Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

148 F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

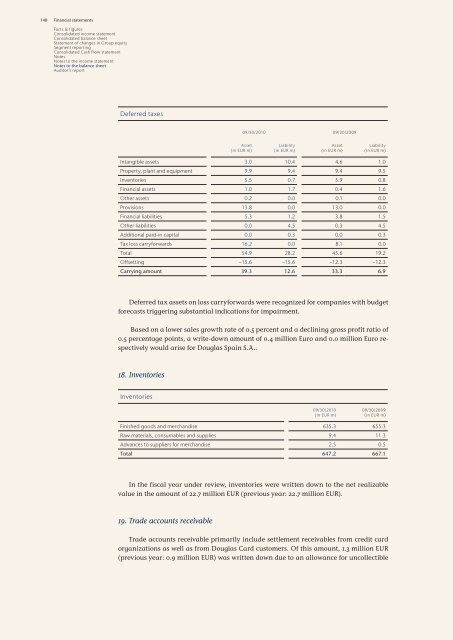

Deferred taxes<br />

Asset<br />

(<strong>in</strong> EUR m)<br />

09/30/20<strong>10</strong> 09/30/<strong>2009</strong><br />

Liability<br />

(<strong>in</strong> EUR m)<br />

Asset<br />

(<strong>in</strong> EUR m)<br />

Liability<br />

(<strong>in</strong> EUR m)<br />

Intangible assets 3.0 <strong>10</strong>.4 4.6 1.0<br />

Property, plant and equipment 9.9 9.4 9.4 9.5<br />

Inventories 5.5 0.7 5.9 0.8<br />

F<strong>in</strong>ancial assets 1.0 1.7 0.4 1.6<br />

Other assets 0.2 0.0 0.1 0.0<br />

Provisions 13.8 0.0 13.0 0.0<br />

F<strong>in</strong>ancial liabilities 5.3 1.2 3.8 1.5<br />

Other liabilities 0.0 4.5 0.3 4.5<br />

Additional paid-<strong>in</strong> capital 0.0 0.3 0.0 0.3<br />

Tax loss carryforwards 16.2 0.0 8.1 0.0<br />

Total 54.9 28.2 45.6 19.2<br />

Offsett<strong>in</strong>g −15.6 −15.6 −12.3 −12.3<br />

Carry<strong>in</strong>g amount 39.3 12.6 33.3 6.9<br />

Deferred tax assets on loss carryforwards were recognized for companies with budget<br />

forecasts trigger<strong>in</strong>g substantial <strong>in</strong>dications for impairment.<br />

Based on a lower sales growth rate of 0.5 percent and a decl<strong>in</strong><strong>in</strong>g gross profit ratio of<br />

0.5 percentage po<strong>in</strong>ts, a write-down amount of 0.4 million Euro and 0.0 million Euro respectively<br />

would arise for <strong>Douglas</strong> Spa<strong>in</strong> S.A..<br />

18. Inventories<br />

Inventories<br />

09/30/20<strong>10</strong><br />

(<strong>in</strong> EUR m)<br />

09/30/<strong>2009</strong><br />

(<strong>in</strong> EUR m)<br />

F<strong>in</strong>ished goods and merchandise 635.3 655.3<br />

Raw materials, consumables and supplies 9.4 11.3<br />

Advances to suppliers for merchandise 2.5 0.5<br />

Total 647.2 667.1<br />

In the fiscal year under review, <strong>in</strong>ventories were written down to the net realizable<br />

value <strong>in</strong> the amount of 22.7 million EUR (previous year: 22.7 million EUR).<br />

19. Trade accounts receivable<br />

Trade accounts receivable primarily <strong>in</strong>clude settlement receivables from credit card<br />

organizations as well as from <strong>Douglas</strong> Card customers. Of this amount, 1.3 million EUR<br />

(previous year: 0.9 million EUR) was written down due to an allowance for uncollectible