Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

44 Management <strong>Report</strong><br />

Key results<br />

Bus<strong>in</strong>ess activities and operat<strong>in</strong>g environment<br />

Net assets, f<strong>in</strong>ancial position and result of operations<br />

DOUGLAS HOLDING AG<br />

Subsequent events<br />

Control system and success factors<br />

Opportunities and risks situation<br />

Statutory disclosures<br />

Forecast and overall assessment<br />

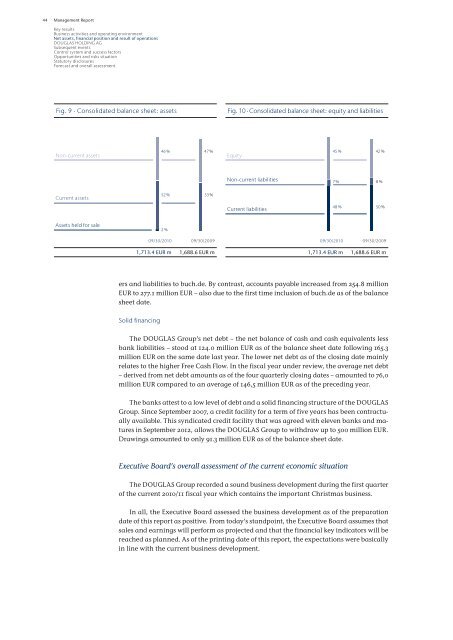

Fig. 9 · Consolidated balance sheet: assets<br />

Non-current assets<br />

Current assets<br />

Assets held for sale<br />

ers and liabilities to buch.de. By contrast, accounts payable <strong>in</strong>creased from 254.8 million<br />

EUR to 277.1 million EUR – also due to the first time <strong>in</strong>clusion of buch.de as of the balance<br />

sheet date.<br />

Solid f<strong>in</strong>anc<strong>in</strong>g<br />

46 %<br />

52 %<br />

2%<br />

47 %<br />

53 %<br />

09/30/20<strong>10</strong> 09/30/<strong>2009</strong><br />

1,713.4 EUR m 1,688.6 EUR m<br />

Fig. <strong>10</strong> · Consolidated balance sheet: equity and liabilities<br />

Equity<br />

Non-current liabilities<br />

Current liabilities<br />

The DOUGLAS Group’s net debt – the net balance of cash and cash equivalents less<br />

bank liabilities – stood at 124.0 million EUR as of the balance sheet date follow<strong>in</strong>g 165.3<br />

million EUR on the same date last year. The lower net debt as of the clos<strong>in</strong>g date ma<strong>in</strong>ly<br />

relates to the higher Free Cash Flow. In the fiscal year under review, the average net debt<br />

– derived from net debt amounts as of the four quarterly clos<strong>in</strong>g dates – amounted to 76,0<br />

million EUR compared to an average of 146,5 million EUR as of the preced<strong>in</strong>g year.<br />

The banks attest to a low level of debt and a solid f<strong>in</strong>anc<strong>in</strong>g structure of the DOUGLAS<br />

Group. S<strong>in</strong>ce September 2007, a credit facility for a term of five years has been contractually<br />

available. This syndicated credit facility that was agreed with eleven banks and matures<br />

<strong>in</strong> September 2012, allows the DOUGLAS Group to withdraw up to 500 million EUR.<br />

Draw<strong>in</strong>gs amounted to only 91.3 million EUR as of the balance sheet date.<br />

Executive Board’s overall assessment of the current economic situation<br />

09/30/20<strong>10</strong> 09/30/<strong>2009</strong><br />

1,713.4 EUR m 1,688.6 EUR m<br />

The DOUGLAS Group recorded a sound bus<strong>in</strong>ess development dur<strong>in</strong>g the first quarter<br />

of the current 20<strong>10</strong>/11 fiscal year which conta<strong>in</strong>s the important Christmas bus<strong>in</strong>ess.<br />

In all, the Executive Board assessed the bus<strong>in</strong>ess development as of the preparation<br />

date of this report as positive. From today’s standpo<strong>in</strong>t, the Executive Board assumes that<br />

sales and earn<strong>in</strong>gs will perform as projected and that the f<strong>in</strong>ancial key <strong>in</strong>dicators will be<br />

reached as planned. As of the pr<strong>in</strong>t<strong>in</strong>g date of this report, the expectations were basically<br />

<strong>in</strong> l<strong>in</strong>e with the current bus<strong>in</strong>ess development.<br />

45 %<br />

7%<br />

48%<br />

42 %<br />

8%<br />

50 %