Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

118 F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

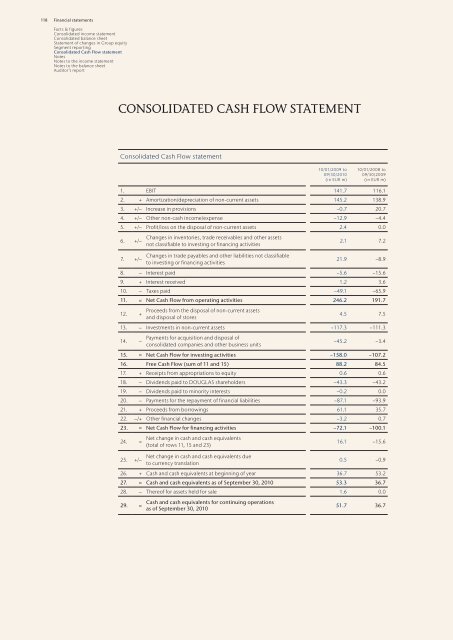

CONSOLIDATED CASH FLOW STATEMENT<br />

Consolidated Cash Flow statement<br />

<strong>10</strong>/01/<strong>2009</strong> to<br />

09/30/20<strong>10</strong><br />

(<strong>in</strong> EUR m)<br />

<strong>10</strong>/01/2008 to<br />

09/30/<strong>2009</strong><br />

(<strong>in</strong> EUR m)<br />

1. EBIT 141.7 116.1<br />

2. + Amortization/depreciation of non-current assets 145.2 138.9<br />

3. +/– Increase <strong>in</strong> provisions −0.7 20.7<br />

4. +/– Other non-cash <strong>in</strong>come/expense −12.9 −4.4<br />

5. +/– Profit/loss on the disposal of non-current assets 2.4 0.0<br />

6. +/–<br />

Changes <strong>in</strong> <strong>in</strong>ventories, trade receivables and other assets<br />

not classifiable to <strong>in</strong>vest<strong>in</strong>g or f<strong>in</strong>anc<strong>in</strong>g activities<br />

2.1 7.2<br />

7. +/–<br />

Changes <strong>in</strong> trade payables and other liabilities not classifiable<br />

to <strong>in</strong>vest<strong>in</strong>g or f<strong>in</strong>anc<strong>in</strong>g activities<br />

21.9 −8.9<br />

8. – Interest paid −5.6 −15.6<br />

9. + Interest received 1.2 3.6<br />

<strong>10</strong>. – Taxes paid −49.1 −65.9<br />

11. = Net Cash Flow from operat<strong>in</strong>g activities 246.2 191.7<br />

12. +<br />

Proceeds from the disposal of non-current assets<br />

and disposal of stores<br />

4.5 7.5<br />

13. – Investments <strong>in</strong> non-current assets −117.3 −111.3<br />

14. –<br />

Payments for acquisition and disposal of<br />

consolidated companies and other bus<strong>in</strong>ess units<br />

−45.2 −3.4<br />

15. = Net Cash Flow for <strong>in</strong>vest<strong>in</strong>g activities −158.0 −<strong>10</strong>7.2<br />

16. Free Cash Flow (sum of 11 and 15) 88.2 84.5<br />

17. + Receipts from appropriations to equity 0.6 0.6<br />

18. – Dividends paid to DOUGLAS shareholders −43.3 −43.2<br />

19. – Dividends paid to m<strong>in</strong>ority <strong>in</strong>terests −0.2 0.0<br />

20. – Payments for the repayment of f<strong>in</strong>ancial liabilities −87.1 −93.9<br />

21. + Proceeds from borrow<strong>in</strong>gs 61.1 35.7<br />

22. –/+ Other f<strong>in</strong>ancial changes −3.2 0.7<br />

23. = Net Cash Flow for f<strong>in</strong>anc<strong>in</strong>g activities −72.1 −<strong>10</strong>0.1<br />

24. =<br />

Net change <strong>in</strong> cash and cash equivalents<br />

(total of rows 11, 15 and 23)<br />

16.1 −15.6<br />

25. +/–<br />

Net change <strong>in</strong> cash and cash equivalents due<br />

to currency translation<br />

0.5 −0.9<br />

26. + Cash and cash equivalents at beg<strong>in</strong>n<strong>in</strong>g of year 36.7 53.2<br />

27. = Cash and cash equivalents as of September 30, 20<strong>10</strong> 53.3 36.7<br />

28. – Thereof for assets held for sale 1.6 0.0<br />

29. =<br />

Cash and cash equivalents for cont<strong>in</strong>u<strong>in</strong>g operations<br />

as of September 30, 20<strong>10</strong><br />

51.7 36.7