Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

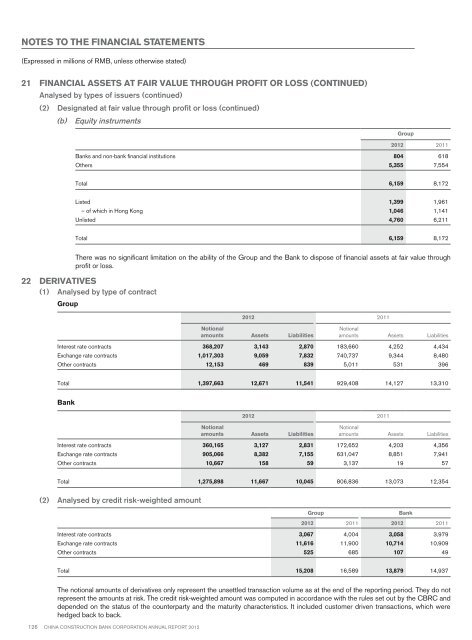

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)21 Financial assets at fair value through profit or loss (continued)Analysed by types of issuers (continued)(2) Designated at fair value through profit or loss (continued)(b) Equity instrumentsGroup<strong>2012</strong> 2011Banks and non-bank financial institutions 804 618Others 5,355 7,554Total 6,159 8,172Listed 1,399 1,961– of which in Hong Kong 1,046 1,141Unlisted 4,760 6,211Total 6,159 8,172There was no significant limitation on the ability of the Group and the Bank to dispose of financial assets at fair value throughprofit or loss.22 Derivatives(1) Analysed by type of contractGroup<strong>2012</strong> 2011Notionalamounts Assets LiabilitiesNotionalamounts Assets LiabilitiesInterest rate contracts 368,207 3,143 2,870 183,660 4,252 4,434Exchange rate contracts 1,017,303 9,059 7,832 740,737 9,344 8,480Other contracts 12,153 469 839 5,011 531 396Total 1,397,663 12,671 11,541 929,408 14,127 13,310Bank<strong>2012</strong> 2011Notionalamounts Assets LiabilitiesNotionalamounts Assets LiabilitiesInterest rate contracts 360,165 3,127 2,831 172,652 4,203 4,356Exchange rate contracts 905,066 8,382 7,155 631,047 8,851 7,941Other contracts 10,667 158 59 3,137 19 57Total 1,275,898 11,667 10,045 806,836 13,073 12,354(2) Analysed by credit risk-weighted amountGroupBank<strong>2012</strong> 2011 <strong>2012</strong> 2011Interest rate contracts 3,067 4,004 3,058 3,979Exchange rate contracts 11,616 11,900 10,714 10,909Other contracts 525 685 107 49Total 15,208 16,589 13,879 14,937The notional amounts of derivatives only represent the unsettled transaction volume as at the end of the reporting period. They do notrepresent the amounts at risk. The credit risk-weighted amount was computed in accordance with the rules set out by the CBRC anddepended on the status of the counterparty and the maturity characteristics. It included customer driven transactions, which werehedged back to back.126 China Construction Bank Corporation annual report <strong>2012</strong>