Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

134 F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

47–49<br />

<strong>in</strong>g the Fair Values and acquisition costs associated with first time consolidation. Actual<br />

values may vary <strong>in</strong> <strong>in</strong>dividual cases from the assumptions and estimates made. Changes<br />

are recognized <strong>in</strong> <strong>in</strong>come as soon as more detailed <strong>in</strong>formation is known.<br />

Capital Management<br />

The purpose of capital management is to ma<strong>in</strong>ta<strong>in</strong> equity <strong>in</strong> conformity with IFRS. The<br />

goal of the DOUGLAS Group’s capital management is to assure that the Group can cont<strong>in</strong>ue<br />

to meet its f<strong>in</strong>ancial obligations and to susta<strong>in</strong> the bus<strong>in</strong>ess value on a long-term basis.<br />

Thus, the DOUGLAS Group aims at a Group equity ratio of more than 35 percent. The<br />

central control factor of the DOUGLAS Group is the DOUGLAS Value Added (DVA). This<br />

represents a control and management system <strong>in</strong> which all decision-mak<strong>in</strong>g processes are<br />

reviewed <strong>in</strong> terms of their susta<strong>in</strong>ed contribution to value and measured <strong>in</strong> terms of DVA.<br />

Further <strong>in</strong>formation about the current development of the DVA can be found <strong>in</strong> the Management<br />

<strong>Report</strong> on page 47-49.<br />

The aim of the DOUGLAS Group’s capital management strategy is to ensure that all<br />

the Group companies have appropriate equity accord<strong>in</strong>g to local needs, such that external<br />

capital requirements have always been met <strong>in</strong> the past fiscal year.<br />

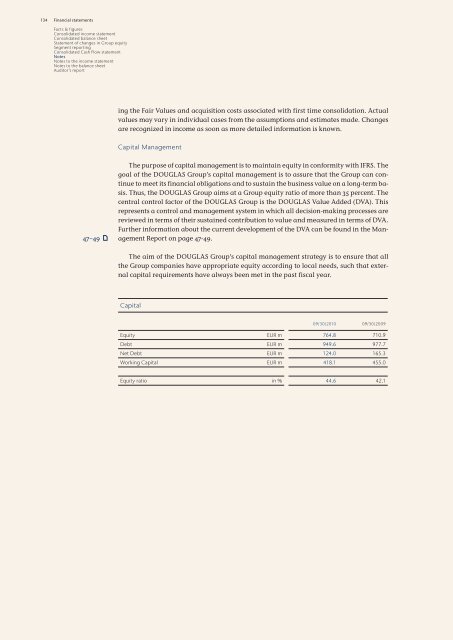

Capital<br />

09/30/20<strong>10</strong> 09/30/<strong>2009</strong><br />

Equity EUR m 764.8 7<strong>10</strong>.9<br />

Debt EUR m 949.6 977.7<br />

Net Debt EUR m 124.0 165.3<br />

Work<strong>in</strong>g Capital EUR m 418.1 455.0<br />

Equity ratio <strong>in</strong> % 44.6 42.1