Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

144 F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

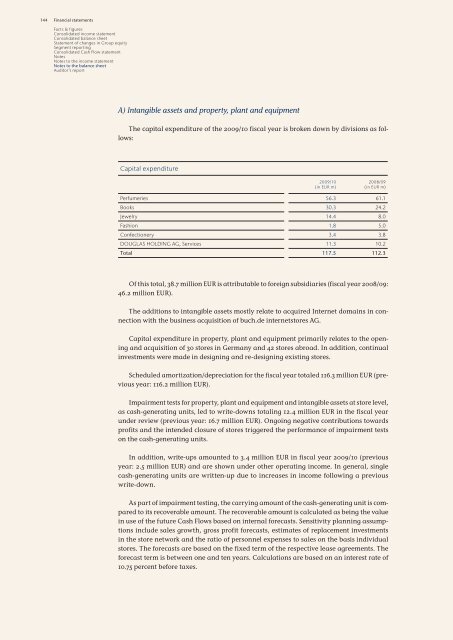

A) Intangible assets and property, plant and equipment<br />

The capital expenditure of the <strong>2009</strong>/<strong>10</strong> fiscal year is broken down by divisions as follows:<br />

Capital expenditure<br />

<strong>2009</strong>/<strong>10</strong><br />

(<strong>in</strong> EUR m)<br />

2008/09<br />

(<strong>in</strong> EUR m)<br />

Perfumeries 56.3 61.1<br />

Books 30.3 24.2<br />

Jewelry 14.4 8.0<br />

Fashion 1.8 5.0<br />

Confectionery 3.4 3.8<br />

DOUGLAS HOLDING AG, Services 11.3 <strong>10</strong>.2<br />

Total 117.5 112.3<br />

Of this total, 38.7 million EUR is attributable to foreign subsidiaries (fiscal year 2008/09:<br />

46.2 million EUR).<br />

The additions to <strong>in</strong>tangible assets mostly relate to acquired Internet doma<strong>in</strong>s <strong>in</strong> connection<br />

with the bus<strong>in</strong>ess acquisition of buch.de <strong>in</strong>ternetstores AG.<br />

Capital expenditure <strong>in</strong> property, plant and equipment primarily relates to the open<strong>in</strong>g<br />

and acquisition of 30 stores <strong>in</strong> Germany and 42 stores abroad. In addition, cont<strong>in</strong>ual<br />

<strong>in</strong>vestments were made <strong>in</strong> design<strong>in</strong>g and re-design<strong>in</strong>g exist<strong>in</strong>g stores.<br />

Scheduled amortization/depreciation for the fiscal year totaled 116.3 million EUR (previous<br />

year: 116.2 million EUR).<br />

Impairment tests for property, plant and equipment and <strong>in</strong>tangible assets at store level,<br />

as cash-generat<strong>in</strong>g units, led to write-downs total<strong>in</strong>g 12.4 million EUR <strong>in</strong> the fiscal year<br />

under review (previous year: 16.7 million EUR). Ongo<strong>in</strong>g negative contributions towards<br />

profits and the <strong>in</strong>tended closure of stores triggered the performance of impairment tests<br />

on the cash-generat<strong>in</strong>g units.<br />

In addition, write-ups amounted to 3.4 million EUR <strong>in</strong> fiscal year <strong>2009</strong>/<strong>10</strong> (previous<br />

year: 2.5 million EUR) and are shown under other operat<strong>in</strong>g <strong>in</strong>come. In general, s<strong>in</strong>gle<br />

cash-generat<strong>in</strong>g units are written-up due to <strong>in</strong>creases <strong>in</strong> <strong>in</strong>come follow<strong>in</strong>g a previous<br />

write-down.<br />

As part of impairment test<strong>in</strong>g, the carry<strong>in</strong>g amount of the cash-generat<strong>in</strong>g unit is compared<br />

to its recoverable amount. The recoverable amount is calculated as be<strong>in</strong>g the value<br />

<strong>in</strong> use of the future Cash Flows based on <strong>in</strong>ternal forecasts. Sensitivity plann<strong>in</strong>g assumptions<br />

<strong>in</strong>clude sales growth, gross profit forecasts, estimates of replacement <strong>in</strong>vestments<br />

<strong>in</strong> the store network and the ratio of personnel expenses to sales on the basis <strong>in</strong>dividual<br />

stores. The forecasts are based on the fixed term of the respective lease agreements. The<br />

forecast term is between one and ten years. Calculations are based on an <strong>in</strong>terest rate of<br />

<strong>10</strong>.75 percent before taxes.