Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

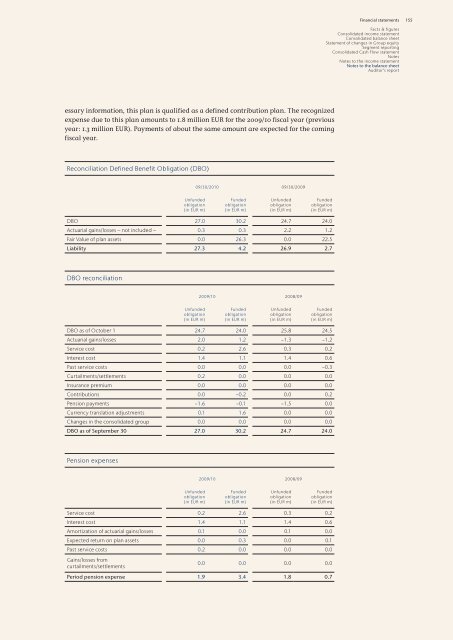

essary <strong>in</strong>formation, this plan is qualified as a def<strong>in</strong>ed contribution plan. The recognized<br />

expense due to this plan amounts to 1.8 million EUR for the <strong>2009</strong>/<strong>10</strong> fiscal year (previous<br />

year: 1.3 million EUR). Payments of about the same amount are expected for the com<strong>in</strong>g<br />

fiscal year.<br />

Reconciliation Def<strong>in</strong>ed Benefit Obligation (DBO)<br />

Unfunded<br />

obligation<br />

(<strong>in</strong> EUR m)<br />

09/30/20<strong>10</strong> 09/30/<strong>2009</strong><br />

Funded<br />

obligation<br />

(<strong>in</strong> EUR m)<br />

Unfunded<br />

obligation<br />

(<strong>in</strong> EUR m)<br />

Funded<br />

obligation<br />

(<strong>in</strong> EUR m)<br />

DBO 27.0 30.2 24.7 24.0<br />

Actuarial ga<strong>in</strong>s/losses – not <strong>in</strong>cluded – 0.3 0.3 2.2 1.2<br />

Fair Value of plan assets 0.0 26.3 0.0 22.5<br />

Liability 27.3 4.2 26.9 2.7<br />

DBO reconciliation<br />

Unfunded<br />

obligation<br />

(<strong>in</strong> EUR m)<br />

<strong>2009</strong>/<strong>10</strong> 2008/09<br />

Funded<br />

obligation<br />

(<strong>in</strong> EUR m)<br />

Unfunded<br />

obligation<br />

(<strong>in</strong> EUR m)<br />

Funded<br />

obligation<br />

(<strong>in</strong> EUR m)<br />

DBO as of October 1 24.7 24.0 25.8 24.5<br />

Actuarial ga<strong>in</strong>s/losses 2.0 1.2 −1.3 −1.2<br />

Service cost 0.2 2.6 0.3 0.2<br />

Interest cost 1.4 1.1 1.4 0.6<br />

Past service costs 0.0 0.0 0.0 −0.3<br />

Curtailments/settlements 0.2 0.0 0.0 0.0<br />

Insurance premium 0.0 0.0 0.0 0.0<br />

Contributions 0.0 −0.2 0.0 0.2<br />

Pension payments −1.6 −0.1 −1.5 0.0<br />

Currency translation adjustments 0.1 1.6 0.0 0.0<br />

Changes <strong>in</strong> the consolidated group 0.0 0.0 0.0 0.0<br />

DBO as of September 30 27.0 30.2 24.7 24.0<br />

Pension expenses<br />

Unfunded<br />

obligation<br />

(<strong>in</strong> EUR m)<br />

<strong>2009</strong>/<strong>10</strong> 2008/09<br />

Funded<br />

obligation<br />

(<strong>in</strong> EUR m)<br />

Unfunded<br />

obligation<br />

(<strong>in</strong> EUR m)<br />

Funded<br />

obligation<br />

(<strong>in</strong> EUR m)<br />

Service cost 0.2 2.6 0.3 0.2<br />

Interest cost 1.4 1.1 1.4 0.6<br />

Amortization of actuarial ga<strong>in</strong>s/losses 0.1 0.0 0.1 0.0<br />

Expected return on plan assets 0.0 0.3 0.0 0.1<br />

Past service costs 0.2 0.0 0.0 0.0<br />

Ga<strong>in</strong>s/losses from<br />

curtailments/settlements<br />

0.0 0.0 0.0 0.0<br />

Period pension expense 1.9 3.4 1.8 0.7<br />

F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

155