collega - Károli Gáspár Református Egyetem

collega - Károli Gáspár Református Egyetem

collega - Károli Gáspár Református Egyetem

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The Place and Theiry of Banking Law<br />

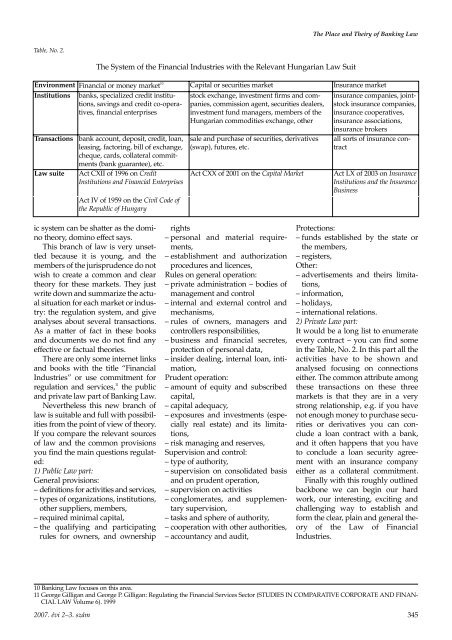

Table, No. 2.<br />

The System of the Financial Industries with the Relevant Hungarian Law Suit<br />

Environment Financial or money market 10 Capital or securities market Insurance market<br />

Institutions banks, specialized credit institutions,<br />

savings and credit co-operatives,<br />

financial enterprises<br />

Transactions<br />

Law suite<br />

bank account, deposit, credit, loan,<br />

leasing, factoring, bill of exchange,<br />

cheque, cards, collateral commitments<br />

(bank guarantee), etc.<br />

Act CXII of 1996 on Credit<br />

Institutions and Financial Enterprises<br />

Act IV of 1959 on the Civil Code of<br />

the Republic of Hungary<br />

stock exchange, investment firms and companies,<br />

commission agent, securities dealers,<br />

investment fund managers, members of the<br />

Hungarian commodities exchange, other<br />

sale and purchase of securities, derivatives<br />

(swap), futures, etc.<br />

Act CXX of 2001 on the Capital Market<br />

insurance companies, jointstock<br />

insurance companies,<br />

insurance cooperatives,<br />

insurance associations,<br />

insurance brokers<br />

all sorts of insurance contract<br />

Act LX of 2003 on Insurance<br />

Institutions and the Insurance<br />

Business<br />

ic system can be shatter as the domino<br />

theory, domino effect says.<br />

This branch of law is very unsettled<br />

because it is young, and the<br />

members of the jurisprudence do not<br />

wish to create a common and clear<br />

theory for these markets. They just<br />

write down and summarize the actual<br />

situation for each market or industry:<br />

the regulation system, and give<br />

analyses about several transactions.<br />

As a matter of fact in these books<br />

and documents we do not find any<br />

effective or factual theories.<br />

There are only some internet links<br />

and books with the title “Financial<br />

Industries” or use commitment for<br />

regulation and services, 11<br />

the public<br />

and private law part of Banking Law.<br />

Nevertheless this new branch of<br />

law is suitable and full with possibilities<br />

from the point of view of theory.<br />

If you compare the relevant sources<br />

of law and the common provisions<br />

you find the main questions regulated:<br />

1) Public Law part:<br />

General provisions:<br />

– definitions for activities and services,<br />

– types of organizations, institutions,<br />

other suppliers, members,<br />

– required minimal capital,<br />

– the qualifying and participating<br />

rules for owners, and ownership<br />

rights<br />

– personal and material requirements,<br />

– establishment and authorization<br />

procedures and licences,<br />

Rules on general operation:<br />

– private administration – bodies of<br />

management and control<br />

– internal and external control and<br />

mechanisms,<br />

– rules of owners, managers and<br />

controllers responsibilities,<br />

– business and financial secretes,<br />

protection of personal data,<br />

– insider dealing, internal loan, intimation,<br />

Prudent operation:<br />

– amount of equity and subscribed<br />

capital,<br />

– capital adequacy,<br />

– exposures and investments (especially<br />

real estate) and its limitations,<br />

– risk managing and reserves,<br />

Supervision and control:<br />

– type of authority,<br />

– supervision on consolidated basis<br />

and on prudent operation,<br />

– supervision on activities<br />

– conglomerates, and supplementary<br />

supervision,<br />

– tasks and sphere of authority,<br />

– cooperation with other authorities,<br />

– accountancy and audit,<br />

Protections:<br />

– funds established by the state or<br />

the members,<br />

– registers,<br />

Other:<br />

– advertisements and theirs limitations,<br />

– information,<br />

– holidays,<br />

– international relations.<br />

2) Private Law part:<br />

It would be a long list to enumerate<br />

every contract – you can find some<br />

in the Table, No. 2. In this part all the<br />

activities have to be shown and<br />

analysed focusing on connections<br />

either. The common attribute among<br />

these transactions on these three<br />

markets is that they are in a very<br />

strong relationship, e.g. if you have<br />

not enough money to purchase securities<br />

or derivatives you can conclude<br />

a loan contract with a bank,<br />

and it often happens that you have<br />

to conclude a loan security agreement<br />

with an insurance company<br />

either as a collateral commitment.<br />

Finally with this roughly outlined<br />

backbone we can begin our hard<br />

work, our interesting, exciting and<br />

challenging way to establish and<br />

form the clear, plain and general theory<br />

of the Law of Financial<br />

Industries.<br />

10 Banking Law focuses on this area.<br />

11 George Gilligan and George P. Gilligan: Regulating the Financial Services Sector (STUDIES IN COMPARATIVE CORPORATE AND FINAN-<br />

CIAL LAW Volume 6). 1999<br />

2007. évi 2–3. szám<br />

345