Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

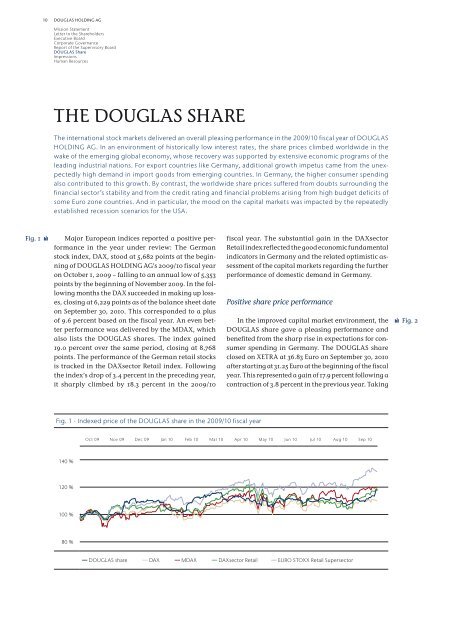

Fig. 1<br />

<strong>10</strong> DOUGLAS HOLDING AG<br />

Mission Statement<br />

Letter to the Shareholders<br />

Executive Board<br />

Corporate Governance<br />

<strong>Report</strong> of the Supervisory Board<br />

DOUGLAS Share<br />

Impressions<br />

Human Resources<br />

THE DOUGLAS SHARE<br />

The <strong>in</strong>ternational stock markets delivered an overall pleas<strong>in</strong>g performance <strong>in</strong> the <strong>2009</strong>/<strong>10</strong> fiscal year of DOUGLAS<br />

HOLDING AG. In an environment of historically low <strong>in</strong>terest rates, the share prices climbed worldwide <strong>in</strong> the<br />

wake of the emerg<strong>in</strong>g global economy, whose recovery was supported by extensive economic programs of the<br />

lead<strong>in</strong>g <strong>in</strong>dustrial nations. For export countries like Germany, additional growth impetus came from the unexpectedly<br />

high demand <strong>in</strong> import goods from emerg<strong>in</strong>g countries. In Germany, the higher consumer spend<strong>in</strong>g<br />

also contributed to this growth. By contrast, the worldwide share prices suffered from doubts surround<strong>in</strong>g the<br />

f<strong>in</strong>ancial sector’s stability and from the credit rat<strong>in</strong>g and f<strong>in</strong>ancial problems aris<strong>in</strong>g from high budget deficits of<br />

some Euro zone countries. And <strong>in</strong> particular, the mood on the capital markets was impacted by the repeatedly<br />

established recession scenarios for the USA.<br />

Major European <strong>in</strong>dices reported a positive performance<br />

<strong>in</strong> the year under review: The German<br />

stock <strong>in</strong>dex, DAX, stood at 5,682 po<strong>in</strong>ts at the beg<strong>in</strong>n<strong>in</strong>g<br />

of DOUGLAS HOLDING AG’s <strong>2009</strong>/<strong>10</strong> fiscal year<br />

on October 1, <strong>2009</strong> – fall<strong>in</strong>g to an annual low of 5,353<br />

po<strong>in</strong>ts by the beg<strong>in</strong>n<strong>in</strong>g of November <strong>2009</strong>. In the follow<strong>in</strong>g<br />

months the DAX succeeded <strong>in</strong> mak<strong>in</strong>g up losses,<br />

clos<strong>in</strong>g at 6,229 po<strong>in</strong>ts as of the balance sheet date<br />

on September 30, 20<strong>10</strong>. This corresponded to a plus<br />

of 9.6 percent based on the fiscal year. An even better<br />

performance was delivered by the MDAX, which<br />

also lists the DOUGLAS shares. The <strong>in</strong>dex ga<strong>in</strong>ed<br />

19.0 percent over the same period, clos<strong>in</strong>g at 8,768<br />

po<strong>in</strong>ts. The performance of the German retail stocks<br />

is tracked <strong>in</strong> the DAXsector Retail <strong>in</strong>dex. Follow<strong>in</strong>g<br />

the <strong>in</strong>dex’s drop of 3.4 percent <strong>in</strong> the preced<strong>in</strong>g year,<br />

it sharply climbed by 18.3 percent <strong>in</strong> the <strong>2009</strong>/<strong>10</strong><br />

Fig. 1 · Indexed price of the DOUGLAS share <strong>in</strong> the <strong>2009</strong>/<strong>10</strong> fiscal year<br />

140 %<br />

120 %<br />

<strong>10</strong>0 %<br />

80 %<br />

fiscal year. The substantial ga<strong>in</strong> <strong>in</strong> the DAXsector<br />

Retail <strong>in</strong>dex reflected the good economic fundamental<br />

<strong>in</strong>dicators <strong>in</strong> Germany and the related optimistic assessment<br />

of the capital markets regard<strong>in</strong>g the further<br />

performance of domestic demand <strong>in</strong> Germany.<br />

Positive share price performance<br />

In the improved capital market environment, the<br />

DOUGLAS share gave a pleas<strong>in</strong>g performance and<br />

benefited from the sharp rise <strong>in</strong> expectations for consumer<br />

spend<strong>in</strong>g <strong>in</strong> Germany. The DOUGLAS share<br />

closed on XETRA at 36.83 Euro on September 30, 20<strong>10</strong><br />

after start<strong>in</strong>g at 31.25 Euro at the beg<strong>in</strong>n<strong>in</strong>g of the fiscal<br />

year. This represented a ga<strong>in</strong> of 17.9 percent follow<strong>in</strong>g a<br />

contraction of 3.8 percent <strong>in</strong> the previous year. Tak<strong>in</strong>g<br />

Oct 09 Nov 09 Dec 09 Jan <strong>10</strong> Feb <strong>10</strong> Mar <strong>10</strong> Apr <strong>10</strong> May <strong>10</strong> Jun <strong>10</strong> Jul <strong>10</strong> Aug <strong>10</strong> Sep <strong>10</strong><br />

DOUGLAS share DAX MDAX DAXsector Retail EURO STOXX Retail Supersector<br />

Fig. 2