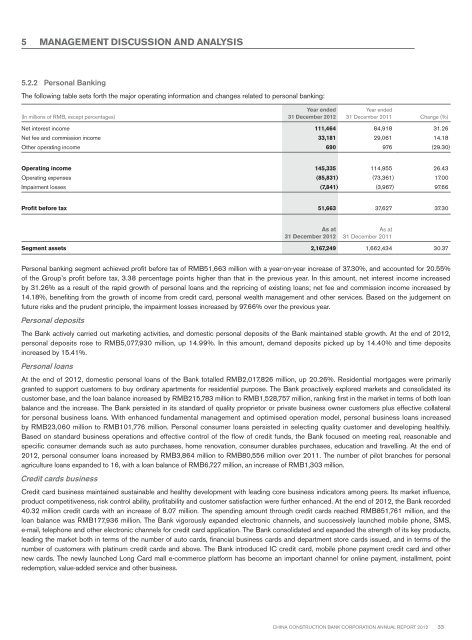

5 MANAGEMENT DISCUSSION AND ANALYSIS5.2.2 Personal BankingThe following table sets forth the major operating information and changes related to personal banking:(In millions of RMB, except percentages)Year ended31 December <strong>2012</strong>Year ended31 December 2011 Change (%)Net interest income 111,464 84,918 31.26Net fee and commission income 33,181 29,061 14.18Other operating income 690 976 (29.30)Operating income 145,335 114,955 26.43Operating expenses (85,831) (73,361) 17.00Impairment losses (7,841) (3,967) 97.66Profit before tax 51,663 37,627 37.30As at31 December <strong>2012</strong>As at31 December 2011Segment assets 2,167,249 1,662,434 30.37Personal banking segment achieved profit before tax of RMB51,663 million with a year-on-year increase of 37.30%, and accounted for 20.55%of the Group’s profit before tax, 3.38 percentage points higher than that in the previous year. In this amount, net interest income increasedby 31.26% as a result of the rapid growth of personal loans and the repricing of existing loans; net fee and commission income increased by14.18%, benefiting from the growth of income from credit card, personal wealth management and other services. Based on the judgement onfuture risks and the prudent principle, the impairment losses increased by 97.66% over the previous year.Personal depositsThe Bank actively carried out marketing activities, and domestic personal deposits of the Bank maintained stable growth. At the end of <strong>2012</strong>,personal deposits rose to RMB5,077,930 million, up 14.99%. In this amount, demand deposits picked up by 14.40% and time depositsincreased by 15.41%.Personal loansAt the end of <strong>2012</strong>, domestic personal loans of the Bank totalled RMB2,017,826 million, up 20.26%. Residential mortgages were primarilygranted to support customers to buy ordinary apartments for residential purpose. The Bank proactively explored markets and consolidated itscustomer base, and the loan balance increased by RMB215,783 million to RMB1,528,757 million, ranking first in the market in terms of both loanbalance and the increase. The Bank persisted in its standard of quality proprietor or private business owner customers plus effective collateralfor personal business loans. With enhanced fundamental management and optimised operation model, personal business loans increasedby RMB23,060 million to RMB101,776 million. Personal consumer loans persisted in selecting quality customer and developing healthily.Based on standard business operations and effective control of the flow of credit funds, the Bank focused on meeting real, reasonable andspecific consumer demands such as auto purchases, home renovation, consumer durables purchases, education and travelling. At the end of<strong>2012</strong>, personal consumer loans increased by RMB3,864 million to RMB80,556 million over 2011. The number of pilot branches for personalagriculture loans expanded to 16, with a loan balance of RMB6,727 million, an increase of RMB1,303 million.Credit cards businessCredit card business maintained sustainable and healthy development with leading core business indicators among peers. Its market influence,product competitiveness, risk control ability, profitability and customer satisfaction were further enhanced. At the end of <strong>2012</strong>, the Bank recorded40.32 million credit cards with an increase of 8.07 million. The spending amount through credit cards reached RMB851,761 million, and theloan balance was RMB177,936 million. The Bank vigorously expanded electronic channels, and successively launched mobile phone, SMS,e-mail, telephone and other electronic channels for credit card application. The Bank consolidated and expanded the strength of its key products,leading the market both in terms of the number of auto cards, financial business cards and department store cards issued, and in terms of thenumber of customers with platinum credit cards and above. The Bank introduced IC credit card, mobile phone payment credit card and othernew cards. The newly launched Long Card mall e-commerce platform has become an important channel for online payment, installment, pointredemption, value-added service and other business.China Construction Bank Corporation annual report <strong>2012</strong>33

5 MANAGEMENT DISCUSSION AND ANALYSISEntrusted housing finance businessThe Bank continued to innovate its products and upgrade its service to provide whole process financial support for the collection, managementand use of housing funds, and to provide specialised services to provident fund customers. At the end of <strong>2012</strong>, housing fund deposits wereRMB577,997 million, an increase of RMB71,042 million, while personal provident housing loans were RMB781,314 million, an increaseof RMB165,107 million. The Bank actively promoted financial services for the new indemnificatory housing market, and granted personalindemnificatory housing loans of RMB11,535 million (including personal provident housing loans) to 63,400 low and middle-income residents in<strong>2012</strong>, and provident fund loans of RMB8,932 million for indemnificatory housing projects.Debit cards and other personal fee-based businessAt the end of <strong>2012</strong>, the number of debit cards issued increased by 76.15 million to 440 million. The spending amount through debit cardsreached RMB2,368,735 million, and the fee and commission income was RMB9,066 million. The Bank issued 23.76 million financial IC debitcards. A total of 5.10 million express settlement cards targeted at individual business proprietors had been issued, an increase of 3.12 millioncards. Trading of emerging precious metal products grew rapidly, and the trading volume of account silver and account platinum amounted toRMB123,290 million.Private banking businessIn <strong>2012</strong>, the number of private banking customers increased by 18.82%, and their financial assets with the Bank increased by 30.19%. Theaccumulative number of wealth management cards and private banking cards issued was 135,500 and the settlement service capabilitiescontinued to improve. The Bank launched multiple innovative products and services for its private banking customers, including comprehensivewealth planning, Hong Kong investment immigration, comprehensive financial services for study abroad, fortune loan, asset certificates, executivejet services, household wealth management education, and precious metals franchise service. The Bank launched private banking wealth butlerservice, and carried out a wide range of customised services. It enhanced multi-channel delivery capabilities for its products and services withthe exclusive private banking online banking and hotline service. It enhanced the team building to improve the professional competence of itscustomer managers and wealth advisors.Feature article: Housing finance & personal lending businessesAs the earliest bank to provide personal residential mortgage and provident housing fund service in the PRC market, the Bank followspeople’s demands and market changes, and improves its service quality continuously. It actively expands emerging businesses whileconsolidating its traditional advantageous business areas. As the largest bank in terms of personal residential mortgages and providenthousing fund service in the market, it has assisted millions of people to fulfill their housing, living, and entrepreneurial dreams.The Bank persists in supporting residential housing, and endeavours to provide customers with more innovative products and betterprofessional services. The Bank launched “Safe House Trading” housing fund custody service, to safeguard housing transaction funds. Itgrants indemnificatory housing loans to low and middle-income groups, and continuously expands ways and methods for loan repayment. Atthe end of <strong>2012</strong>, the personal residential mortgages increased by RMB215,783 million over 2011 to RMB1,528,757 million, ranking first inthe market in terms of both loan balance and the increase.Adhering to the philosophy of “supporting housing reform and serving common people”, the Bank aims at providing high qualitycomprehensive financial services for housing reform. For over 20 years, the Bank has provided provident housing fund collection service tomore than 100 million staff, and granted over RMB1.3 trillion of provident housing fund loans to over 8.5 million households. At present, theBank cooperates with more than 1,700 provident housing fund management institutions, and provides financial services to more than onemillion participating entities and over 40 million participants. The Bank not only met the customers’ routine needs of provident housing fundaccount management, fund collection and settlement, and account enquiry and reconciliation, but also took the lead to promote multipleservices across the country, including provident housing fund loans combined with commercial mortgages, entrusted withdrawal andrepayment of provident housing fund, small amount cross-bank payment of provident housing fund, and electronic enquiry of provident fund,enabling numerous people to benefit from the low-interest provident housing loan policy to full extent.The product chain of “housing – living – business”, designed around customers’ life cycle, continues to improve. The Bank launched personalloans pledged with gold, “Easy Education Loan”, “House Refurbishment Loan”, “Fortune Loan” and other products to satisfy customers’diversified financial needs. The Bank also launched “e.ccb.com” e-commerce platform to provide personal petty loans and personal loanssecured by monetary assets.The Bank adopted integrated service modes by combining on- and off-line channels including personal loan centres, ehome.ccb.com, and95533 customer service hotline, to provide 7 days 24 hours convenient personal loan services. The Bank has set up nearly 1,200 personalloan centres covering all the cities above the prefecture level and top hundred counties (cities), and built advanced centralised operationmode for personal loans among peers, effectively shortening processing time of loan origination.34 China Construction Bank Corporation annual report <strong>2012</strong>