Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INTERNAL CONTROL SYSTEM AND<br />

KEY SUCCESS FACTORS<br />

The Group aims to raise the bus<strong>in</strong>ess value on a susta<strong>in</strong>ed basis, particularly for sales<br />

and earn<strong>in</strong>gs growth, as well as rais<strong>in</strong>g profitability. For purposes of value-oriented monitor<strong>in</strong>g<br />

of the required capital employment, the DOUGLAS Group applies an Economic<br />

Value Added Analysis (EVA®) model, which has been adapted to the specific framework<br />

conditions of a retail company – namely the DOUGLAS Value Added (DVA). The DVA measures<br />

the contribution made by the operative companies to <strong>in</strong>crease the bus<strong>in</strong>ess value.<br />

DVA <strong>in</strong> fiscal year <strong>2009</strong>/<strong>10</strong><br />

As a consequence of the positive sales and earn<strong>in</strong>gs performance of the <strong>2009</strong>/<strong>10</strong> fiscal<br />

year, the DOUGLAS Group <strong>in</strong>creased the DVA to 23.7 million EUR. Therefore, the preced<strong>in</strong>g<br />

year’s DVA was surpassed by 3.2 million EUR. In addition to the improved net operat<strong>in</strong>g<br />

profit after taxes (NOPAT), the assets <strong>in</strong> use were reduced on the average for the report<strong>in</strong>g<br />

year and consequently the capital costs were alleviated.<br />

With a DVA of 33.6 million EUR, the Perfumeries division significantly surpassed the<br />

prior year’s figure. This <strong>in</strong>crease was ma<strong>in</strong>ly due to the improved NOPAT. It is noted here<br />

that the substantially higher goodwill amortization year-on-year was not taken <strong>in</strong>to account<br />

<strong>in</strong> the determ<strong>in</strong>ation of the NOPAT.<br />

The Books division reported a negative value contribution of 5.1 million EUR for the<br />

fiscal year. This decrease of 8.2 million EUR primarily relates to the challeng<strong>in</strong>g development<br />

of the stationary book trade throughout the <strong>in</strong>dustry and the higher assets, which<br />

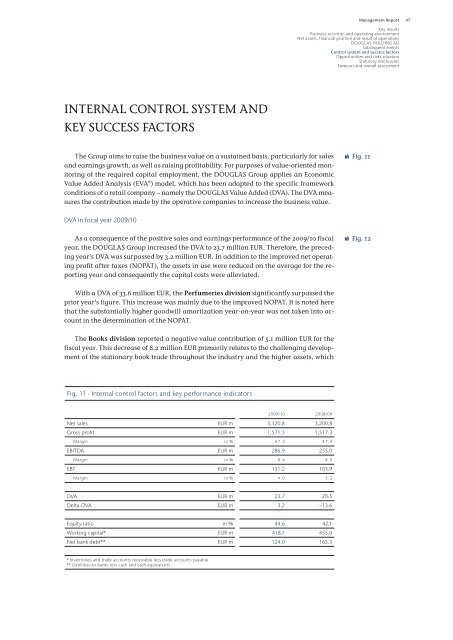

Fig. 11 · Internal control factors and key performance <strong>in</strong>dicators<br />

<strong>2009</strong>/<strong>10</strong> 2008/09<br />

Net sales EUR m 3,320.8 3,200.8<br />

Gross profit EUR m 1,571.3 1,517.3<br />

Marg<strong>in</strong> <strong>in</strong> % 47.3 47.4<br />

EBITDA EUR m 286.9 255.0<br />

Marg<strong>in</strong> <strong>in</strong> % 8.6 8.0<br />

EBT EUR m 131.2 <strong>10</strong>3.9<br />

Marg<strong>in</strong> <strong>in</strong> % 4.0 3.2<br />

DVA EUR m 23.7 20.5<br />

Delta-DVA EUR m 3.2 −13.6<br />

Equity ratio <strong>in</strong> % 44.6 42.1<br />

Work<strong>in</strong>g capital* EUR m 418.1 455.0<br />

Net bank debt** EUR m 124.0 165.3<br />

* Inventories and trade accounts receivable less trade accounts payable<br />

** Liabilities to banks less cash and cash equivalents<br />

Management <strong>Report</strong><br />

Key results<br />

Bus<strong>in</strong>ess activities and operat<strong>in</strong>g environment<br />

Net assets, f<strong>in</strong>ancial position and result of operations<br />

DOUGLAS HOLDING AG<br />

Subsequent events<br />

Control system and success factors<br />

Opportunities and risks situation<br />

Statutory disclosures<br />

Forecast and overall assessment<br />

Fig. 11<br />

Fig. 12<br />

47