Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

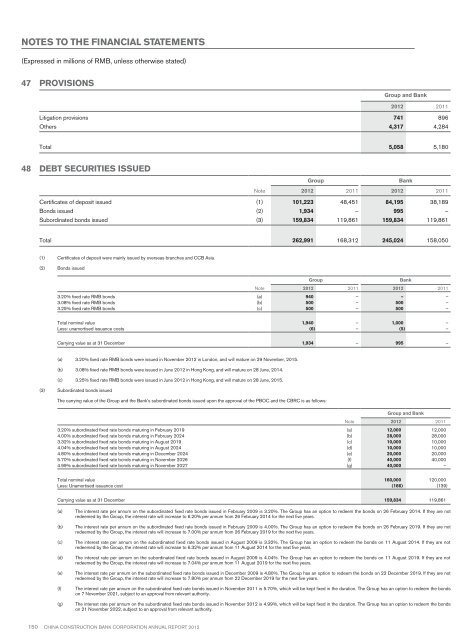

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)47 ProvisionsGroup and Bank<strong>2012</strong> 2011Litigation provisions 741 896Others 4,317 4,284Total 5,058 5,18048 Debt securities issuedGroupBankNote <strong>2012</strong> 2011 <strong>2012</strong> 2011Certificates of deposit issued (1) 101,223 48,451 84,195 38,189Bonds issued (2) 1,934 – 995 –Subordinated bonds issued (3) 159,834 119,861 159,834 119,861Total 262,991 168,312 245,024 158,050(1) Certificates of deposit were mainly issued by overseas branches and CCB Asia.(2) Bonds issuedGroupBankNote <strong>2012</strong> 2011 <strong>2012</strong> 20113.20% fixed rate RMB bonds (a) 940 – – –3.08% fixed rate RMB bonds (b) 500 – 500 –3.25% fixed rate RMB bonds (c) 500 – 500 –Total nominal value 1,940 – 1,000 –Less: unamortised issuance costs (6) – (5) –Carrying value as at 31 December 1,934 – 995 –(a) 3.20% fixed rate RMB bonds were issued in November <strong>2012</strong> in London, and will mature on 29 November, 2015.(b) 3.08% fixed rate RMB bonds were issued in June <strong>2012</strong> in Hong Kong, and will mature on 28 June, 2014.(c) 3.25% fixed rate RMB bonds were issued in June <strong>2012</strong> in Hong Kong, and will mature on 28 June, 2015.(3) Subordinated bonds issuedThe carrying value of the Group and the Bank’s subordinated bonds issued upon the approval of the PBOC and the CBRC is as follows:Group and BankNote <strong>2012</strong> 20113.20% subordinated fixed rate bonds maturing in February 2019 (a) 12,000 12,0004.00% subordinated fixed rate bonds maturing in February 2024 (b) 28,000 28,0003.32% subordinated fixed rate bonds maturing in August 2019 (c) 10,000 10,0004.04% subordinated fixed rate bonds maturing in August 2024 (d) 10,000 10,0004.80% subordinated fixed rate bonds maturing in December 2024 (e) 20,000 20,0005.70% subordinated fixed rate bonds maturing in November 2026 (f) 40,000 40,0004.99% subordinated fixed rate bonds maturing in November 2027 (g) 40,000 –Total nominal value 160,000 120,000Less: Unamortised issuance cost (166) (139)Carrying value as at 31 December 159,834 119,861(a)(b)(c)(d)(e)(f)(g)The interest rate per annum on the subordinated fixed rate bonds issued in February 2009 is 3.20%. The Group has an option to redeem the bonds on 26 February 2014. If they are notredeemed by the Group, the interest rate will increase to 6.20% per annum from 26 February 2014 for the next five years.The interest rate per annum on the subordinated fixed rate bonds issued in February 2009 is 4.00%. The Group has an option to redeem the bonds on 26 February 2019. If they are notredeemed by the Group, the interest rate will increase to 7.00% per annum from 26 February 2019 for the next five years.The interest rate per annum on the subordinated fixed rate bonds issued in August 2009 is 3.32%. The Group has an option to redeem the bonds on 11 August 2014. If they are notredeemed by the Group, the interest rate will increase to 6.32% per annum from 11 August 2014 for the next five years.The interest rate per annum on the subordinated fixed rate bonds issued in August 2009 is 4.04%. The Group has an option to redeem the bonds on 11 August 2019. If they are notredeemed by the Group, the interest rate will increase to 7.04% per annum from 11 August 2019 for the next five years.The interest rate per annum on the subordinated fixed rate bonds issued in December 2009 is 4.80%. The Group has an option to redeem the bonds on 22 December 2019. If they are notredeemed by the Group, the interest rate will increase to 7.80% per annum from 22 December 2019 for the next five years.The interest rate per annum on the subordinated fixed rate bonds issued in November 2011 is 5.70%, which will be kept fixed in the duration. The Group has an option to redeem the bondson 7 November 2021, subject to an approval from relevant authority.The interest rate per annum on the subordinated fixed rate bonds issued in November <strong>2012</strong> is 4.99%, which will be kept fixed in the duration. The Group has an option to redeem the bondson 21 November 2022, subject to an approval from relevant authority.150 China Construction Bank Corporation annual report <strong>2012</strong>