Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

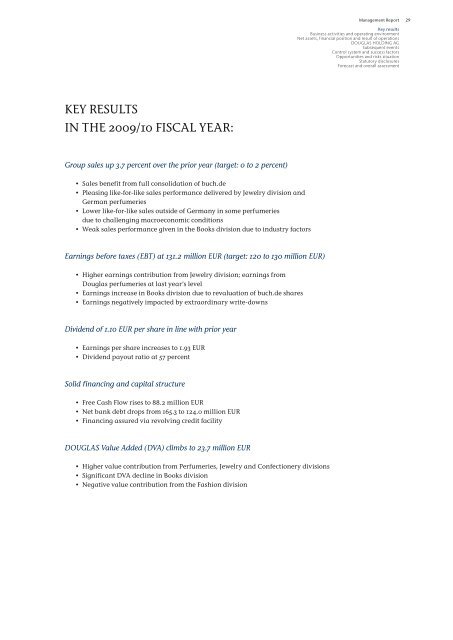

KEY RESULTS<br />

IN THE <strong>2009</strong>/<strong>10</strong> FISCAL YEAR:<br />

Group sales up 3.7 percent over the prior year (target: 0 to 2 percent)<br />

• Sales benefit from full consolidation of buch.de<br />

• Pleas<strong>in</strong>g like-for-like sales performance delivered by Jewelry division and<br />

German perfumeries<br />

• Lower like-for-like sales outside of Germany <strong>in</strong> some perfumeries<br />

due to challeng<strong>in</strong>g macroeconomic conditions<br />

• Weak sales performance given <strong>in</strong> the Books division due to <strong>in</strong>dustry factors<br />

Earn<strong>in</strong>gs before taxes (EBT) at 131.2 million EUR (target: 120 to 130 million EUR)<br />

• Higher earn<strong>in</strong>gs contribution from Jewelry division; earn<strong>in</strong>gs from<br />

<strong>Douglas</strong> perfumeries at last year’s level<br />

• Earn<strong>in</strong>gs <strong>in</strong>crease <strong>in</strong> Books division due to revaluation of buch.de shares<br />

• Earn<strong>in</strong>gs negatively impacted by extraord<strong>in</strong>ary write-downs<br />

Dividend of 1.<strong>10</strong> EUR per share <strong>in</strong> l<strong>in</strong>e with prior year<br />

• Earn<strong>in</strong>gs per share <strong>in</strong>creases to 1.93 EUR<br />

• Dividend payout ratio at 57 percent<br />

Solid f<strong>in</strong>anc<strong>in</strong>g and capital structure<br />

• Free Cash Flow rises to 88.2 million EUR<br />

• Net bank debt drops from 165.3 to 124.0 million EUR<br />

• F<strong>in</strong>anc<strong>in</strong>g assured via revolv<strong>in</strong>g credit facility<br />

DOUGLAS Value Added (DVA) climbs to 23.7 million EUR<br />

• Higher value contribution from Perfumeries, Jewelry and Confectionery divisions<br />

• Significant DVA decl<strong>in</strong>e <strong>in</strong> Books division<br />

• Negative value contribution from the Fashion division<br />

Management <strong>Report</strong><br />

Key results<br />

Bus<strong>in</strong>ess activities and operat<strong>in</strong>g environment<br />

Net assets, f<strong>in</strong>ancial position and result of operations<br />

DOUGLAS HOLDING AG<br />

Subsequent events<br />

Control system and success factors<br />

Opportunities and risks situation<br />

Statutory disclosures<br />

Forecast and overall assessment<br />

29