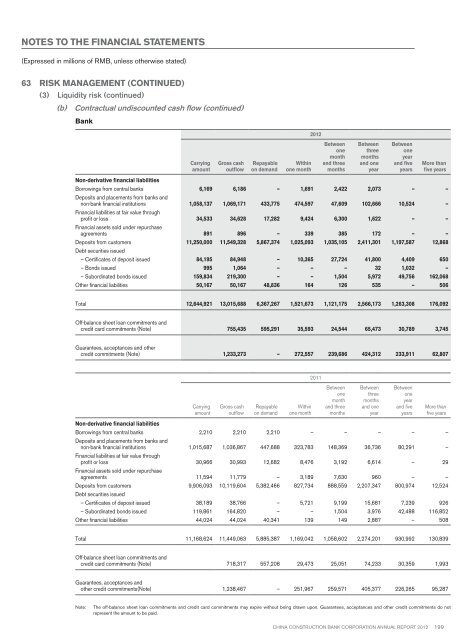

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)63 Risk Management (continued)(3) Liquidity risk (continued)(b) Contractual undiscounted cash flow (continued)Bank<strong>2012</strong>CarryingamountGross cashoutflowRepayableon demandWithinone monthBetweenonemonthand threemonthsBetweenthreemonthsand oneyearBetweenoneyearand fiveyearsMore thanfive yearsNon-derivative financial liabilitiesBorrowings from central banks 6,169 6,186 – 1,691 2,422 2,073 – –Deposits and placements from banks andnon-bank financial institutions 1,058,137 1,069,171 433,775 474,597 47,609 102,666 10,524 –Financial liabilities at fair value throughprofit or loss 34,533 34,628 17,282 9,424 6,300 1,622 – –Financial assets sold under repurchaseagreements 891 896 – 339 385 172 – –Deposits from customers 11,250,000 11,549,328 5,867,374 1,025,093 1,035,105 2,411,301 1,197,587 12,868Debt securities issued– Certificates of deposit issued 84,195 84,948 – 10,365 27,724 41,800 4,409 650– Bonds issued 995 1,064 – – – 32 1,032 –– Subordinated bonds issued 159,834 219,300 – – 1,504 5,972 49,756 162,068Other financial liabilities 50,167 50,167 48,836 164 126 535 – 506Total 12,644,921 13,015,688 6,367,267 1,521,673 1,121,175 2,566,173 1,263,308 176,092Off-balance sheet loan commitments andcredit card commitments (Note) 755,435 595,291 35,593 24,544 65,473 30,789 3,745Guarantees, acceptances and othercredit commitments (Note) 1,233,273 – 272,557 239,686 424,312 233,911 62,8072011CarryingamountGross cashoutflowRepayableon demandWithinone monthBetweenonemonthand threemonthsBetweenthreemonthsand oneyearBetweenoneyearand fiveyearsMore thanfive yearsNon-derivative financial liabilitiesBorrowings from central banks 2,210 2,210 2,210 – – – – –Deposits and placements from banks andnon-bank financial institutions 1,015,687 1,036,867 447,688 323,783 148,369 36,736 80,291 –Financial liabilities at fair value throughprofit or loss 30,966 30,993 12,682 8,476 3,192 6,614 – 29Financial assets sold under repurchaseagreements 11,594 11,779 – 3,189 7,630 960 – –Deposits from customers 9,906,093 10,119,604 5,382,466 827,734 888,559 2,207,347 800,974 12,524Debt securities issued– Certificates of deposit issued 38,189 38,766 – 5,721 9,199 15,681 7,239 926– Subordinated bonds issued 119,861 164,820 – – 1,504 3,976 42,488 116,852Other financial liabilities 44,024 44,024 40,341 139 149 2,887 – 508Total 11,168,624 11,449,063 5,885,387 1,169,042 1,058,602 2,274,201 930,992 130,839Off-balance sheet loan commitments andcredit card commitments (Note) 718,317 557,208 29,473 25,051 74,233 30,359 1,993Guarantees, acceptances andother credit commitments(Note) 1,238,467 – 251,967 259,571 405,377 226,265 95,287Note:The off-balance sheet loan commitments and credit card commitments may expire without being drawn upon. Guarantees, acceptances and other credit commitments do notrepresent the amount to be paid.China Construction Bank Corporation annual report <strong>2012</strong>199

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)63 Risk Management (continued)(4) Operational riskOperational risk represents the risk of loss due to deficient and flawed internal processes, personnel and information system, or otherexternal events.The Group has continued to further strengthen the operational risk management processes to ensure operational stability andbusiness as usual, by enhancing the self-assessment of operational risk, establishing key risk controls and examination, utilisingusage of operational risk tools and systems, streamlining the Group’s banking systems parameters, performing emergency drills toensure continuous business operations in adverse scenarios and promoting business continuity management:– continuous self-assessment of operational risk – The Group continuously improves and expands the scope of self-assessment,placing particular focus on off-balance sheet related items to enhance respective regulations, processes and services;– establishment of examination of key risk controls – The Group carries out examination over key risk controls, and continues torefine, expand and re-examine the scope and contents of the monitoring checks, placing particular focus on key business areasand preventive checks on major operational risk areas;– strengthening the centralised operational risk management evaluation system – The Group refines the operational riskindicators with respect to corporate and personal credit businesses, which assists and drives branches’ evaluation of theoperational risks;– improvement in segregation of duties – The Group continues to improve and review the roles and responsibilities of its keystaff positions to ensure adequate segregation of duties (responsibilities), further strengthening the system of checks andbalances;– steady progress in business continuity management – The Group conducts emergency operational drills in pilot branches,which improves the strategies and mechanisms of the Tier 2 institutions and networks in response to natural disasters;– strengthening major risks and unforeseen events reporting process – The Group formalises the supervision and monitoringover major risks and unforeseen events by prescribing the information recording and reporting processes. Clear informationchannels have also been established to increase the ability of the Group to address these risks and events;– streamline and review of important system parameters – The Group continues to evaluate management system parameters andtimely remediates deficiency to ensure secured and smooth system operations; and– the Group has implemented laws, rules and regulations concerning anti-money laundering (AML). The Group continuedto improve its internal control system relating to AML. The Group follows “know-your-customer” principle in identifying andrecording customers’ identities and transactions diligently, and proactively identifies and reports significant, suspicious andsuspected terrorist-related transactions. Training and publicity for AML has also been enhanced. All these measures are put inplace to effectively fulfill the statutory AML obligations.(5) Fair value(a) Financial assetsThe Group’s financial assets mainly include cash and deposits with central banks, deposits and placements with banks andnon-bank financial institutions, financial assets at fair value through profit or loss, financial assets held under resale agreements,loans and advances to customers, available-for-sale financial assets, held-to-maturity investments and debt securities classifiedas receivables.Deposits with central banks, deposits and placements with banks and non-bank financial institutions andfinancial assets held under resale agreementsDeposits with central banks, deposits and placements with banks and non-bank financial institutions and financial assets heldunder resale agreements are mainly priced at market interest rates and mature within one year. Accordingly, the carrying valuesapproximate the fair values.Loans and advances to customersMajority of the loans and advances to customers are repriced at least annually to the market rate. Accordingly, their carryingvalues approximate the fair values.InvestmentsAvailable-for-sale financial assets and financial assets at fair value through profit or loss are stated at fair value in the financialstatements. The following table shows the carrying values and the fair values of the debt securities classified as receivablesand held-to-maturity investments which are not presented in the statement of financial position at their fair values.200 China Construction Bank Corporation annual report <strong>2012</strong>