Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

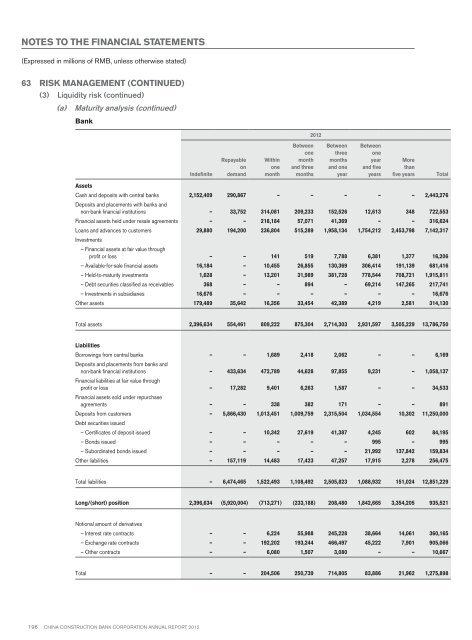

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)63 Risk Management (continued)(3) Liquidity risk (continued)(a) Maturity analysis (continued)Bank<strong>2012</strong>IndefiniteRepayableondemandWithinonemonthBetweenonemonthand threemonthsBetweenthreemonthsand oneyearBetweenoneyearand fiveyearsMorethanfive yearsTotalAssetsCash and deposits with central banks 2,152,409 290,867 – – – – – 2,443,276Deposits and placements with banks andnon-bank financial institutions – 33,752 314,081 209,233 152,526 12,613 348 722,553Financial assets held under resale agreements – – 218,184 57,071 41,369 – – 316,624Loans and advances to customers 29,880 194,200 236,804 515,289 1,958,134 1,754,212 2,453,798 7,142,317Investments– Financial assets at fair value throughprofit or loss – – 141 519 7,788 6,381 1,377 16,206– Available-for-sale financial assets 16,184 – 10,455 26,855 130,369 306,414 191,139 681,416– Held-to-maturity investments 1,628 – 13,201 31,989 381,728 778,544 708,721 1,915,811– Debt securities classified as receivables 368 – – 894 – 69,214 147,265 217,741– Investments in subsidiaries 16,676 – – – – – – 16,676Other assets 179,489 35,642 16,356 33,454 42,389 4,219 2,581 314,130Total assets 2,396,634 554,461 809,222 875,304 2,714,303 2,931,597 3,505,229 13,786,750LiabilitiesBorrowings from central banks – – 1,689 2,418 2,062 – – 6,169Deposits and placements from banks andnon-bank financial institutions – 433,634 472,789 44,628 97,855 9,231 – 1,058,137Financial liabilities at fair value throughprofit or loss – 17,282 9,401 6,263 1,587 – – 34,533Financial assets sold under repurchaseagreements – – 338 382 171 – – 891Deposits from customers – 5,866,430 1,013,451 1,009,759 2,315,504 1,034,554 10,302 11,250,000Debt securities issued– Certificates of deposit issued – – 10,342 27,619 41,387 4,245 602 84,195– Bonds issued – – – – – 995 – 995– Subordinated bonds issued – – – – – 21,992 137,842 159,834Other liabilities – 157,119 14,483 17,423 47,257 17,915 2,278 256,475Total liabilities – 6,474,465 1,522,493 1,108,492 2,505,823 1,088,932 151,024 12,851,229Long/(short) position 2,396,634 (5,920,004) (713,271) (233,188) 208,480 1,842,665 3,354,205 935,521Notional amount of derivatives– Interest rate contracts – – 6,224 55,988 245,228 38,664 14,061 360,165– Exchange rate contracts – – 192,202 193,244 466,497 45,222 7,901 905,066– Other contracts – – 6,080 1,507 3,080 – – 10,667Total – – 204,506 250,739 714,805 83,886 21,962 1,275,898196 China Construction Bank Corporation annual report <strong>2012</strong>