Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

F<strong>in</strong>ance leases<br />

As of the balance sheet date only one subsidiary had f<strong>in</strong>ance leases. The leased assets<br />

mostly comprised of vehicles, which were shown with a carry<strong>in</strong>g value of nil as of September<br />

30, 20<strong>10</strong> (previous year: 0.1 million EUR).<br />

Operat<strong>in</strong>g leases<br />

Contracts qualify<strong>in</strong>g as operat<strong>in</strong>g leases with<strong>in</strong> the DOUGLAS Group mostly comprise<br />

store rental agreements. As a rule, these agreements are concluded for a basic rental period<br />

of <strong>10</strong> years and conta<strong>in</strong> lease extension options. The operat<strong>in</strong>g leases shown do not<br />

<strong>in</strong>clude any lease extension options. The lease <strong>in</strong>stallments are based on both variable<br />

and fixed rental payments. The m<strong>in</strong>imum lease payments from operat<strong>in</strong>g lease agreements<br />

amounted to 280.7 million EUR <strong>in</strong> the <strong>2009</strong>/<strong>10</strong> fiscal year (previous year: 281.1 million<br />

EUR). Cont<strong>in</strong>gent rent payments amounted to 3.0 million Euro.<br />

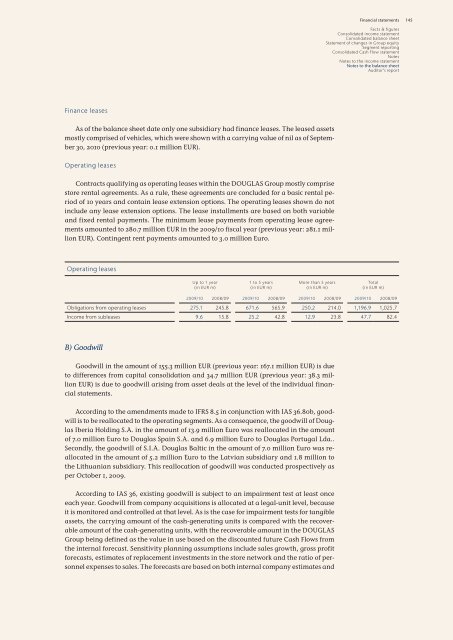

Operat<strong>in</strong>g leases<br />

Up to 1 year<br />

(<strong>in</strong> EUR m)<br />

1 to 5 years<br />

(<strong>in</strong> EUR m)<br />

More than 5 years<br />

(<strong>in</strong> EUR m)<br />

F<strong>in</strong>ancial statements<br />

Total<br />

(<strong>in</strong> EUR m)<br />

<strong>2009</strong>/<strong>10</strong> 2008/09 <strong>2009</strong>/<strong>10</strong> 2008/09 <strong>2009</strong>/<strong>10</strong> 2008/09 <strong>2009</strong>/<strong>10</strong> 2008/09<br />

Obligations from operat<strong>in</strong>g leases 275.1 245.8 671.6 565.9 250.2 214.0 1,196.9 1,025.7<br />

Income from subleases 9.6 15.8 25.2 42.8 12.9 23.8 47.7 82.4<br />

B) Goodwill<br />

Goodwill <strong>in</strong> the amount of 155.3 million EUR (previous year: 167.1 million EUR) is due<br />

to differences from capital consolidation and 34.7 million EUR (previous year: 38.3 million<br />

EUR) is due to goodwill aris<strong>in</strong>g from asset deals at the level of the <strong>in</strong>dividual f<strong>in</strong>ancial<br />

statements.<br />

Accord<strong>in</strong>g to the amendments made to IFRS 8.5 <strong>in</strong> conjunction with IAS 36.80b, goodwill<br />

is to be reallocated to the operat<strong>in</strong>g segments. As a consequence, the goodwill of <strong>Douglas</strong><br />

Iberia Hold<strong>in</strong>g S.A. <strong>in</strong> the amount of 13.9 million Euro was reallocated <strong>in</strong> the amount<br />

of 7.0 million Euro to <strong>Douglas</strong> Spa<strong>in</strong> S.A. and 6.9 million Euro to <strong>Douglas</strong> Portugal Lda..<br />

Secondly, the goodwill of S.I.A. <strong>Douglas</strong> Baltic <strong>in</strong> the amount of 7.0 million Euro was reallocated<br />

<strong>in</strong> the amount of 5.2 million Euro to the Latvian subsidiary and 1.8 million to<br />

the Lithuanian subsidiary. This reallocation of goodwill was conducted prospectively as<br />

per October 1, <strong>2009</strong>.<br />

Accord<strong>in</strong>g to IAS 36, exist<strong>in</strong>g goodwill is subject to an impairment test at least once<br />

each year. Goodwill from company acquisitions is allocated at a legal-unit level, because<br />

it is monitored and controlled at that level. As is the case for impairment tests for tangible<br />

assets, the carry<strong>in</strong>g amount of the cash-generat<strong>in</strong>g units is compared with the recoverable<br />

amount of the cash-generat<strong>in</strong>g units, with the recoverable amount <strong>in</strong> the DOUGLAS<br />

Group be<strong>in</strong>g def<strong>in</strong>ed as the value <strong>in</strong> use based on the discounted future Cash Flows from<br />

the <strong>in</strong>ternal forecast. Sensitivity plann<strong>in</strong>g assumptions <strong>in</strong>clude sales growth, gross profit<br />

forecasts, estimates of replacement <strong>in</strong>vestments <strong>in</strong> the store network and the ratio of personnel<br />

expenses to sales. The forecasts are based on both <strong>in</strong>ternal company estimates and<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

145