Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Annual Report 2009/10 Excellence in Retailing - Douglas Holding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

162 F<strong>in</strong>ancial statements<br />

Facts & figures<br />

Consolidated <strong>in</strong>come statement<br />

Consolidated balance sheet<br />

Statement of changes <strong>in</strong> Group equity<br />

Segment report<strong>in</strong>g<br />

Consolidated Cash Flow statement<br />

Notes<br />

Notes to the <strong>in</strong>come statement<br />

Notes to the balance sheet<br />

Auditor’s report<br />

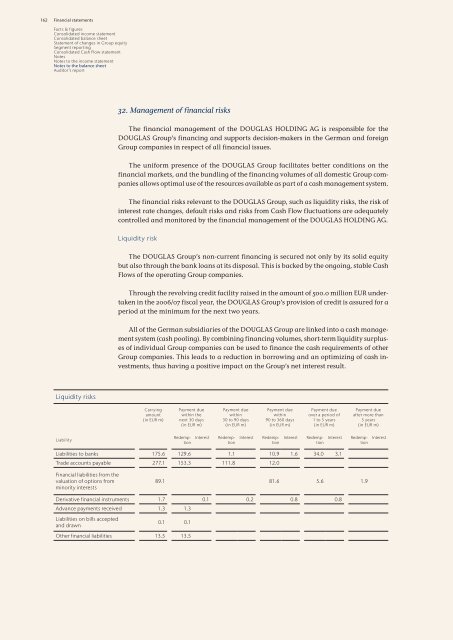

Liquidity risks<br />

Liability<br />

32. Management of f<strong>in</strong>ancial risks<br />

The f<strong>in</strong>ancial management of the DOUGLAS HOLDING AG is responsible for the<br />

DOUGLAS Group’s f<strong>in</strong>anc<strong>in</strong>g and supports decision-makers <strong>in</strong> the German and foreign<br />

Group companies <strong>in</strong> respect of all f<strong>in</strong>ancial issues.<br />

The uniform presence of the DOUGLAS Group facilitates better conditions on the<br />

f<strong>in</strong>ancial markets, and the bundl<strong>in</strong>g of the f<strong>in</strong>anc<strong>in</strong>g volumes of all domestic Group companies<br />

allows optimal use of the resources available as part of a cash management system.<br />

The f<strong>in</strong>ancial risks relevant to the DOUGLAS Group, such as liquidity risks, the risk of<br />

<strong>in</strong>terest rate changes, default risks and risks from Cash Flow fluctuations are adequately<br />

controlled and monitored by the f<strong>in</strong>ancial management of the DOUGLAS HOLDING AG.<br />

Liquidity risk<br />

The DOUGLAS Group’s non-current f<strong>in</strong>anc<strong>in</strong>g is secured not only by its solid equity<br />

but also through the bank loans at its disposal. This is backed by the ongo<strong>in</strong>g, stable Cash<br />

Flows of the operat<strong>in</strong>g Group companies.<br />

Through the revolv<strong>in</strong>g credit facility raised <strong>in</strong> the amount of 500.0 million EUR undertaken<br />

<strong>in</strong> the 2006/07 fiscal year, the DOUGLAS Group’s provision of credit is assured for a<br />

period at the m<strong>in</strong>imum for the next two years.<br />

All of the German subsidiaries of the DOUGLAS Group are l<strong>in</strong>ked <strong>in</strong>to a cash management<br />

system (cash pool<strong>in</strong>g). By comb<strong>in</strong><strong>in</strong>g f<strong>in</strong>anc<strong>in</strong>g volumes, short-term liquidity surpluses<br />

of <strong>in</strong>dividual Group companies can be used to f<strong>in</strong>ance the cash requirements of other<br />

Group companies. This leads to a reduction <strong>in</strong> borrow<strong>in</strong>g and an optimiz<strong>in</strong>g of cash <strong>in</strong>vestments,<br />

thus hav<strong>in</strong>g a positive impact on the Group’s net <strong>in</strong>terest result.<br />

Carry<strong>in</strong>g<br />

amount<br />

(<strong>in</strong> EUR m)<br />

Payment due<br />

with<strong>in</strong> the<br />

next 30 days<br />

(<strong>in</strong> EUR m)<br />

Redemption<br />

Payment due<br />

with<strong>in</strong><br />

30 to 90 days<br />

(<strong>in</strong> EUR m)<br />

Interest Redemption<br />

Payment due<br />

with<strong>in</strong><br />

90 to 360 days<br />

(<strong>in</strong> EUR m)<br />

Interest Redemption<br />

Payment due<br />

over a period of<br />

1 to 5 years<br />

(<strong>in</strong> EUR m)<br />

Interest Redemption<br />

Liabilities to banks 175.6 129.6 1.1 <strong>10</strong>.9 1.6 34.0 3.1<br />

Trade accounts payable 277.1 153.3 111.8 12.0<br />

F<strong>in</strong>ancial liabilities from the<br />

valuation of options from<br />

m<strong>in</strong>ority <strong>in</strong>terests<br />

Payment due<br />

after more than<br />

5 years<br />

(<strong>in</strong> EUR m)<br />

Interest Redemption<br />

89.1 81.6 5.6 1.9<br />

Derivative f<strong>in</strong>ancial <strong>in</strong>struments 1.7 0.1 0.2 0.8 0.8<br />

Advance payments received 1.3 1.3<br />

Liabilities on bills accepted<br />

and drawn<br />

0.1 0.1<br />

Other f<strong>in</strong>ancial liabilities 13.5 13.5<br />

Interest