Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

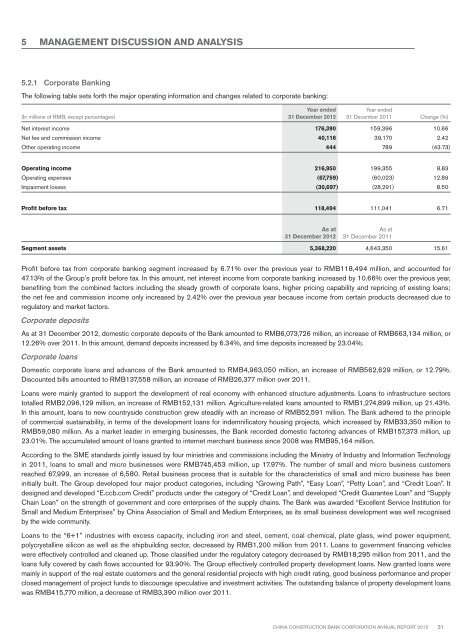

5 MANAGEMENT DISCUSSION AND ANALYSIS5.2.1 Corporate BankingThe following table sets forth the major operating information and changes related to corporate banking:(In millions of RMB, except percentages)Year ended31 December <strong>2012</strong>Year ended31 December 2011 Change (%)Net interest income 176,390 159,396 10.66Net fee and commission income 40,116 39,170 2.42Other operating income 444 789 (43.73)Operating income 216,950 199,355 8.83Operating expenses (67,759) (60,023) 12.89Impairment losses (30,697) (28,291) 8.50Profit before tax 118,494 111,041 6.71As at31 December <strong>2012</strong>As at31 December 2011Segment assets 5,368,220 4,643,350 15.61Profit before tax from corporate banking segment increased by 6.71% over the previous year to RMB118,494 million, and accounted for47.13% of the Group’s profit before tax. In this amount, net interest income from corporate banking increased by 10.66% over the previous year,benefiting from the combined factors including the steady growth of corporate loans, higher pricing capability and repricing of existing loans;the net fee and commission income only increased by 2.42% over the previous year because income from certain products decreased due toregulatory and market factors.Corporate depositsAs at 31 December <strong>2012</strong>, domestic corporate deposits of the Bank amounted to RMB6,073,726 million, an increase of RMB663,134 million, or12.26% over 2011. In this amount, demand deposits increased by 6.34%, and time deposits increased by 23.04%.Corporate loansDomestic corporate loans and advances of the Bank amounted to RMB4,963,050 million, an increase of RMB562,629 million, or 12.79%.Discounted bills amounted to RMB137,558 million, an increase of RMB26,377 million over 2011.Loans were mainly granted to support the development of real economy with enhanced structure adjustments. Loans to infrastructure sectorstotalled RMB2,096,129 million, an increase of RMB152,131 million. Agriculture-related loans amounted to RMB1,274,899 million, up 21.43%.In this amount, loans to new countryside construction grew steadily with an increase of RMB52,591 million. The Bank adhered to the principleof commercial sustainability, in terms of the development loans for indemnificatory housing projects, which increased by RMB33,350 million toRMB59,080 million. As a market leader in emerging businesses, the Bank recorded domestic factoring advances of RMB157,373 million, up23.01%. The accumulated amount of loans granted to internet merchant business since 2008 was RMB95,164 million.According to the SME standards jointly issued by four ministries and commissions including the Ministry of Industry and Information Technologyin 2011, loans to small and micro businesses were RMB745,453 million, up 17.97%. The number of small and micro business customersreached 67,999, an increase of 6,580. Retail business process that is suitable for the characteristics of small and micro business has beeninitially built. The Group developed four major product categories, including “Growing Path”, “Easy Loan”, “Petty Loan”, and “Credit Loan”. Itdesigned and developed “E.ccb.com Credit” products under the category of “Credit Loan”, and developed “Credit Guarantee Loan” and “SupplyChain Loan” on the strength of government and core enterprises of the supply chains. The Bank was awarded “Excellent Service Institution forSmall and Medium Enterprises” by China Association of Small and Medium Enterprises, as its small business development was well recognisedby the wide community.Loans to the “6+1” industries with excess capacity, including iron and steel, cement, coal chemical, plate glass, wind power equipment,polycrystalline silicon as well as the shipbuilding sector, decreased by RMB1,200 million from 2011. Loans to government financing vehicleswere effectively controlled and cleaned up. Those classified under the regulatory category decreased by RMB18,295 million from 2011, and theloans fully covered by cash flows accounted for 93.90%. The Group effectively controlled property development loans. New granted loans weremainly in support of the real estate customers and the general residential projects with high credit rating, good business performance and properclosed management of project funds to discourage speculative and investment activities. The outstanding balance of property development loanswas RMB415,770 million, a decrease of RMB3,390 million over 2011.China Construction Bank Corporation annual report <strong>2012</strong>31