Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Fig. 3<br />

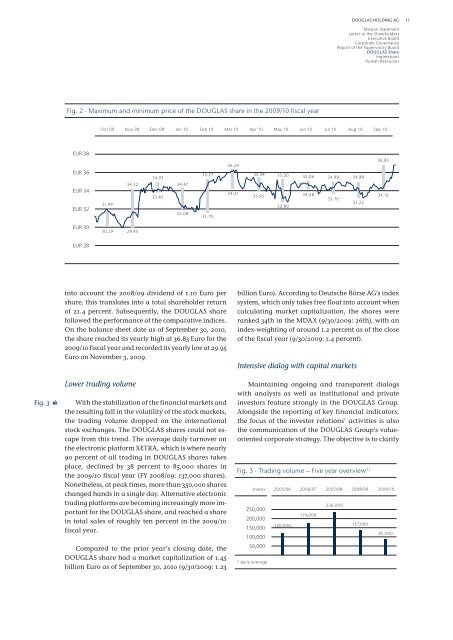

Fig. 2 · Maximum and m<strong>in</strong>imum price of the DOUGLAS share <strong>in</strong> the <strong>2009</strong>/<strong>10</strong> fiscal year<br />

EUR 38<br />

EUR 36<br />

EUR 34<br />

EUR 32<br />

EUR 30<br />

EUR 28<br />

DOUGLAS HOLDING AG<br />

Oct 09 Nov 09 Dec 09 Jan <strong>10</strong> Feb <strong>10</strong> Mar <strong>10</strong> Apr <strong>10</strong> May <strong>10</strong> Jun <strong>10</strong> Jul <strong>10</strong> Aug <strong>10</strong> Sep <strong>10</strong><br />

31.99<br />

30.29<br />

34.32<br />

29.95<br />

34.93<br />

33.83<br />

34.47<br />

32.08<br />

35.27<br />

31.70<br />

<strong>in</strong>to account the 2008/09 dividend of 1.<strong>10</strong> Euro per<br />

share, this translates <strong>in</strong>to a total shareholder return<br />

of 21.4 percent. Subsequently, the DOUGLAS share<br />

followed the performance of the comparative <strong>in</strong>dices.<br />

On the balance sheet date as of September 30, 20<strong>10</strong>,<br />

the share reached its yearly high at 36.83 Euro for the<br />

<strong>2009</strong>/<strong>10</strong> fiscal year and recorded its yearly low at 29.95<br />

Euro on November 3, <strong>2009</strong>.<br />

Lower trad<strong>in</strong>g volume<br />

With the stabilization of the f<strong>in</strong>ancial markets and<br />

the result<strong>in</strong>g fall <strong>in</strong> the volatility of the stock markets,<br />

the trad<strong>in</strong>g volume dropped on the <strong>in</strong>ternational<br />

stock exchanges. The DOUGLAS shares could not escape<br />

from this trend. The average daily turnover on<br />

the electronic platform XETRA, which is where nearly<br />

90 percent of all trad<strong>in</strong>g <strong>in</strong> DOUGLAS shares takes<br />

place, decl<strong>in</strong>ed by 38 percent to 85,000 shares <strong>in</strong><br />

the <strong>2009</strong>/<strong>10</strong> fiscal year (FY 2008/09: 137,000 shares).<br />

Nonetheless, at peak times, more than 350,000 shares<br />

changed hands <strong>in</strong> a s<strong>in</strong>gle day. Alternative electronic<br />

trad<strong>in</strong>g platforms are becom<strong>in</strong>g <strong>in</strong>creas<strong>in</strong>gly more important<br />

for the DOUGLAS share, and reached a share<br />

<strong>in</strong> total sales of roughly ten percent <strong>in</strong> the <strong>2009</strong>/<strong>10</strong><br />

fiscal year.<br />

Compared to the prior year’s clos<strong>in</strong>g date, the<br />

DOUGLAS share had a market capitalization of 1.45<br />

billion Euro as of September 30, 20<strong>10</strong> (9/30/<strong>2009</strong>: 1.23<br />

36.24<br />

34.21<br />

35.49<br />

33.95<br />

35.20<br />

32.80<br />

35.06<br />

34.28<br />

34.99<br />

33.70<br />

34.98<br />

33.22<br />

36.83<br />

34.16<br />

billion Euro). Accord<strong>in</strong>g to Deutsche Börse AG’s <strong>in</strong>dex<br />

system, which only takes free float <strong>in</strong>to account when<br />

calculat<strong>in</strong>g market capitalization, the shares were<br />

ranked 34th <strong>in</strong> the MDAX (9/30/<strong>2009</strong>: 26th), with an<br />

<strong>in</strong>dex-weight<strong>in</strong>g of around 1.2 percent as of the close<br />

of the fiscal year (9/30/<strong>2009</strong>: 1.4 percent).<br />

Intensive dialog with capital markets<br />

Ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g ongo<strong>in</strong>g and transparent dialogs<br />

with analysts as well as <strong>in</strong>stitutional and private<br />

<strong>in</strong>vestors feature strongly <strong>in</strong> the DOUGLAS Group.<br />

Alongside the report<strong>in</strong>g of key f<strong>in</strong>ancial <strong>in</strong>dicators,<br />

the focus of the <strong>in</strong>vestor relations’ activities is also<br />

the communication of the DOUGLAS Group’s valueoriented<br />

corporate strategy. The objective is to clarify<br />

Fig. 3 · Trad<strong>in</strong>g volume – Five year overview 1)<br />

shares 2005/06 2006/07 2007/08 2008/09 <strong>2009</strong>/<strong>10</strong><br />

250,000<br />

200,000<br />

150,000<br />

<strong>10</strong>0,000<br />

50,000<br />

1) daily average<br />

120,000<br />

174,000<br />

236,000<br />

Mission Statement<br />

Letter to the Shareholders<br />

Executive Board<br />

Corporate Governance<br />

<strong>Report</strong> of the Supervisory Board<br />

DOUGLAS Share<br />

Impressions<br />

Human Resources<br />

137,000<br />

85,000<br />

11