Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

128 F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

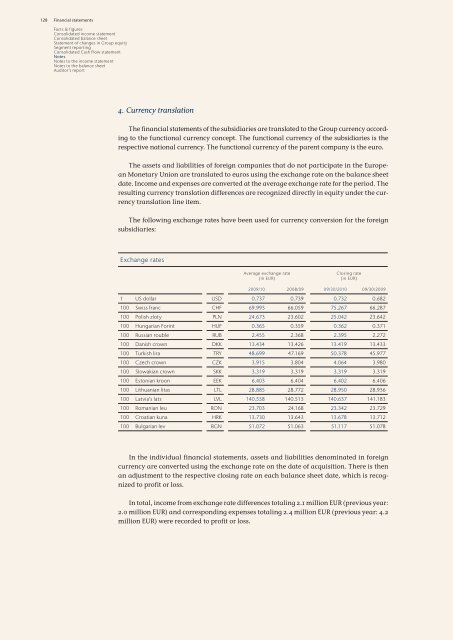

4. Currency translation<br />

The f<strong>in</strong>ancial statements of the subsidiaries are translated to the Group currency accord<strong>in</strong>g<br />

to the functional currency concept. The functional currency of the subsidiaries is the<br />

respective national currency. The functional currency of the parent company is the euro.<br />

The assets and liabilities of foreign companies that do not participate <strong>in</strong> the European<br />

Monetary Union are translated to euros us<strong>in</strong>g the exchange rate on the balance sheet<br />

date. Income and expenses are converted at the average exchange rate for the period. The<br />

result<strong>in</strong>g currency translation differences are recognized directly <strong>in</strong> equity under the currency<br />

translation l<strong>in</strong>e item.<br />

The follow<strong>in</strong>g exchange rates have been used for currency conversion for the foreign<br />

subsidiaries:<br />

Exchange rates<br />

Average exchange rate<br />

(<strong>in</strong> EUR)<br />

Clos<strong>in</strong>g rate<br />

(<strong>in</strong> EUR)<br />

<strong>2009</strong>/<strong>10</strong> 2008/09 09/30/20<strong>10</strong> 09/30/<strong>2009</strong><br />

1 US dollar USD 0.737 0.739 0.732 0.682<br />

<strong>10</strong>0 Swiss franc CHF 69.993 66.059 75.267 66.287<br />

<strong>10</strong>0 Polish zloty PLN 24.673 23.602 25.042 23.642<br />

<strong>10</strong>0 Hungarian For<strong>in</strong>t HUF 0.365 0.359 0.362 0.371<br />

<strong>10</strong>0 Russian rouble RUB 2.455 2.368 2.395 2.272<br />

<strong>10</strong>0 Danish crown DKK 13.434 13.426 13.419 13.433<br />

<strong>10</strong>0 Turkish lira TRY 48.699 47.169 50.378 45.977<br />

<strong>10</strong>0 Czech crown CZK 3.915 3.804 4.064 3.980<br />

<strong>10</strong>0 Slowakian crown SKK 3.319 3.319 3.319 3.319<br />

<strong>10</strong>0 Estonian kroon EEK 6.403 6.404 6.402 6.406<br />

<strong>10</strong>0 Lithuanian litas LTL 28.885 28.772 28.950 28.936<br />

<strong>10</strong>0 Latvia’s lats LVL 140.558 140.513 140.637 141.183<br />

<strong>10</strong>0 Romanian leu RON 23.703 24.168 23.342 23.729<br />

<strong>10</strong>0 Croatian kuna HRK 13.730 13.643 13.678 13.712<br />

<strong>10</strong>0 Bulgarian lev BGN 51.072 51.063 51.117 51.078<br />

In the <strong>in</strong>dividual f<strong>in</strong>ancial statements, assets and liabilities denom<strong>in</strong>ated <strong>in</strong> foreign<br />

currency are converted us<strong>in</strong>g the exchange rate on the date of acquisition. There is then<br />

an adjustment to the respective clos<strong>in</strong>g rate on each balance sheet date, which is recognized<br />

to profit or loss.<br />

In total, <strong>in</strong>come from exchange rate differences total<strong>in</strong>g 2.1 million EUR (previous year:<br />

2.0 million EUR) and correspond<strong>in</strong>g expenses total<strong>in</strong>g 2.4 million EUR (previous year: 4.2<br />

million EUR) were recorded to profit or loss.