Solar Energy Perspectives - IEA

Solar Energy Perspectives - IEA

Solar Energy Perspectives - IEA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Solar</strong> <strong>Energy</strong> <strong>Perspectives</strong>: Policies<br />

starting with the lowest-price offer, moving up to more expensive options until demand is<br />

met. Under normal conditions, the offer price of the last unit of generation dispatched (the<br />

“marginal” unit of generation) sets the market price for electricity, which is paid for all<br />

generation dispatched irrespective of their individual offers (giving birth to what is called<br />

“infra-marginal rents”).<br />

Perhaps counter-intuitively, nuclear and renewable generators can be more exposed to fuel<br />

and carbon price uncertainty than fossil-fuel generators under marginal pricing. A gas-fired<br />

combined-cycle plant that sets the marginal price will generally recover its operating costs<br />

(including fuel and carbon), because the electricity price adjusts to cover these costs. It will<br />

also benefit from higher prices during peak periods to recover its modest capital costs.<br />

Ultimately, the gas-fired generators’ profits are not strongly exposed to fluctuations in the<br />

price of gas or carbon, as long as the generation is setting the marginal price.<br />

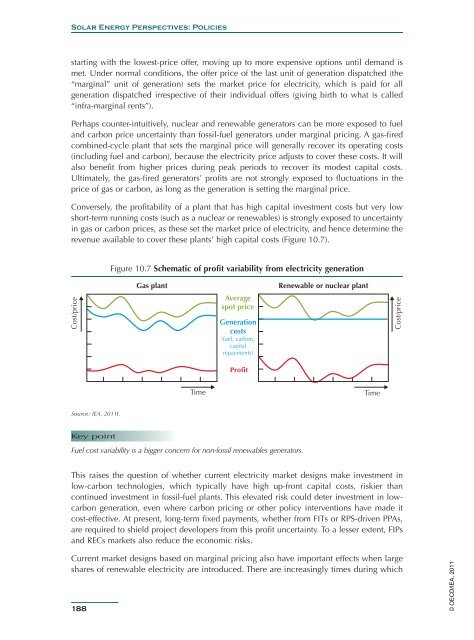

Conversely, the profitability of a plant that has high capital investment costs but very low<br />

short-term running costs (such as a nuclear or renewables) is strongly exposed to uncertainty<br />

in gas or carbon prices, as these set the market price of electricity, and hence determine the<br />

revenue available to cover these plants’ high capital costs (Figure 10.7).<br />

Figure 10.7 Schematic of profit variability from electricity generation<br />

Cost/price<br />

Gas plant<br />

Average<br />

spot price<br />

Generation<br />

costs<br />

(fuel, carbon,<br />

capital<br />

repayments)<br />

Profit<br />

Renewable or nuclear plant<br />

Cost/price<br />

Time<br />

Time<br />

Source: <strong>IEA</strong>, 2011f.<br />

Key point<br />

Fuel cost variability is a bigger concern for non-fossil renewables generators.<br />

This raises the question of whether current electricity market designs make investment in<br />

low-carbon technologies, which typically have high up-front capital costs, riskier than<br />

continued investment in fossil-fuel plants. This elevated risk could deter investment in lowcarbon<br />

generation, even where carbon pricing or other policy interventions have made it<br />

cost-effective. At present, long-term fixed payments, whether from FITs or RPS-driven PPAs,<br />

are required to shield project developers from this profit uncertainty. To a lesser extent, FIPs<br />

and RECs markets also reduce the economic risks.<br />

Current market designs based on marginal pricing also have important effects when large<br />

shares of renewable electricity are introduced. There are increasingly times during which<br />

188<br />

© OECD/<strong>IEA</strong>, 2011