Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

154 F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

Pursuant to a resolution of the Shareholders´ Meet<strong>in</strong>g on March 24, 20<strong>10</strong>, a dividend<br />

of 1.<strong>10</strong> EUR per share, or a total amount of 43.3 million EUR was distributed to the shareholders<br />

from the net reta<strong>in</strong>ed earn<strong>in</strong>gs of 44.0 million EUR from the fiscal year 2008/09.<br />

The rema<strong>in</strong><strong>in</strong>g amount of 0.7 million EUR was carried forward.<br />

The Executive Board will propose to the Shareholders’ Meet<strong>in</strong>g to pay from the reported<br />

reta<strong>in</strong>ed earn<strong>in</strong>gs of DOUGLAS HOLDING AG total<strong>in</strong>g 44.0 million EUR for the<br />

fiscal year <strong>2009</strong>/<strong>10</strong>, a dividend of 1.<strong>10</strong> EUR per no-par value share with dividend rights,<br />

or a total amount of 43.3 million EUR. The rema<strong>in</strong><strong>in</strong>g amount of 0.7 million EUR is to be<br />

carried forward.<br />

25. Provisions for pensions<br />

Provisions for pensions are formed for commitments aris<strong>in</strong>g from pension entitlements<br />

and ongo<strong>in</strong>g payments to employees and former employees and their surviv<strong>in</strong>g dependents.<br />

The pension entitlements usually relate to a payment for contractually agreed oldage<br />

pension as a monthly amount. These commitments are accounted for accord<strong>in</strong>g to<br />

the requirements of IAS 19. The measurement for German subsidiaries is valued based on<br />

actuarial reports pursuant to the follow<strong>in</strong>g parameters:<br />

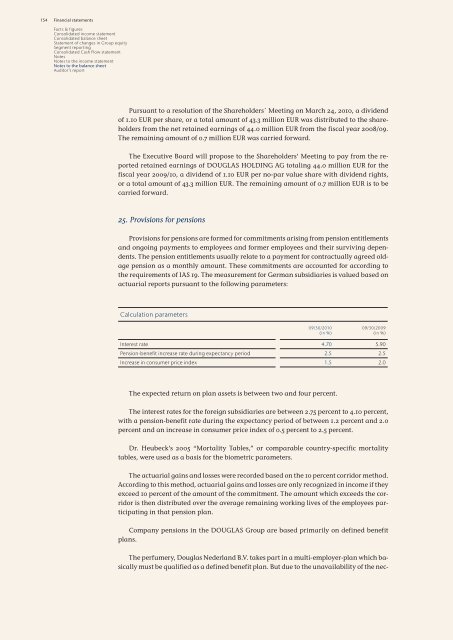

Calculation parameters<br />

09/30/20<strong>10</strong><br />

(<strong>in</strong> %)<br />

09/30/<strong>2009</strong><br />

(<strong>in</strong> %)<br />

Interest rate 4.70 5.90<br />

Pension-benefit <strong>in</strong>crease rate dur<strong>in</strong>g expectancy period 2.5 2.5<br />

Increase <strong>in</strong> consumer price <strong>in</strong>dex 1.5 2.0<br />

The expected return on plan assets is between two and four percent.<br />

The <strong>in</strong>terest rates for the foreign subsidiaries are between 2.75 percent to 4.<strong>10</strong> percent,<br />

with a pension-benefit rate dur<strong>in</strong>g the expectancy period of between 1.2 percent and 2.0<br />

percent and an <strong>in</strong>crease <strong>in</strong> consumer price <strong>in</strong>dex of 0.5 percent to 2.5 percent.<br />

Dr. Heubeck’s 2005 “Mortality Tables,” or comparable country-specific mortality<br />

tables, were used as a basis for the biometric parameters.<br />

The actuarial ga<strong>in</strong>s and losses were recorded based on the <strong>10</strong> percent corridor method.<br />

Accord<strong>in</strong>g to this method, actuarial ga<strong>in</strong>s and losses are only recognized <strong>in</strong> <strong>in</strong>come if they<br />

exceed <strong>10</strong> percent of the amount of the commitment. The amount which exceeds the corridor<br />

is then distributed over the average rema<strong>in</strong><strong>in</strong>g work<strong>in</strong>g lives of the employees participat<strong>in</strong>g<br />

<strong>in</strong> that pension plan.<br />

Company pensions <strong>in</strong> the DOUGLAS Group are based primarily on def<strong>in</strong>ed benefit<br />

plans.<br />

The perfumery, <strong>Douglas</strong> Nederland B.V. takes part <strong>in</strong> a multi-employer-plan which basically<br />

must be qualified as a def<strong>in</strong>ed benefit plan. But due to the unavailability of the nec-