Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

F<strong>in</strong>ancial liabilities<br />

In the 2006/07 fiscal year, DOUGLAS HOLDING AG entered <strong>in</strong>to a revolv<strong>in</strong>g credit facility<br />

up to a maximum amount of 500 million EUR from an <strong>in</strong>ternational bank<strong>in</strong>g syndicate.<br />

The residual term of this revolv<strong>in</strong>g credit facility is two years. Withdrawals are charged at<br />

EURIBOR + 25 base po<strong>in</strong>ts, whereby the marg<strong>in</strong> is fixed for the term. The commitment commission<br />

for the unutilized portion of the facility is 30 percent of the marg<strong>in</strong>. As of the balance<br />

sheet date, this facility had been utilized <strong>in</strong> the amount of 91.3 million EUR. The aim<br />

of this revolv<strong>in</strong>g credit facility is to reduce cash and cash equivalents as well as to create<br />

flexible f<strong>in</strong>anc<strong>in</strong>g possibilities. The unused portion of the revolv<strong>in</strong>g credit facility is not subject<br />

to any restrictions.<br />

Besides DOUGLAS HOLDING AG, another lend<strong>in</strong>g company, <strong>Douglas</strong> F<strong>in</strong>ance B.V. located<br />

<strong>in</strong> the Netherlands, also became a borrower. This f<strong>in</strong>anc<strong>in</strong>g company serves the purpose<br />

of provid<strong>in</strong>g f<strong>in</strong>anc<strong>in</strong>g to the foreign subsidiaries of the DOUGLAS Group. Due to the rais<strong>in</strong>g<br />

and draw<strong>in</strong>gs of the revolv<strong>in</strong>g credit facility by DOUGLAS HOLDING AG and <strong>Douglas</strong><br />

F<strong>in</strong>ance B.V. and further submission to the companies of the DOUGLAS Group, the utilization<br />

of the bilateral credit l<strong>in</strong>es by the companies was <strong>in</strong> part reduced. Withdrawals from<br />

the bilateral credit l<strong>in</strong>es amounted to 37.2 million EUR (previous year: 45.5 million EUR)<br />

and under the revolv<strong>in</strong>g credit facility to 91.3 million EUR (previous year: 84.2 million EUR).<br />

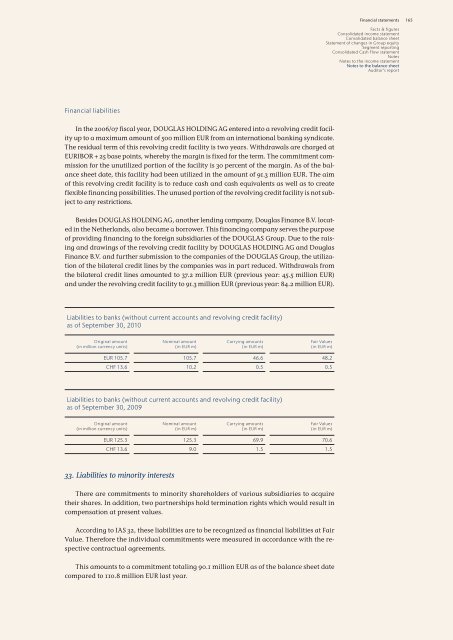

Liabilities to banks (without current accounts and revolv<strong>in</strong>g credit facility)<br />

as of September 30, 20<strong>10</strong><br />

Orig<strong>in</strong>al amount<br />

(<strong>in</strong> million currency units)<br />

Nom<strong>in</strong>al amount<br />

(<strong>in</strong> EUR m)<br />

Carry<strong>in</strong>g amounts<br />

(<strong>in</strong> EUR m)<br />

Fair Values<br />

(<strong>in</strong> EUR m)<br />

EUR <strong>10</strong>5.7 <strong>10</strong>5.7 46.6 48.2<br />

CHF 13.6 <strong>10</strong>.2 0.5 0.5<br />

Liabilities to banks (without current accounts and revolv<strong>in</strong>g credit facility)<br />

as of September 30, <strong>2009</strong><br />

Orig<strong>in</strong>al amount<br />

(<strong>in</strong> million currency units)<br />

Nom<strong>in</strong>al amount<br />

(<strong>in</strong> EUR m)<br />

Carry<strong>in</strong>g amounts<br />

(<strong>in</strong> EUR m)<br />

Fair Values<br />

(<strong>in</strong> EUR m)<br />

EUR 125.3 125.3 69.9 70.6<br />

CHF 13.6 9.0 1.5 1.5<br />

33. Liabilities to m<strong>in</strong>ority <strong>in</strong>terests<br />

There are commitments to m<strong>in</strong>ority shareholders of various subsidiaries to acquire<br />

their shares. In addition, two partnerships hold term<strong>in</strong>ation rights which would result <strong>in</strong><br />

compensation at present values.<br />

Accord<strong>in</strong>g to IAS 32, these liabilities are to be recognized as f<strong>in</strong>ancial liabilities at Fair<br />

Value. Therefore the <strong>in</strong>dividual commitments were measured <strong>in</strong> accordance with the respective<br />

contractual agreements.<br />

This amounts to a commitment total<strong>in</strong>g 90.1 million EUR as of the balance sheet date<br />

compared to 1<strong>10</strong>.8 million EUR last year.<br />

F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

165