Solar Energy Perspectives - IEA

Solar Energy Perspectives - IEA

Solar Energy Perspectives - IEA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chapter 10: Policies<br />

ambition of the initial programme. They totalled 62% of the added capacity, the remainder<br />

being provided by less than 1 200 larger installations.<br />

As a result, the supply curve seems rather flat, reflecting considerable potential at a given<br />

cost. Controlling quantities would require a very precise price setting in an uncertain and<br />

ever-changing economic environment. At any time, the incentive level risks being either “too<br />

high”, not generating too-high returns to investors but driving more PV investments in PV<br />

than wished, or “too low” and much less investment than desired will take place. The<br />

difficulty is illustrated in Figure 10.6.<br />

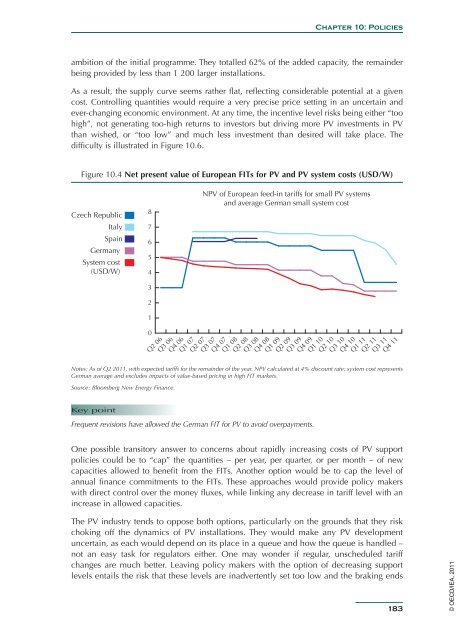

Figure 10.4 Net present value of European FITs for PV and PV system costs (USD/W)<br />

Czech Republic<br />

Italy<br />

Spain<br />

Germany<br />

System cost<br />

(USD/W)<br />

Notes: As of Q2 2011, with expected tariffs for the remainder of the year. NPV calculated at 4% discount rate; system cost represents<br />

German average and excludes impacts of value-based pricing in high FIT markets.<br />

Source: Bloomberg New <strong>Energy</strong> Finance.<br />

Key point<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Q2 06<br />

Q3 06<br />

Q4 06<br />

Q1 07<br />

NPV of European feed-in tariffs for small PV systems<br />

and average German small system cost<br />

Frequent revisions have allowed the German FIT for PV to avoid overpayments.<br />

Q2 07<br />

Q3 07<br />

Q4 07<br />

Q1 08<br />

Q2 08<br />

Q3 08<br />

Q4 08<br />

Q1 09<br />

Q2 09<br />

Q3 09<br />

Q4 09<br />

Q1 10<br />

Q2 10<br />

Q3 10<br />

Q4 10<br />

Q1 11<br />

Q2 11<br />

Q3 11<br />

Q4 11<br />

One possible transitory answer to concerns about rapidly increasing costs of PV support<br />

policies could be to “cap” the quantities – per year, per quarter, or per month – of new<br />

capacities allowed to benefit from the FITs. Another option would be to cap the level of<br />

annual finance commitments to the FITs. These approaches would provide policy makers<br />

with direct control over the money fluxes, while linking any decrease in tariff level with an<br />

increase in allowed capacities.<br />

The PV industry tends to oppose both options, particularly on the grounds that they risk<br />

choking off the dynamics of PV installations. They would make any PV development<br />

uncertain, as each would depend on its place in a queue and how the queue is handled –<br />

not an easy task for regulators either. One may wonder if regular, unscheduled tariff<br />

changes are much better. Leaving policy makers with the option of decreasing support<br />

levels entails the risk that these levels are inadvertently set too low and the braking ends<br />

183<br />

© OECD/<strong>IEA</strong>, 2011