Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

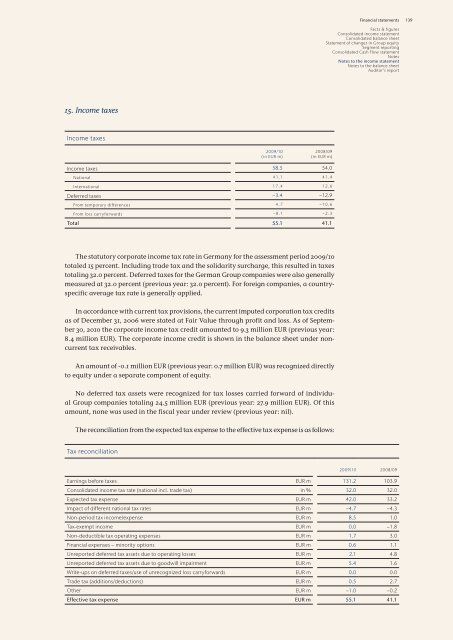

15. Income taxes<br />

Income taxes<br />

<strong>2009</strong>/<strong>10</strong><br />

(<strong>in</strong> EUR m)<br />

2008/09<br />

(<strong>in</strong> EUR m)<br />

Income taxes 58.5 54.0<br />

National 41.1 41.4<br />

International 17.4 12.6<br />

Deferred taxes −3.4 −12.9<br />

From temporary differences 4.7 −<strong>10</strong>.6<br />

From loss carryforwards −8.1 −2.3<br />

Total 55.1 41.1<br />

The statutory corporate <strong>in</strong>come tax rate <strong>in</strong> Germany for the assessment period <strong>2009</strong>/<strong>10</strong><br />

totaled 15 percent. Includ<strong>in</strong>g trade tax and the solidarity surcharge, this resulted <strong>in</strong> taxes<br />

total<strong>in</strong>g 32.0 percent. Deferred taxes for the German Group companies were also generally<br />

measured at 32.0 percent (previous year: 32.0 percent). For foreign companies, a countryspecific<br />

average tax rate is generally applied.<br />

In accordance with current tax provisions, the current imputed corporation tax credits<br />

as of December 31, 2006 were stated at Fair Value through profit and loss. As of September<br />

30, 20<strong>10</strong> the corporate <strong>in</strong>come tax credit amounted to 9.3 million EUR (previous year:<br />

8.4 million EUR). The corporate <strong>in</strong>come credit is shown <strong>in</strong> the balance sheet under noncurrent<br />

tax receivables.<br />

An amount of -0.1 million EUR (previous year: 0.7 million EUR) was recognized directly<br />

to equity under a separate component of equity.<br />

No deferred tax assets were recognized for tax losses carried forward of <strong>in</strong>dividual<br />

Group companies total<strong>in</strong>g 24.5 million EUR (previous year: 27.9 million EUR). Of this<br />

amount, none was used <strong>in</strong> the fiscal year under review (previous year: nil).<br />

The reconciliation from the expected tax expense to the effective tax expense is as follows:<br />

Tax reconciliation<br />

F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

<strong>2009</strong>/<strong>10</strong> 2008/09<br />

Earn<strong>in</strong>gs before taxes EUR m 131.2 <strong>10</strong>3.9<br />

Consolidated <strong>in</strong>come tax rate (national <strong>in</strong>cl. trade tax) <strong>in</strong> % 32.0 32.0<br />

Expected tax expense EUR m 42.0 33.2<br />

Impact of different national tax rates EUR m −4.7 −4.3<br />

Non-period tax <strong>in</strong>come/expense EUR m 8.5 1.0<br />

Tax-exempt <strong>in</strong>come EUR m 0.0 −1.8<br />

Non-deductible tax operat<strong>in</strong>g expenses EUR m 1.7 3.0<br />

F<strong>in</strong>ancial expenses – m<strong>in</strong>ority options EUR m 0.6 1.1<br />

Unreported deferred tax assets due to operat<strong>in</strong>g losses EUR m 2.1 4.8<br />

Unreported deferred tax assets due to goodwill impairment EUR m 5.4 1.6<br />

Write-ups on deferred taxes/use of unrecognized loss carryforwards EUR m 0.0 0.0<br />

Trade tax (additions/deductions) EUR m 0.5 2.7<br />

Other EUR m −1.0 −0.2<br />

Effective tax expense EUR m 55.1 41.1<br />

139