Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

accounts. The write-downs on trade accounts receivable are shown under other operat<strong>in</strong>g<br />

expenses. They are payable immediately. These receivables do not bear <strong>in</strong>terest and are<br />

therefore not exposed to any <strong>in</strong>terest rate risk. The carry<strong>in</strong>g amounts of the receivables<br />

are basically equivalent to their Fair Values. The maximum default risk corresponded to<br />

the carry<strong>in</strong>g value as of the balance sheet date.<br />

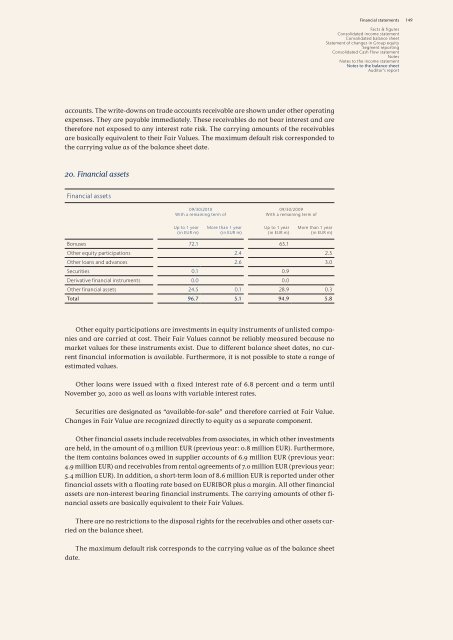

20. F<strong>in</strong>ancial assets<br />

F<strong>in</strong>ancial assets<br />

09/30/20<strong>10</strong><br />

With a rema<strong>in</strong><strong>in</strong>g term of<br />

Up to 1 year<br />

(<strong>in</strong> EUR m)<br />

More than 1 year<br />

(<strong>in</strong> EUR m)<br />

09/30/<strong>2009</strong><br />

With a rema<strong>in</strong><strong>in</strong>g term of<br />

Up to 1 year<br />

(<strong>in</strong> EUR m)<br />

More than 1 year<br />

(<strong>in</strong> EUR m)<br />

Bonuses 72.1 65.1<br />

Other equity participations 2.4 2.5<br />

Other loans and advances 2.6 3.0<br />

Securities 0.1 0.9<br />

Derivative f<strong>in</strong>ancial <strong>in</strong>struments 0.0 0.0<br />

Other f<strong>in</strong>ancial assets 24.5 0.1 28.9 0.3<br />

Total 96.7 5.1 94.9 5.8<br />

Other equity participations are <strong>in</strong>vestments <strong>in</strong> equity <strong>in</strong>struments of unlisted companies<br />

and are carried at cost. Their Fair Values cannot be reliably measured because no<br />

market values for these <strong>in</strong>struments exist. Due to different balance sheet dates, no current<br />

f<strong>in</strong>ancial <strong>in</strong>formation is available. Furthermore, it is not possible to state a range of<br />

estimated values.<br />

Other loans were issued with a fixed <strong>in</strong>terest rate of 6.8 percent and a term until<br />

November 30, 20<strong>10</strong> as well as loans with variable <strong>in</strong>terest rates.<br />

Securities are designated as “available-for-sale” and therefore carried at Fair Value.<br />

Changes <strong>in</strong> Fair Value are recognized directly to equity as a separate component.<br />

Other f<strong>in</strong>ancial assets <strong>in</strong>clude receivables from associates, <strong>in</strong> which other <strong>in</strong>vestments<br />

are held, <strong>in</strong> the amount of 0.3 million EUR (previous year: 0.8 million EUR). Furthermore,<br />

the item conta<strong>in</strong>s balances owed <strong>in</strong> supplier accounts of 6.9 million EUR (previous year:<br />

4.9 million EUR) and receivables from rental agreements of 7.0 million EUR (previous year:<br />

5.4 million EUR). In addition, a short-term loan of 8.6 million EUR is reported under other<br />

f<strong>in</strong>ancial assets with a float<strong>in</strong>g rate based on EURIBOR plus a marg<strong>in</strong>. All other f<strong>in</strong>ancial<br />

assets are non-<strong>in</strong>terest bear<strong>in</strong>g f<strong>in</strong>ancial <strong>in</strong>struments. The carry<strong>in</strong>g amounts of other f<strong>in</strong>ancial<br />

assets are basically equivalent to their Fair Values.<br />

There are no restrictions to the disposal rights for the receivables and other assets carried<br />

on the balance sheet.<br />

The maximum default risk corresponds to the carry<strong>in</strong>g value as of the balance sheet<br />

date.<br />

F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

149