Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

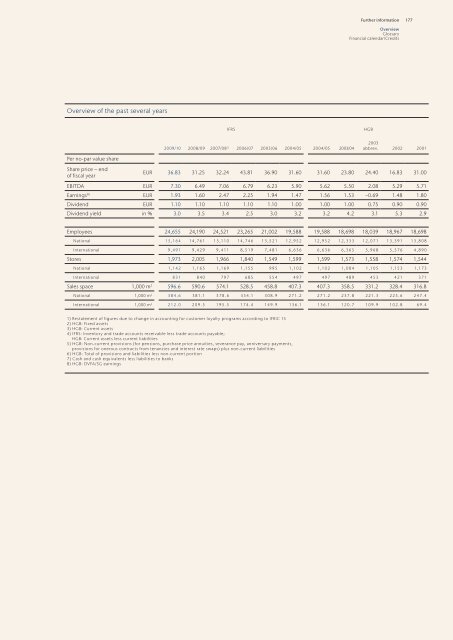

Overview of the past several years<br />

IFRS HGB<br />

<strong>2009</strong>/<strong>10</strong> 2008/09 2007/08 1) 2006/07 2005/06 2004/05 2004/05 2003/04<br />

Further <strong>in</strong>formation<br />

177<br />

2003<br />

abbrev. 2002 2001<br />

Per no-par value share<br />

Share price – end<br />

of fiscal year<br />

EUR 36.83 31.25 32.24 43.81 36.90 31.60 31.60 23.80 24.40 16.83 31.00<br />

EBITDA EUR 7.30 6.49 7.06 6.79 6.23 5.90 5.62 5.50 2.08 5.29 5.71<br />

Earn<strong>in</strong>gs8) EUR 1.93 1.60 2.47 2.25 1.94 1.47 1.56 1.53 −0.69 1.48 1.80<br />

Dividend EUR 1.<strong>10</strong> 1.<strong>10</strong> 1.<strong>10</strong> 1.<strong>10</strong> 1.<strong>10</strong> 1.00 1.00 1.00 0.75 0.90 0.90<br />

Dividend yield <strong>in</strong> % 3.0 3.5 3.4 2.5 3.0 3.2 3.2 4.2 3.1 5.3 2.9<br />

Employees 24,655 24,190 24,521 23,265 21,002 19,588 19,588 18,698 18,039 18,967 18,698<br />

National 15,164 14,761 15,1<strong>10</strong> 14,746 13,521 12,952 12,952 12,333 12,071 13,391 13,808<br />

International 9,491 9,429 9,411 8,519 7,481 6,636 6,636 6,365 5,968 5,576 4,890<br />

Stores 1,973 2,005 1,966 1,840 1,549 1,599 1,599 1,573 1,558 1,574 1,544<br />

National 1,142 1,165 1,169 1,155 995 1,<strong>10</strong>2 1,<strong>10</strong>2 1,084 1,<strong>10</strong>5 1,153 1,173<br />

International 831 840 797 685 554 497 497 489 453 421 371<br />

Sales space 1,000 m2 596.6 590.6 574.1 528.5 458.8 407.3 407.3 358.5 331.2 328.4 316.8<br />

National 1,000 m2 384.6 381.1 378.6 354.1 308.9 271.2 271.2 237.8 221.3 225.6 247.4<br />

International 1,000 m2 212.0 209.5 195.5 174.4 149.9 136.1 136.1 120.7 <strong>10</strong>9.9 <strong>10</strong>2.8 69.4<br />

1) Restatement of figures due to change <strong>in</strong> account<strong>in</strong>g for customer loyalty programs accord<strong>in</strong>g to IFRIC 13<br />

2) HGB: Fixed assets<br />

3) HGB: Current assets<br />

4) IFRS: Inventory and trade accounts receivable less trade accounts payable;<br />

HGB: Current assets less current liabilities<br />

5) HGB: Non-current provisions (for pensions, purchase price annuities, severance pay, anniversary payments,<br />

provisions for onerous contracts from tenancies and <strong>in</strong>terest rate swaps) plus non-current liabilities<br />

6) HGB: Total of provisions and liabilities less non-current portion<br />

7) Cash and cash equivalents less liabilities to banks<br />

8) HGB: DVFA/SG earn<strong>in</strong>gs<br />

Overview<br />

Glossary<br />

F<strong>in</strong>ancial calendar/Credits