Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

of the fiscal year, which are then issued by DOUGLAS HOLDING AG. The employee shares<br />

option program is measured at Fair Value. The Fair Value is based on the stock price, which<br />

amounted to 36.83 EUR as of the balance sheet date (previous year: 31.25 EUR). The benefit<br />

of 0.8 million EUR granted to employees for the difference between the issue price and<br />

stock price is recognized under personnel expenses <strong>in</strong> the <strong>2009</strong>/<strong>10</strong> fiscal year. In addition,<br />

the transaction costs <strong>in</strong>curred <strong>in</strong> this connection <strong>in</strong> the amount of 0.1 million EUR are offset<br />

directly aga<strong>in</strong>st the additional paid-<strong>in</strong> capital.<br />

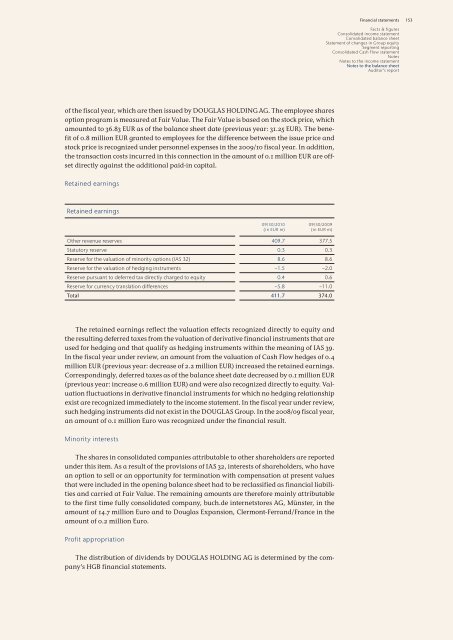

Reta<strong>in</strong>ed earn<strong>in</strong>gs<br />

Reta<strong>in</strong>ed earn<strong>in</strong>gs<br />

09/30/20<strong>10</strong><br />

(<strong>in</strong> EUR m)<br />

09/30/<strong>2009</strong><br />

(<strong>in</strong> EUR m)<br />

Other revenue reserves 409.7 377.5<br />

Statutory reserve 0.3 0.3<br />

Reserve for the valuation of m<strong>in</strong>ority options (IAS 32) 8.6 8.6<br />

Reserve for the valuation of hedg<strong>in</strong>g <strong>in</strong>struments −1.5 −2.0<br />

Reserve pursuant to deferred tax directly charged to equity 0.4 0.6<br />

Reserve for currency translation differences −5.8 −11.0<br />

Total 411.7 374.0<br />

The reta<strong>in</strong>ed earn<strong>in</strong>gs reflect the valuation effects recognized directly to equity and<br />

the result<strong>in</strong>g deferred taxes from the valuation of derivative f<strong>in</strong>ancial <strong>in</strong>struments that are<br />

used for hedg<strong>in</strong>g and that qualify as hedg<strong>in</strong>g <strong>in</strong>struments with<strong>in</strong> the mean<strong>in</strong>g of IAS 39.<br />

In the fiscal year under review, an amount from the valuation of Cash Flow hedges of 0.4<br />

million EUR (previous year: decrease of 2.2 million EUR) <strong>in</strong>creased the reta<strong>in</strong>ed earn<strong>in</strong>gs.<br />

Correspond<strong>in</strong>gly, deferred taxes as of the balance sheet date decreased by 0.1 million EUR<br />

(previous year: <strong>in</strong>crease 0.6 million EUR) and were also recognized directly to equity. Valuation<br />

fluctuations <strong>in</strong> derivative f<strong>in</strong>ancial <strong>in</strong>struments for which no hedg<strong>in</strong>g relationship<br />

exist are recognized immediately to the <strong>in</strong>come statement. In the fiscal year under review,<br />

such hedg<strong>in</strong>g <strong>in</strong>struments did not exist <strong>in</strong> the DOUGLAS Group. In the 2008/09 fiscal year,<br />

an amount of 0.1 million Euro was recognized under the f<strong>in</strong>ancial result.<br />

M<strong>in</strong>ority <strong>in</strong>terests<br />

The shares <strong>in</strong> consolidated companies attributable to other shareholders are reported<br />

under this item. As a result of the provisions of IAS 32, <strong>in</strong>terests of shareholders, who have<br />

an option to sell or an opportunity for term<strong>in</strong>ation with compensation at present values<br />

that were <strong>in</strong>cluded <strong>in</strong> the open<strong>in</strong>g balance sheet had to be reclassified as f<strong>in</strong>ancial liabilities<br />

and carried at Fair Value. The rema<strong>in</strong><strong>in</strong>g amounts are therefore ma<strong>in</strong>ly attributable<br />

to the first time fully consolidated company, buch.de <strong>in</strong>ternetstores AG, Münster, <strong>in</strong> the<br />

amount of 14.7 million Euro and to <strong>Douglas</strong> Expansion, Clermont-Ferrand/France <strong>in</strong> the<br />

amount of 0.2 million Euro.<br />

Profit appropriation<br />

The distribution of dividends by DOUGLAS HOLDING AG is determ<strong>in</strong>ed by the company’s<br />

HGB f<strong>in</strong>ancial statements.<br />

F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

153