Post 2015: Global Action for an Inclusive and Sustainable Future

Post 2015: Global Action for an Inclusive and Sustainable Future

Post 2015: Global Action for an Inclusive and Sustainable Future

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

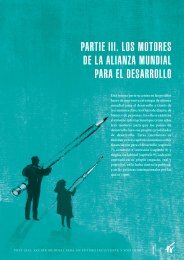

lmIcs <strong>an</strong>d lIcs (oEcD, 2011b). Figure 7.5 shows<br />

the difference in the scale of potential tax increases<br />

between countries in different income groups. While<br />

potential additional tax revenues as a share of GDp<br />

are similar across the groups, the absolute potential<br />

amounts differ subst<strong>an</strong>tially. the oEcD (2012b)<br />

there<strong>for</strong>e argues that only the group of umIcs has<br />

the potential to raise enough taxes to fund social<br />

expenditure in order to reach the mDG targets on<br />

poverty reduction, education <strong>an</strong>d health. moreover,<br />

several lIcs <strong>an</strong>d lmIcs, among them côte d’Ivoire,<br />

have already reached their tax potential <strong>an</strong>d<br />

collect more taxes th<strong>an</strong> might be expected given<br />

their structural characteristics (oEcD, 2011b).<br />

Increasing the tax potential in countries where it is<br />

low is thus a necessary but medium- to long-term<br />

task because it requires broadening the tax base by<br />

fostering the growth of productive sectors, which<br />

c<strong>an</strong> be politically challenging. political challenges<br />

arise because growth of the productive sector<br />

me<strong>an</strong>s finding ways to strengthen coordination<br />

<strong>an</strong>d collaboration between the state <strong>an</strong>d private<br />

investors (moore <strong>an</strong>d Schmitz, 2008), whereas<br />

re<strong>for</strong>ms of the investment climate tend to reduce<br />

the privileges of certain powerful actors within<br />

the private sector <strong>an</strong>d government <strong>an</strong>d c<strong>an</strong> thus<br />

increase conflicts between them.<br />

Limited tax capacity<br />

capacity constraints also limit the potential<br />

contribution of taxation to development<br />

fin<strong>an</strong>ce. m<strong>an</strong>y developing countries have<br />

successfully increased the technical capacity of<br />

tax administrations, <strong>for</strong> inst<strong>an</strong>ce by adopting<br />

in<strong>for</strong>mation <strong>an</strong>d communication technologies<br />

(Icts), ensuring adequate staffing or developing<br />

the capacity <strong>for</strong> tax expenditure <strong>an</strong>d wider tax<br />

policy <strong>an</strong>alysis (ImF, 2011). Some governments have<br />

stepped up their ef<strong>for</strong>ts to improve the technical<br />

capacity of sub-national tax administrations<br />

in order to address the mismatch between the<br />

devolution of public fin<strong>an</strong>cial responsibilities <strong>an</strong>d<br />

Figure 7.5 Total potential tax increases (in US$ billion) <strong>an</strong>d average potential tax<br />

increases as a share of GDP by income group (<strong>an</strong>nual amounts)<br />

% of GDP<br />

5.0<br />

4.5<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

Low-income Low-middle-<br />

income<br />

Upper-middleincome<br />

Total Potential Tax Increase (USD Billion) Average Potential Tax Increase<br />

Source: OECD (2012b)<br />

poSt-<strong>2015</strong>: <strong>Global</strong> actIon For <strong>an</strong> IncluSIvE <strong>an</strong>D SuStaInablE FuturE<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

USD Billions<br />

UMICs are<br />

generally<br />

better able to<br />

mobilise enough<br />

resources through<br />

taxation to fund<br />

development<br />

spending th<strong>an</strong><br />

are the groups<br />

of LMICs <strong>an</strong>d<br />

LICs.<br />

111