Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

from Executive Board speeches as well as annual<br />

and <strong>in</strong>terim f<strong>in</strong>ancial reports can be accessed. Moreover,<br />

major portions of the Shareholders’ Meet<strong>in</strong>g are<br />

broadcast live on the Internet every year. Company<br />

figures are cont<strong>in</strong>uously updated and dur<strong>in</strong>g the current<br />

fiscal year <strong>in</strong>formation provided on the website<br />

will cont<strong>in</strong>ue to improve <strong>in</strong> terms of content and to<br />

expand <strong>in</strong> specific areas.<br />

It was most gratify<strong>in</strong>g that the Investor Relations<br />

<strong>in</strong>itiatives of DOUGLAS HOLDING AG <strong>in</strong> the<br />

<strong>2009</strong>/<strong>10</strong> fiscal year reached top positions <strong>in</strong> external<br />

evaluations. As a result, DOUGLAS HOLDING AG<br />

ranked third place <strong>in</strong> the MDAX category of the German<br />

Investor Relations Award granted annually by the<br />

Deutsche Investor Relations Verband e.V. (DIRK). The<br />

economic magaz<strong>in</strong>e, Capital, and the Society of Investment<br />

Professionals <strong>in</strong> Germany (DVFA) awarded the<br />

Investor Relations Team second place with the “Capital<br />

Investor Relations” prize <strong>in</strong> the MDAX category.<br />

Investor Relations activities will be further improved<br />

<strong>in</strong> the 20<strong>10</strong>/11 fiscal year. DOUGLAS HOLDING<br />

AG’s idea is to strengthen communication not only<br />

<strong>in</strong> cont<strong>in</strong>u<strong>in</strong>g to give first-class attention to exist<strong>in</strong>g<br />

shareholders, but also to attract new <strong>in</strong>vestors <strong>in</strong><br />

Germany and abroad for the DOUGLAS share.<br />

High <strong>in</strong>terest exhibited by analysts<br />

In the <strong>2009</strong>/<strong>10</strong> fiscal year, 24 analysts from renowned<br />

<strong>in</strong>vestment firms – ma<strong>in</strong>ly from Germany<br />

and the United K<strong>in</strong>gdom – regularly published studies<br />

and commentaries of current developments of the<br />

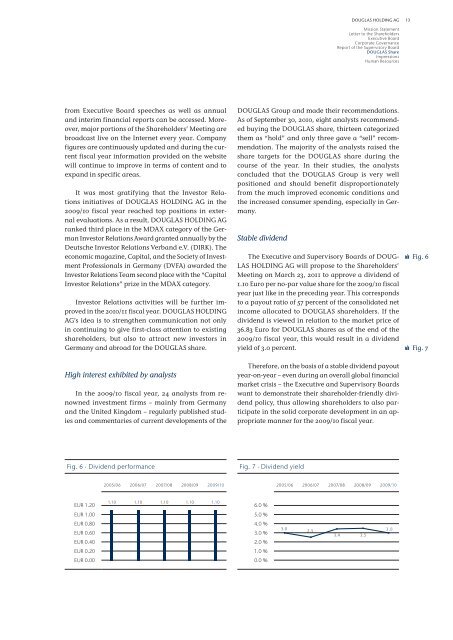

Fig. 6 · Dividend performance<br />

EUR 1.20<br />

EUR 1.00<br />

EUR 0.80<br />

EUR 0.60<br />

EUR 0.40<br />

EUR 0.20<br />

EUR 0.00<br />

2005/06 2006/07 2007/08 2008/09 <strong>2009</strong>/<strong>10</strong><br />

1.<strong>10</strong> 1.<strong>10</strong> 1.<strong>10</strong> 1.<strong>10</strong> 1.<strong>10</strong><br />

DOUGLAS HOLDING AG<br />

DOUGLAS Group and made their recommendations.<br />

As of September 30, 20<strong>10</strong>, eight analysts recommended<br />

buy<strong>in</strong>g the DOUGLAS share, thirteen categorized<br />

them as “hold” and only three gave a “sell” recommendation.<br />

The majority of the analysts raised the<br />

share targets for the DOUGLAS share dur<strong>in</strong>g the<br />

course of the year. In their studies, the analysts<br />

concluded that the DOUGLAS Group is very well<br />

positioned and should benefit disproportionately<br />

from the much improved economic conditions and<br />

the <strong>in</strong>creased consumer spend<strong>in</strong>g, especially <strong>in</strong> Germany.<br />

Stable dividend<br />

The Executive and Supervisory Boards of DOUG-<br />

LAS HOLDING AG will propose to the Shareholders’<br />

Meet<strong>in</strong>g on March 23, 2011 to approve a dividend of<br />

1.<strong>10</strong> Euro per no-par value share for the <strong>2009</strong>/<strong>10</strong> fiscal<br />

year just like <strong>in</strong> the preced<strong>in</strong>g year. This corresponds<br />

to a payout ratio of 57 percent of the consolidated net<br />

<strong>in</strong>come allocated to DOUGLAS shareholders. If the<br />

dividend is viewed <strong>in</strong> relation to the market price of<br />

36.83 Euro for DOUGLAS shares as of the end of the<br />

<strong>2009</strong>/<strong>10</strong> fiscal year, this would result <strong>in</strong> a dividend<br />

yield of 3.0 percent.<br />

Therefore, on the basis of a stable dividend payout<br />

year-on-year – even dur<strong>in</strong>g an overall global f<strong>in</strong>ancial<br />

market crisis – the Executive and Supervisory Boards<br />

want to demonstrate their shareholder-friendly dividend<br />

policy, thus allow<strong>in</strong>g shareholders to also participate<br />

<strong>in</strong> the solid corporate development <strong>in</strong> an appropriate<br />

manner for the <strong>2009</strong>/<strong>10</strong> fiscal year.<br />

Fig. 7 · Dividend yield<br />

6.0 %<br />

5.0 %<br />

4.0 %<br />

3.0 %<br />

2.0 %<br />

1.0 %<br />

0.0 %<br />

2005/06 2006/07 2007/08 2008/09 <strong>2009</strong>/<strong>10</strong><br />

3.0<br />

2.5<br />

Mission Statement<br />

Letter to the Shareholders<br />

Executive Board<br />

Corporate Governance<br />

<strong>Report</strong> of the Supervisory Board<br />

DOUGLAS Share<br />

Impressions<br />

Human Resources<br />

3.4 3.5<br />

3.0<br />

13<br />

Fig. 6<br />

Fig. 7