Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

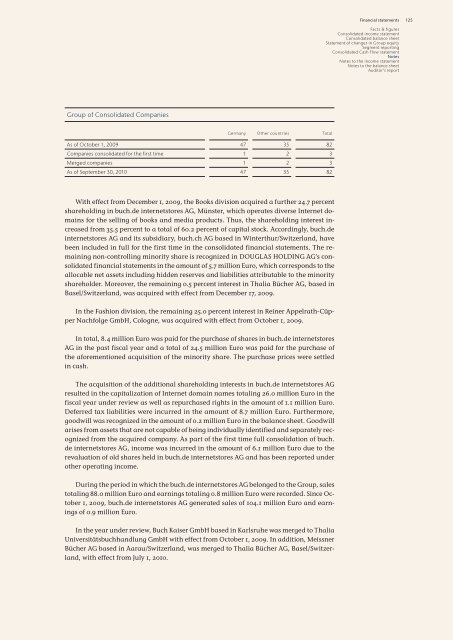

Group of Consolidated Companies<br />

Germany Other countries Total<br />

As of October 1, <strong>2009</strong> 47 35 82<br />

Companies consolidated for the first time 1 2 3<br />

Merged companies 1 2 3<br />

As of September 30, 20<strong>10</strong> 47 35 82<br />

With effect from December 1, <strong>2009</strong>, the Books division acquired a further 24.7 percent<br />

sharehold<strong>in</strong>g <strong>in</strong> buch.de <strong>in</strong>ternetstores AG, Münster, which operates diverse Internet doma<strong>in</strong>s<br />

for the sell<strong>in</strong>g of books and media products. Thus, the sharehold<strong>in</strong>g <strong>in</strong>terest <strong>in</strong>creased<br />

from 35.5 percent to a total of 60.2 percent of capital stock. Accord<strong>in</strong>gly, buch.de<br />

<strong>in</strong>ternetstores AG and its subsidiary, buch.ch AG based <strong>in</strong> W<strong>in</strong>terthur/Switzerland, have<br />

been <strong>in</strong>cluded <strong>in</strong> full for the first time <strong>in</strong> the consolidated f<strong>in</strong>ancial statements. The rema<strong>in</strong><strong>in</strong>g<br />

non-controll<strong>in</strong>g m<strong>in</strong>ority share is recognized <strong>in</strong> DOUGLAS HOLDING AG’s consolidated<br />

f<strong>in</strong>ancial statements <strong>in</strong> the amount of 5.7 million Euro, which corresponds to the<br />

allocable net assets <strong>in</strong>clud<strong>in</strong>g hidden reserves and liabilities attributable to the m<strong>in</strong>ority<br />

shareholder. Moreover, the rema<strong>in</strong><strong>in</strong>g 0.5 percent <strong>in</strong>terest <strong>in</strong> Thalia Bücher AG, based <strong>in</strong><br />

Basel/Switzerland, was acquired with effect from December 17, <strong>2009</strong>.<br />

In the Fashion division, the rema<strong>in</strong><strong>in</strong>g 25.0 percent <strong>in</strong>terest <strong>in</strong> Re<strong>in</strong>er Appelrath-Cüpper<br />

Nachfolge GmbH, Cologne, was acquired with effect from October 1, <strong>2009</strong>.<br />

In total, 8.4 million Euro was paid for the purchase of shares <strong>in</strong> buch.de <strong>in</strong>ternetstores<br />

AG <strong>in</strong> the past fiscal year and a total of 24.5 million Euro was paid for the purchase of<br />

the aforementioned acquisition of the m<strong>in</strong>ority share. The purchase prices were settled<br />

<strong>in</strong> cash.<br />

The acquisition of the additional sharehold<strong>in</strong>g <strong>in</strong>terests <strong>in</strong> buch.de <strong>in</strong>ternetstores AG<br />

resulted <strong>in</strong> the capitalization of Internet doma<strong>in</strong> names total<strong>in</strong>g 26.0 million Euro <strong>in</strong> the<br />

fiscal year under review as well as repurchased rights <strong>in</strong> the amount of 1.1 million Euro.<br />

Deferred tax liabilities were <strong>in</strong>curred <strong>in</strong> the amount of 8.7 million Euro. Furthermore,<br />

goodwill was recognized <strong>in</strong> the amount of 0.2 million Euro <strong>in</strong> the balance sheet. Goodwill<br />

arises from assets that are not capable of be<strong>in</strong>g <strong>in</strong>dividually identified and separately recognized<br />

from the acquired company. As part of the first time full consolidation of buch.<br />

de <strong>in</strong>ternetstores AG, <strong>in</strong>come was <strong>in</strong>curred <strong>in</strong> the amount of 6.1 million Euro due to the<br />

revaluation of old shares held <strong>in</strong> buch.de <strong>in</strong>ternetstores AG and has been reported under<br />

other operat<strong>in</strong>g <strong>in</strong>come.<br />

Dur<strong>in</strong>g the period <strong>in</strong> which the buch.de <strong>in</strong>ternetstores AG belonged to the Group, sales<br />

total<strong>in</strong>g 88.0 million Euro and earn<strong>in</strong>gs total<strong>in</strong>g 0.8 million Euro were recorded. S<strong>in</strong>ce October<br />

1, <strong>2009</strong>, buch.de <strong>in</strong>ternetstores AG generated sales of <strong>10</strong>4.1 million Euro and earn<strong>in</strong>gs<br />

of 0.9 million Euro.<br />

In the year under review, Buch Kaiser GmbH based <strong>in</strong> Karlsruhe was merged to Thalia<br />

Universitätsbuchhandlung GmbH with effect from October 1, <strong>2009</strong>. In addition, Meissner<br />

Bücher AG based <strong>in</strong> Aarau/Switzerland, was merged to Thalia Bücher AG, Basel/Switzerland,<br />

with effect from July 1, 20<strong>10</strong>.<br />

F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

125