Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

158 F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

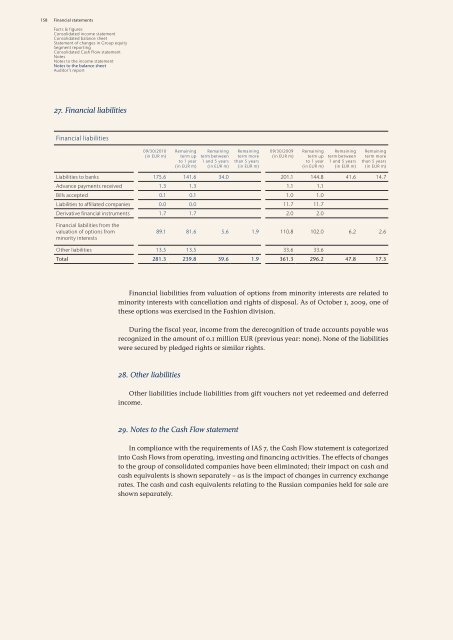

27. F<strong>in</strong>ancial liabilities<br />

F<strong>in</strong>ancial liabilities<br />

09/30/20<strong>10</strong><br />

(<strong>in</strong> EUR m)<br />

Rema<strong>in</strong><strong>in</strong>g<br />

term up<br />

to 1 year<br />

(<strong>in</strong> EUR m)<br />

Rema<strong>in</strong><strong>in</strong>g<br />

term between<br />

1 and 5 years<br />

(<strong>in</strong> EUR m)<br />

Rema<strong>in</strong><strong>in</strong>g<br />

term more<br />

than 5 years<br />

(<strong>in</strong> EUR m)<br />

09/30/<strong>2009</strong><br />

(<strong>in</strong> EUR m)<br />

Rema<strong>in</strong><strong>in</strong>g<br />

term up<br />

to 1 year<br />

(<strong>in</strong> EUR m)<br />

Rema<strong>in</strong><strong>in</strong>g<br />

term between<br />

1 and 5 years<br />

(<strong>in</strong> EUR m)<br />

Rema<strong>in</strong><strong>in</strong>g<br />

term more<br />

than 5 years<br />

(<strong>in</strong> EUR m)<br />

Liabilities to banks 175.6 141.6 34.0 201.1 144.8 41.6 14.7<br />

Advance payments received 1.3 1.3 1.1 1.1<br />

Bills accepted 0.1 0.1 1.0 1.0<br />

Liabilities to affiliated companies 0.0 0.0 11.7 11.7<br />

Derivative f<strong>in</strong>ancial <strong>in</strong>struments 1.7 1.7 2.0 2.0<br />

F<strong>in</strong>ancial liabilities from the<br />

valuation of options from<br />

m<strong>in</strong>ority <strong>in</strong>terests<br />

89.1 81.6 5.6 1.9 1<strong>10</strong>.8 <strong>10</strong>2.0 6.2 2.6<br />

Other liabilities 13.5 13.5 33.6 33.6<br />

Total 281.3 239.8 39.6 1.9 361.3 296.2 47.8 17.3<br />

F<strong>in</strong>ancial liabilities from valuation of options from m<strong>in</strong>ority <strong>in</strong>terests are related to<br />

m<strong>in</strong>ority <strong>in</strong>terests with cancellation and rights of disposal. As of October 1, <strong>2009</strong>, one of<br />

these options was exercised <strong>in</strong> the Fashion division.<br />

Dur<strong>in</strong>g the fiscal year, <strong>in</strong>come from the derecognition of trade accounts payable was<br />

recognized <strong>in</strong> the amount of 0.1 million EUR (previous year: none). None of the liabilities<br />

were secured by pledged rights or similar rights.<br />

28. Other liabilities<br />

Other liabilities <strong>in</strong>clude liabilities from gift vouchers not yet redeemed and deferred<br />

<strong>in</strong>come.<br />

29. Notes to the Cash Flow statement<br />

In compliance with the requirements of IAS 7, the Cash Flow statement is categorized<br />

<strong>in</strong>to Cash Flows from operat<strong>in</strong>g, <strong>in</strong>vest<strong>in</strong>g and f<strong>in</strong>anc<strong>in</strong>g activities. The effects of changes<br />

to the group of consolidated companies have been elim<strong>in</strong>ated; their impact on cash and<br />

cash equivalents is shown separately – as is the impact of changes <strong>in</strong> currency exchange<br />

rates. The cash and cash equivalents relat<strong>in</strong>g to the Russian companies held for sale are<br />

shown separately.