Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

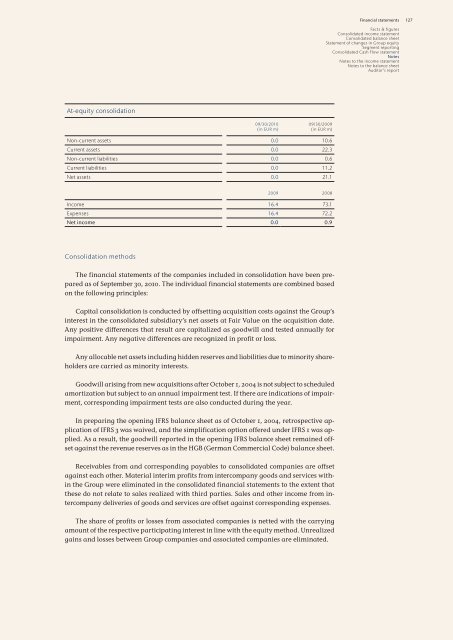

At-equity consolidation<br />

09/30/20<strong>10</strong><br />

(<strong>in</strong> EUR m)<br />

09/30/<strong>2009</strong><br />

(<strong>in</strong> EUR m)<br />

Non-current assets 0.0 <strong>10</strong>.6<br />

Current assets 0.0 22.3<br />

Non-current liabilities 0.0 0.6<br />

Current liabilities 0.0 11.2<br />

Net assets 0.0 21.1<br />

<strong>2009</strong> 2008<br />

Income 16.4 73.1<br />

Expenses 16.4 72.2<br />

Net <strong>in</strong>come 0.0 0.9<br />

Consolidation methods<br />

The f<strong>in</strong>ancial statements of the companies <strong>in</strong>cluded <strong>in</strong> consolidation have been prepared<br />

as of September 30, 20<strong>10</strong>. The <strong>in</strong>dividual f<strong>in</strong>ancial statements are comb<strong>in</strong>ed based<br />

on the follow<strong>in</strong>g pr<strong>in</strong>ciples:<br />

Capital consolidation is conducted by offsett<strong>in</strong>g acquisition costs aga<strong>in</strong>st the Group’s<br />

<strong>in</strong>terest <strong>in</strong> the consolidated subsidiary’s net assets at Fair Value on the acquisition date.<br />

Any positive differences that result are capitalized as goodwill and tested annually for<br />

impairment. Any negative differences are recognized <strong>in</strong> profit or loss.<br />

Any allocable net assets <strong>in</strong>clud<strong>in</strong>g hidden reserves and liabilities due to m<strong>in</strong>ority shareholders<br />

are carried as m<strong>in</strong>ority <strong>in</strong>terests.<br />

Goodwill aris<strong>in</strong>g from new acquisitions after October 1, 2004 is not subject to scheduled<br />

amortization but subject to an annual impairment test. If there are <strong>in</strong>dications of impairment,<br />

correspond<strong>in</strong>g impairment tests are also conducted dur<strong>in</strong>g the year.<br />

In prepar<strong>in</strong>g the open<strong>in</strong>g IFRS balance sheet as of October 1, 2004, retrospective application<br />

of IFRS 3 was waived, and the simplification option offered under IFRS 1 was applied.<br />

As a result, the goodwill reported <strong>in</strong> the open<strong>in</strong>g IFRS balance sheet rema<strong>in</strong>ed offset<br />

aga<strong>in</strong>st the revenue reserves as <strong>in</strong> the HGB (German Commercial Code) balance sheet.<br />

Receivables from and correspond<strong>in</strong>g payables to consolidated companies are offset<br />

aga<strong>in</strong>st each other. Material <strong>in</strong>terim profits from <strong>in</strong>tercompany goods and services with<strong>in</strong><br />

the Group were elim<strong>in</strong>ated <strong>in</strong> the consolidated f<strong>in</strong>ancial statements to the extent that<br />

these do not relate to sales realized with third parties. Sales and other <strong>in</strong>come from <strong>in</strong>tercompany<br />

deliveries of goods and services are offset aga<strong>in</strong>st correspond<strong>in</strong>g expenses.<br />

The share of profits or losses from associated companies is netted with the carry<strong>in</strong>g<br />

amount of the respective participat<strong>in</strong>g <strong>in</strong>terest <strong>in</strong> l<strong>in</strong>e with the equity method. Unrealized<br />

ga<strong>in</strong>s and losses between Group companies and associated companies are elim<strong>in</strong>ated.<br />

F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

127